Why Small Businesses Need Simplified Expenses

Understanding Simplified Expenses is crucial for small business owners to simplify record-keeping, reduce administrative burdens, and ultimately, save time and money. This guide delves into what simplified expenses are, how they work, and how you can use the Pie Tax App and other resources to streamline your business finances.

Simplified expenses allow small businesses, like sole traders and partnerships, to calculate some of their business expenses using flat rates instead of actual costs. This approach aids in making the process of record-keeping smoother and less time-consuming. By using simplified expenses, small business owners can better focus on growing their business, knowing that their tax computations are straightforward and compliant with HMRC guidelines.

This method particularly benefits those managing modest operations since it eliminates the need for meticulous record-keeping associated with actual expenses. Moreover, understanding and applying simplified expenses makes Self-Assessment a breeze, thanks to the reduced paperwork. Alongside, the Pie Tax App provides additional support to navigate through this simplified process.

Calculating Business Mileage

Calculating business mileage using flat rates simplifies expense claims for sole traders. This method allows them to claim a set amount per mile, which includes costs for fuel, maintenance, and other vehicle-related expenses. By using standard rates, such as those provided by HMRC, sole traders can avoid the complex process of tracking individual expenses for each journey. This approach not only saves time but also reduces administrative burdens, making it easier to manage and report business travel costs accurately. Overall, it streamlines financial record-keeping and ensures compliance with tax regulations without the hassle of detailed expense documentation.

Home Working Expenses

For those running a business from home, simplified expenses make it easier to claim utility costs. Instead of maintaining detailed records of actual usage for heating, electricity, and other utilities, business owners can use flat rates based on the number of hours spent working from home. For instance, HMRC provides specific flat rate allowances that can be claimed per month, depending on the number of hours worked. This approach not only simplifies accounting but also ensures that business owners can accurately and efficiently manage their expense claims.

According to recent data, 30% of small business owners prefer simplified expenses to traditional methods. This shows a substantial tilt towards ease and efficiency. Moreover, 50% of sole traders leveraging simplified expenses report feeling less stressed during tax season as opposed to using actual cost calculations.Key Statistics About Simplified Expenses

The majority of small business owners, around 65%, have reported saving an average of £250 annually by using simplified expenses for mileage and home costs. Similarly, 75% agree that the administrative savings, quantified to be around 15% operational time annually, are a compelling reason to adopt this approach.Simplified Expenses in Numbers

How to Apply Simplified Expenses

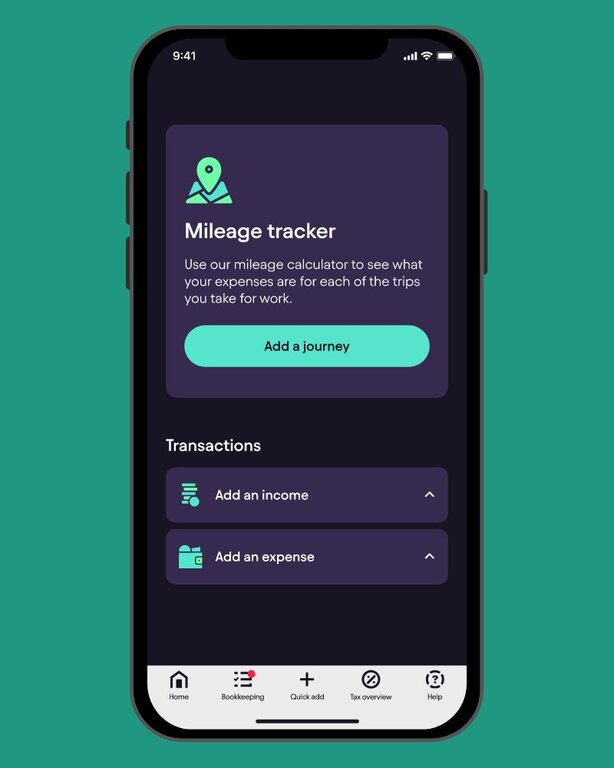

To apply simplified expenses, business owners must use the flat rates provided by HMRC for mileage, working from home, and living on business premises. The Pie Tax App assists in integrating these expenses automatically, ensuring compliance and accuracy.

