Understanding Tax Relief for Self-Employed Individuals

Navigating tax responsibilities can be challenging for self-employed individuals, especially when it comes to maximising tax relief. Understanding what qualifies for tax relief and how to claim it can significantly impact your bottom line. As a self-employed professional, you are entitled to various tax reliefs that can help reduce your taxable income and, consequently, your tax bill.

Tax reliefs available to self-employed individuals include deductions for business expenses, capital allowances on equipment, and specific allowances for working from home. By understanding these reliefs and how to apply them, you can make informed decisions about your tax planning strategy. This guide provides a comprehensive overview of tax relief options available to the self-employed, helping you keep more of your hard-earned money.

By taking advantage of the available tax reliefs and allowances, self-employed individuals can reduce their tax burden significantly. The Pie Tax App and expert tax assistants available on the Pie app can provide valuable guidance to ensure you fully utilise all available reliefs while staying compliant with HMRC regulations.

Business Expenses and Tax Relief

Self-employed individuals can reduce their tax bill by claiming business expenses like office supplies, travel, marketing, and professional fees. Deduct these from your income to lower your tax.

It’s crucial to keep detailed records of all business-related expenses throughout the year. Proper documentation not only ensures you are claiming everything you’re entitled to but also helps in case of an HMRC audit. Remember, personal expenses are not deductible, so it’s important to differentiate between personal and business expenditures when managing your finances.

Capital Allowances for Equipment

Capital allowances provide another vital avenue for tax relief. If you purchase equipment for your business, such as computers, machinery, or vehicles, you can claim capital allowances to deduct a portion of the cost from your taxable income. This allowance helps spread the cost of large expenses over several years, reflecting their depreciation and ongoing use in your business.

Different types of capital allowances are available depending on the nature of the asset and the total amount spent. For example, the Annual Investment Allowance (AIA) allows you to deduct the full cost of qualifying equipment up to a certain limit. Understanding the various capital allowances and their application can help you make the most of your tax relief opportunities.

Two important figures to remember when considering tax relief for the self-employed are the £1,000 trading allowance available to small businesses and the 100% capital allowance available under the AIA for qualifying equipment up to £1 million. Key Numbers for Self-Employed Relief

Recent statistics reveal that over 60% of self-employed individuals in the UK claim business expenses to reduce their tax liability. Additionally, nearly 50% of eligible businesses utilise capital allowances, indicating a growing awareness of these valuable tax relief options.Tax Relief Statistics for Self-Employed

Working from Home Allowances

With the rise of remote working, many self-employed individuals now operate from home, which brings its own set of tax relief opportunities. HMRC allows for a flat rate deduction or a calculation based on actual costs incurred, such as utilities and internet, to account for the expenses of maintaining a home office. Choosing the best method depends on your specific circumstances and can make a significant difference in your overall tax liability.

To claim these allowances effectively, you must keep accurate records of all relevant expenses. Detailed documentation ensures that you are fully compliant with HMRC rules and maximises your eligible deductions. As remote work continues to be a trend, understanding these allowances is crucial for self-employed individuals looking to optimise their tax situation.

Self-Assessment and Tax Relief

Self-employed individuals must navigate the complexities of self-assessment to claim their tax reliefs accurately. This process involves submitting an annual tax return to HMRC, detailing your income and expenses. Understanding what can be claimed as an expense or allowance is vital to avoid overpaying taxes or facing penalties for underreporting.

Staying organised throughout the year with detailed records of income and expenses simplifies the self-assessment process. Utilising digital tools, such as accounting software, can streamline record-keeping and ensure accuracy. For many self-employed individuals, working with a tax expert can also provide clarity and confidence during self-assessment.

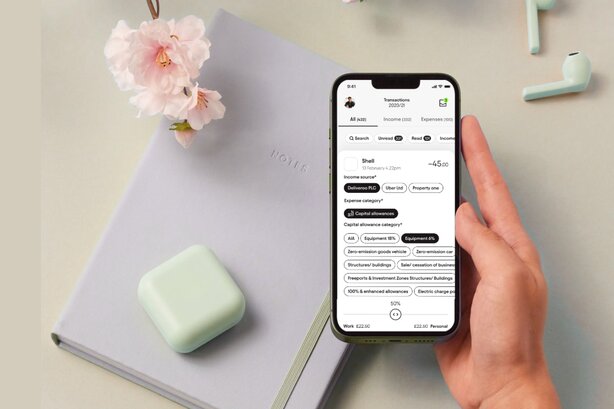

Streamlining Capital Allowances made easy with Pie Tax App

Managing capital allowances is simplified with the Pie Tax App, allowing you to keep track of eligible expenses and maximise your tax savings. The app simplifies the process by offering a user-friendly interface that ensures you accurately record capital allowances for your business assets.

