Introduction to the Upcoming Digital Tax Change

A significant deadline is approaching for UK landlords and self-employed workers, as HMRC’s Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) initiative enters its final six-month countdown. Beginning in April 2026, the UK government will require certain landlords and self-employed individuals with qualifying annual income to shift from traditional tax returns to a strictly digital reporting framework.

The change aims to modernise tax administration, improve accuracy, and support taxpayers in real time. With the introduction of MTD for ITSA, those affected must keep digital tax records and submit updates to HMRC using approved software throughout the year. This marks a significant shift from the long-standing self-assessment system. Tax experts, accountants, and software providers are closely tracking the rollout, while both HMRC and professional bodies are stepping up efforts to inform and prepare affected taxpayers for the transition.

The government’s goal is to reduce errors, increase compliance, and make the tax process more efficient but concerns remain about the practical implications for those impacted.

Who Is Affected by the New Requirements?

From April 2026, the first group required to comply with MTD for ITSA will be self-employed workers and landlords with a gross business or property income exceeding £50,000 per year.

According to HMRC, this threshold is designed to capture higher-earning individuals who file self-assessment tax returns, while reducing the compliance burden on those with lower incomes during the initial rollout. In April 2027, the threshold will extend to individuals earning over £30,000 annually from self-employment or property income. Partnerships and those below £30,000 are not yet included, though HMRC is expected to review the impact before considering further expansions.

The digital requirements apply specifically to unincorporated businesses and landlords, not to limited companies or employees paying tax only through PAYE. This step-wise introduction aims to give taxpayers more time to understand the new system and allow software market development, with HMRC stressing the importance of early preparation.

Affected individuals will be required to keep digital records using compatible software and to submit quarterly updates on their income and expenses.

Key Features of Making Tax Digital for Income Tax

MTD for ITSA marks a fundamental change in how income tax records are kept and submitted. Under the new system, affected taxpayers must keep all relevant tax records digitally and use compatible third-party software to submit regular updates. Instead of the current annual tax return, individuals will provide a summary of business or property income and expenses every three months, with an end-of-year statement to finalise their tax affairs.

According to HMRC guidance, the quarterly submissions will replace only part of the current process, with taxpayers still required to undertake the usual end-of-year finalisation to confirm allowable reliefs and adjustments. The aim is to create a smoother, more transparent tax process and reduce mistakes sometimes associated with annual self-assessment. “We want to help taxpayers get their tax right and reduce the gap caused by avoidable errors,” an HMRC spokesperson said in an official statement.

For property landlords, the changes are significant, particularly for those who have previously relied on spreadsheets or manual records. HMRC stresses that compatible, secure software is needed to ensure records are accurate and updates are timely. Free and paid software options are available from HMRC’s approved list.

Stakeholder Views and Professional Concerns

The new rules are seen by HMRC as a vital step toward digital transformation, but reactions from tax professionals, accountants, and representative groups are mixed. While there is recognition that digital record-keeping could help reduce errors, many have raised concerns about the cost, the additional administrative burden, and the readiness of the software market for such a wide-ranging shift.

The Institute of Chartered Accountants in England and Wales (ICAEW) has called for clear and consistent communication from HMRC, especially for those who may find digital record-keeping challenging. In a recent statement, the ICAEW’s Tax Faculty warned, “Some taxpayers may not have access to digital devices or the necessary skills and need extra support to comply with the new regime.” Professional bodies are also urging HMRC to ramp up direct communication and education campaigns to avoid confusion.

While HMRC is running a communications programme and a pilot for volunteers, tax experts argue that many affected individuals remain unaware of the practical steps needed. There have been calls for HMRC to clarify exemption processes, especially for those who cannot reasonably operate digitally due to age, disability, or remote location.

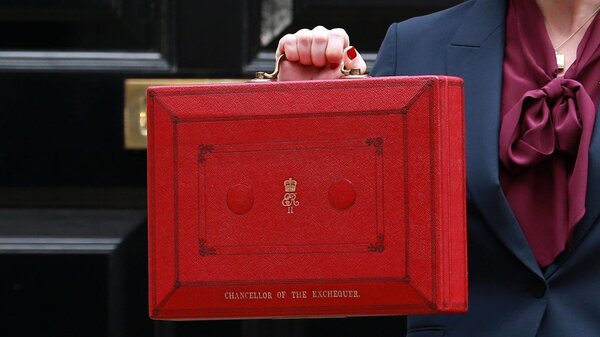

Political and Economic Context Behind the Shift

MTD for ITSA is part of a wider government strategy to modernise and digitise the UK tax system. Originally announced in 2015, the Making Tax Digital initiative is also intended to help close the UK’s “tax gap,” or the difference between expected and actual tax receipts.

According to HMRC’s latest figures, avoidable mistakes cost the Treasury around £3.1 billion in lost income tax revenue annually. The phased rollout of MTD has seen several delays due to technical and operational challenges, feedback from stakeholders, and the impact of the pandemic on both the public and HMRC. The first stage, Making Tax Digital for VAT, went live in 2019, with all VAT-registered businesses now required to keep digital records and submit tax returns using approved software.

With self-assessment representing a significant part of the tax base, the government hopes digitalisation will set a new standard for compliance and efficiency. The government has also introduced measures to support taxpayers in making the transition, such as allowing time for software companies to develop affordable, accessible solutions and providing additional support for those unable to comply digitally.

Preparing for the Transition: Advice and Resources

With six months until the first phase begins, HMRC and professional advisers are stressing the importance of early action. HMRC has urged those affected to review whether their income meets the threshold, begin researching approved software options, and consider joining the ongoing MTD pilot to gain firsthand experience of the system before full implementation.

Accountants are advising clients to maintain accurate, up-to-date digital records and to schedule time to review their current systems. They warn that failure to comply could result in penalties and administrative complications. “It’s important for landlords and the self-employed not to leave preparation until the last minute,” said Nimesh Shah, CEO of Blick Rothenberg, in a recent consultation paper. “Early planning will help prevent disruption to your business or rental income.”

HMRC’s official guidance offers a list of compatible software, FAQs, and access to the pilot programme. Those concerned about digital exclusion can apply for an exemption through a straightforward process explained on the government website.

Final Summary

With the MTD for ITSA deadline drawing closer, affected landlords and self-employed workers must take action to ensure compliance with the new digital tax requirements.

The shift represents a major development in HMRC’s drive for greater efficiency and accuracy in tax administration, and while there are real challenges ahead, early preparation and clear communication could help ease the transition. Broader lessons from MTD for ITSA may influence how government digital projects are delivered in future, especially where compliance and accessibility are at stake.

Although there is broad support for making tax administration more efficient, policymakers and professionals alike will be watching closely how the first waves of digital self-assessment fare. As the transition unfolds, experts advise taking advantage of available resources and guidance to understand the changes and stay ahead of potential problems. Efficient tax handling is just one way the Pie app helps simplify personal finances for UK taxpayers.