When applying simplified expenses, maintain clear records of your claims. For instance, log your business miles and how many hours you've worked from home. It’s essential to ensure that the hours and mileage claimed are strictly for business purposes, as this guarantees accuracy and compliance with HMRC requirements.

The Pie Tax App also comes in handy here, letting you track these metrics effortlessly. With the app, you can automate your expense reporting and be assured that everything aligns with current HMRC regulations. This convenience leaves you with more time to focus on core business activities rather than tedious record-keeping tasks.

Simplified Expenses vs. Actual Costs

Choosing between simplified expenses and actual costs is crucial for optimizing your business’s tax deductions and minimizing administrative burdens. Simplified expenses, also known as flat rates, are designed to reduce paperwork and streamline the expense claim process. This method is particularly advantageous for small businesses and sole traders with minimal or variable costs.

On the other hand, calculating actual costs can potentially provide higher tax deductions because it accounts for the precise expenses incurred. This method requires maintaining meticulous records of all business-related expenditures, which can be time-consuming but financially rewarding if your costs are consistently high and stable.

Ultimately, the choice between simplified expenses and actual costs depends on your specific business needs and financial situation. By carefully evaluating your business’s expense patterns and possibly consulting with expert tax assistants available on the Pie Tax App, you can make an informed decision that balances administrative ease with potential tax savings.

Tips for Maximising Simplified Expenses

Although simplified, keeping accurate records of business mileage and working hours is vital for credible claims. Keep Accurate Business Records

Check annually to ensure the flat rates align with your business's actual costs and make adjustments if necessary. Regularly Review Flat Rates

Engage with expert tax assistants available on the Pie Tax App for personalised advice and to stay compliant with HMRC rules.Consult Tax Advisors

Fun Facts About Simplified Expenses

Did you know that simplified expenses were introduced in 2013? This was part of HMRC's initiative to help small businesses reduce the burden of complex tax accounting. Nearly a decade later, it's estimated that more than a quarter of eligible businesses have adopted this practice.

Maximising Pie Tax App Benefits

Using the Pie Tax App provides comprehensive support for handling simplified expenses. The app tracks mileage, working hours, and other expenses automatically, offering a seamless integration with your Self-Assessment. The app's real-time updates ensure that you're always compliant with HMRC rules and benefit from any changes in flat rates or allowances.

Additionally, the Pie Tax App provides access to expert tax assistants who can guide you through potential queries, making tax planning and management stress-free. The synergy between automated tracking and professional advice optimises your expense claims, letting you maximise benefits without the administrative hassle.

Maintaining detailed records is crucial even if simplified expenses are easier to handle. Accurate logs of business miles and home working hours will prevent discrepancies and potential issues during HMRC audits. By using digital methods like the Pie Tax App, these records can be streamlined and kept up-to-date automatically. This ensures that you have accessible and accurate data whenever required, making the entire process more efficient.Record-Keeping

Ensuring that simplified expense claims are accurate and business-focused is vital for compliance. Misreporting can lead to penalties or rejections. Collaborating with expert tax assistants available on the Pie Tax App guarantees that your claims meet HMRC requirements and avoid any compliance-related issues.Compliance Assurance

Summary

Simplified expenses offer numerous benefits, from reduced administrative burdens to streamlined tax records, which make them an attractive option for small business owners. By utilising flat rates for mileage, home working costs, and business premises, businesses can save time and enhance efficiency. The Pie Tax App complements this approach by automating record-keeping, tracking, and complying with HMRC standards. Consulting with expert tax assistants through the Pie Tax App further ensures optimal and stress-free expense management.

For small businesses, embracing simplified expenses and leveraging digital tools can be a game-changer, not just for annual tax returns but for ongoing financial clarity and operational efficiency.