Understanding Bank Interest Reporting for Self-Employed

Navigating the world of taxes can be daunting, especially for self-employed individuals. One common question that arises is whether self-employed individuals need to report bank interest on their tax returns. This article explores this topic, sheds light on the importance of reporting all sources of income to HMRC, and explains how using tools like the Pie Tax App can make the process easier.

When it comes to filing your tax return, every bit of income counts—including the interest earned from your bank accounts. Bank interest is considered a form of income by HMRC and must be reported accordingly. This requirement is part of the government's effort to ensure all forms of earnings are taxed appropriately, ensuring a fair tax system for everyone.

Failure to report bank interest can lead to penalties, further complicating an already complex situation. Self-employed individuals, who might be juggling various income streams, need to be vigilant about including all sources of income in their tax returns. The Pie Tax App can significantly aid in this endeavour by providing a streamlined process for reporting all incomes and offering expert assistance when needed.

Why Report Bank Interest?

Reporting bank interest is not just a legal obligation; it also ensures that your taxes are accurate and can prevent potential issues with HMRC.

How To Report Bank Interest

Using tools like the Pie Tax App can simplify the process of reporting bank interest, ensuring accuracy and compliance.

In recent years, HMRC has increased scrutiny on unreported income. In 2022, there was a 12% increase in tax audits targeting self-employed individuals, highlighting the need for thorough and accurate reporting.Key Statistic

Failing to report all forms of income, including bank interest, can result in fines. In 2021, HMRC issued £12 million in penalties for unreported income, underscoring the importance of compliance.Financial Penalties

Accurate Reporting Benefits

Accurate reporting ensures that you stay compliant with tax laws and avoid legal trouble. More importantly, it provides a clear picture of your financial health, which can be beneficial for future planning and investments.

Easy Compliance with Pie Tax

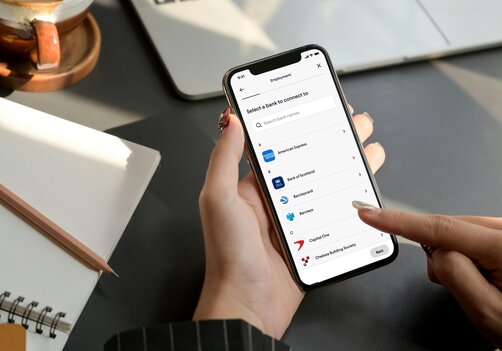

The Pie Tax App simplifies this process by providing a user-friendly platform where you can report all your income sources, including bank interest.

By automating much of the process, it reduces the risk of errors and ensures timely submission.

The expert tax assistants available on the app can guide you through any complexities, making the entire process seamless.

Reporting Bank Interest on Self Assessment

Check Your Personal Savings Allowance You may not need to pay tax on bank interest if it falls within your Personal Savings Allowance. Review the current thresholds carefully.

Include Untaxed Bank Interest Any bank interest earned that hasn't been taxed automatically must be reported on your Self Assessment. Make sure to keep records of all interest earned throughout the year.

Use Your Bank Statements Gather your annual bank statements to confirm how much interest you’ve earned. Only include the interest from savings and other taxable accounts.

Fun Facts

Did you know that most people overlook small amounts of interest earned from savings accounts? Even these small amounts need to be reported to ensure full compliance with tax laws.

Handling Bank Interest Reporting

If you are uncertain about how to report your bank interest, you can rely on platforms like the Pie Tax App. It not only provides an easy way to calculate and report taxes but also offers expert advice to navigate through any tax-related concerns. The app’s intuitive interface makes it easier to input various income sources, ensuring you stay compliant without the heavy lifting.

If you’re ever in doubt, consult the expert tax assistants available on the Pie Tax App. These professionals can provide tailored advice to ensure that you don’t miss any important steps in your tax reporting process. Staying compliant has never been this straightforward.

Accurate Reporting: Always ensure that every income source, including bank interest, is documented correctly. This avoids any potential legal troubles and ensures your tax return is as precise as possible.Key Reminders

Utilize tools designed for tax reporting, such as the Pie Tax App. It helps in tracking income sources and provides guidance on what needs to be reported, simplifying the entire process. Leveraging Tools

Summary

In conclusion, it is crucial for self-employed individuals to report bank interest on their tax returns. This type of income, although it may seem insignificant, is considered taxable by HMRC. Accurate and thorough reporting not only keeps you in compliance with the law but also provides a clear financial picture.

Using the Pie Tax App can greatly simplify this task, offering both a user-friendly platform and expert advice to ensure your tax return is accurate and comprehensive. Remember, staying compliant and keeping detailed records are key to smooth tax filing. Don't overlook the importance of reporting all forms of income, including bank interest.

Frequently Asked Questions

Do I need to report all types of bank interest?

Yes, all types of bank interest must be reported to HMRC, irrespective of the amount.

What if I forget to report my bank interest?

Failing to report any form of income, including bank interest, can result in penalties from HMRC. It's essential to review your accounts carefully.

Can I use the Pie Tax App to report bank interest?

Absolutely. The Pie Tax App streamlines the entire process, making it easy to report your bank interest accurately.

Are there any exceptions to reporting bank interest?

No, all bank interest is considered taxable and must be reported, without exceptions.

How can I get help if I'm unsure about tax reporting?

The Pie Tax App offers access to expert tax assistants who can provide guidance and ensure you meet all reporting requirements.