To add a capital allowance, start by navigating the bookkeeping section of the app. Once there, select the option to add a new expense. You’ll be prompted to choose an expense type—select "capital allowance" from the list provided. This ensures that the expense is categorised correctly for tax purposes.

Tips for Claiming Tax Relief

Ensure all business expenses are accurately documented to maximise eligible tax reliefs.Keep meticulous records

Differentiate between personal and business expenses to avoid costly mistakes during tax filing.Understand allowable expenses

Strategically plan equipment purchases to take full advantage of capital allowances like the AIA.Plan for capital allowances

Fun Facts

Did you know that self-employed individuals can claim tax relief on their mobile phone bills? As long as the phone is used for business purposes, a portion of the bill can be deducted from your taxable income!

Navigating Tax Relief Complexities

Navigating the complexities of tax relief for the self-employed can be daunting, especially with the variety of expenses and allowances to consider. To make the most of these opportunities, it’s crucial to stay informed about what expenses qualify for relief and how to claim them. Proper documentation and a clear understanding of HMRC guidelines are essential to avoid any issues during self-assessment.

For those who find this process challenging, consulting with a tax expert or using tools like the Pie Tax App can provide much-needed support. The app offers expert advice and real-time updates on tax regulations, helping self-employed individuals optimise their tax relief and stay compliant with HMRC rules.

Effectively claiming tax relief requires understanding the different options available to self-employed individuals, such as allowable business expenses, capital allowances, and home office deductions. By keeping detailed records and staying organised, you can ensure that you’re claiming all the reliefs you’re entitled to. Seeking professional advice or using digital tools can simplify the process and maximise your tax savings. The goal is not just compliance but also making the most of every opportunity to reduce your tax burden.Key Takeaways

Being proactive about your tax planning is crucial for self-employed individuals. Waiting until the end of the tax year to consider tax relief options can lead to missed opportunities and higher tax bills. Instead, integrate tax planning into your regular financial strategy by reviewing expenses and potential allowances throughout the year. It’s also vital to stay updated on any changes to tax laws that could impact your eligibility for relief. By doing so, you can avoid costly mistakes and ensure you’re making the most of your self-employed status.Important Advice

Summary

Maximising tax relief is a vital part of managing finances as a self-employed individual. By understanding what qualifies for tax relief, utilising capital allowances, and effectively claiming expenses, you can significantly reduce your tax burden.

The Pie Tax App, with its expert tax assistants, provides invaluable support in navigating these complexities, ensuring that you fully benefit from all available reliefs while remaining compliant with HMRC regulations.

Keeping accurate records, planning ahead, and seeking expert advice are all essential steps to optimising your tax position and keeping more of your hard-earned money.

Frequently Asked Questions

What expenses can self-employed individuals claim for tax relief?

Self-employed individuals can claim a range of business expenses, including office supplies, travel costs, marketing expenses, and professional fees, as long as they are necessary for the business.

How do capital allowances benefit self-employed individuals?

Capital allowances allow self-employed individuals to deduct the cost of certain business assets, such as machinery and computers, from their taxable income, reducing their overall tax bill.

What is the trading allowance for small businesses?

The trading allowance allows small businesses to earn up to £1,000 of trading income tax-free each year, providing a straightforward way to reduce tax liability.

How can the Pie Tax App help with tax relief?

The Pie Tax App provides expert guidance on available tax reliefs and helps self-employed individuals navigate the complexities of tax regulations, ensuring maximum savings.

Why is record-keeping important for claiming tax relief?

Keeping detailed records of all business expenses and assets is essential for accurately claiming tax relief and remaining compliant with HMRC regulations. It helps ensure you claim everything you're entitled to and protects against potential audits.