Understanding Self-Assessment for Rental Income

Are you a landlord in the UK, puzzled about filing your self-assessment tax return for your rental income? Worry not! We've got you covered with a comprehensive guide on how to file your self-assessment for rental income effectively.

Understanding the Self-Assessment Process

When you receive rental income, it's crucial to understand the self-assessment process and its related components:

Knowing important deadlines for self-assessment is critical. The tax year runs from April 6 to April 5 of the following year, with key deadlines for online and paper returns.Key Dates

If your rental income is above £1,000, you must report it via self-assessment. Understanding the threshold helps ensure compliance and avoid penalties.The Rental Income Threshold

Deducting allowable expenses, such as maintenance costs and agent fees, can significantly reduce your taxable rental income. Knowing what you can claim is crucial.Allowable Expenses

How to File Your Self-Assessment for Rental Income

Follow these steps to submit your self-assessment for rental income with Pie App by availing our We Do It for You service:

Register for self-assessment if you haven’t already.

Gather all relevant financial records, including rental income and expenses.

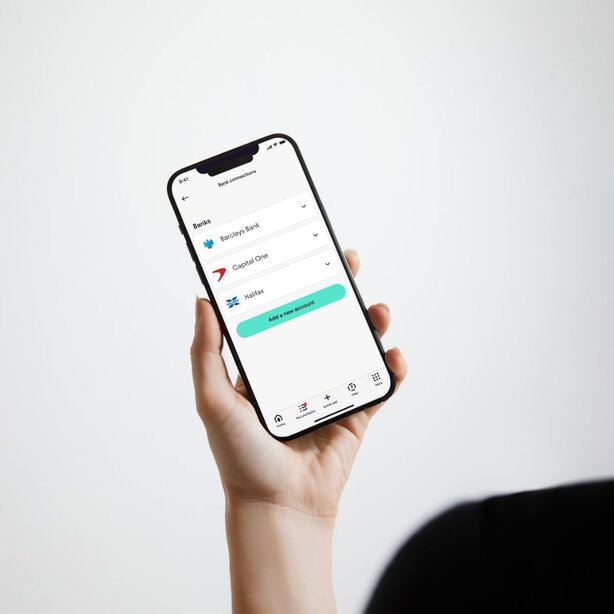

Log in to the Pie App and use the open-banking feature to add your income and reconcile your expenses.

Book a call with your Tax Assistant to discuss more about your rental income.

Your dedicated Pie Tax Assistant will submit your return for you.

Alternative Filing Options

Option 1: Online Return

Submitting your self-assessment online is quicker and more convenient than filing a paper return. It allows you to take advantage of extended deadlines, giving you until 31 January to submit your tax return for the previous tax year. You also receive immediate confirmation of submission, so you know your return has been successfully received by HMRC. Online filing makes it easier to manage your tax information and reduces the likelihood of errors with built-in checks and guidance.

Option 2: Paper Returns

Filing a paper return might be preferable if you lack internet access or are more comfortable with traditional methods. This option allows you to keep physical records of your tax submission. However, be sure to meet the earlier deadline of 31 October to avoid penalties, as paper returns have stricter timelines than online submissions. Double-check your entries for accuracy, as manual filing does not offer the same error-checking features as online submissions.

Additional Considerations

Keeping meticulous records of all rental income and expenses is crucial for ensuring accurate tax reporting and maximising eligible deductions.Keep Detailed Records

Filing your tax return early helps you avoid the stress of last-minute rushes and gives you ample time to address any potential issues.Filing Deadlines

Consulting a tax professional can provide valuable insights and guidance, ensuring that your complex tax situation is handled correctly and efficiently.Seek Professional Help

Expert Assistance with Pie

Navigating the self-assessment process can be complex, but with Pie Tax, you have access to expert assistance that can guide you through the process. Our intuitive software simplifies everything from registration to submission, ensuring you get the best advice and maximise your tax benefits.

According to HMRC, over 10% of UK landlords overpay their taxes due to not claiming all allowable expenses.

More than 700,000 UK landlords file a self-assessment tax return each year.

Frequently Asked Questions

What is the deadline for filing an online self-assessment return?

The deadline for online self-assessment is January 31 following the end of the tax year.

How do I register for self-assessment?

You can register for self-assessment via the HMRC website. Ensure you do this well before the deadline to avoid penalties.

Can I deduct my mortgage interest from my rental income?

Yes, but the allowable deduction has been restricted to a basic rate reduction since April 2020.

What happens if I miss the self-assessment deadline?

Late submissions incur an initial £100 penalty. Additional penalties apply if you are more than three months late.

Do I need to file a self-assessment if my rental income is below £1,000?

Generally not, but you might still need to file a return if you have other income or are required by HMRC.