Introduction to CIS Payments and UTR Numbers

When you're navigating the complex world of Construction Industry Scheme (CIS) payments, particularly if you’re operating as a limited company, the question often arises: Can you use your limited company UTR number for CIS payments? Understanding the role of the Unique Taxpayer Reference (UTR) number and its implications is crucial for ensuring compliance and efficient tax handling.

In this detailed guide, we will explore whether you can use your limited company UTR number for CIS payments, how it impacts your business, and provide practical tips on managing this aspect of your financial operations. Whether you're a seasoned contractor or new to the industry, knowing the ins and outs of UTR numbers under CIS can help streamline your payment processes and give you peace of mind.

With the Pie Tax App, you'll have access to expert tax assistants who are ready to answer your questions and help you navigate these nuances. Let’s delve into the vital aspects of using your limited company UTR number for CIS payments.

What is a UTR Number?

A Unique Taxpayer Reference (UTR) number is a 10-digit identifier issued by HMRC to individuals and companies for tax purposes. This number is essential for managing tax affairs, as it uniquely identifies taxpayers and ensures all transactions are accurately recorded and compliant with HMRC regulations. Whether you’re filing a tax return, making payments, or communicating with HMRC, your UTR number is crucial for tracking and processing your tax records efficiently. This helps maintain proper documentation and compliance with UK tax laws, facilitating smoother interactions with tax authorities.

What is CIS?

The Construction Industry Scheme (CIS) is a government program designed to ensure tax compliance in the construction sector. It outlines rules for contractors regarding payments to subcontractors, including tax deductions. CIS promotes transparency and tax accountability, safeguarding against tax evasion and ensuring fair practices within the industry. By enforcing these regulations, the scheme helps maintain integrity and compliance in financial transactions, benefiting both contractors and subcontractors. Compliance with CIS is crucial for upholding tax laws, preventing fraud, and fostering a level playing field in the construction industry.

In 2020, over £3.5 billion was collected through CIS deductions, reflecting the scheme's significant role in the UK construction industry. This shows how crucial it is to accurately adhere to CIS guidelines.Key Statistic of CIS Deductions

Recent statistics indicate that compliance rates among contractors improved by 15% from 2018 to 2020, highlighting the increasing awareness and adherence to CIS regulations.Key Statistics of Compliance Rates

UTR Numbers in CIS Payments

When it comes to CIS payments, your UTR number serves as a crucial element. If you're a limited company, it’s vital to register your company for CIS independently of your personal UTR. This ensures your company's transactions are correctly recorded and any tax deductions are properly applied.

First, ensure your company is separately registered for CIS under your company’s UTR number and not your personal one. This distinction is key for both legal and financial reasons. Using your limited company UTR number allows payments to be tracked and attributed accurately, avoiding mix-ups that could result in potential fines or misallocated tax deductions.

Registering your limited company under CIS with its UTR number helps maintain clear and organised records. This can save you from many potential headaches during tax season and streamline the process when using tools like the Pie Tax App.

Why Separate UTRs Matter

It is crucial to distinguish between your personal and company Unique Taxpayer Reference (UTR) numbers to prevent complications. Utilising your limited company's UTR for the Construction Industry Scheme (CIS) guarantees that all payments and deductions are accurately linked to the business, streamlining tax compliance. Mixing personal and business UTRs can result in erroneous tax documentation, potential legal complications, and fines.

Establishing a clear division aids in ensuring precise tax payments, maintaining accurate financial records, and simplifying the reconciliation of accounts. The Pie Tax App, along with expert tax assistants accessible through the app, can offer invaluable assistance in managing these intricacies, providing guidance and support in navigating the complexities of tax compliance and record-keeping for both personal and business finances.

Tips for Managing UTR Numbers

Firstly, always use your limited company UTR number for all business-related transactions. This ensures a clear distinction between your personal and business finances.Use Your Company UTR for Business

UTR for Business Clarity Secondly, keep your UTR details secure and organised. Regularly review your records to ensure all transactions under the CIS are correctly attributed and compliant.

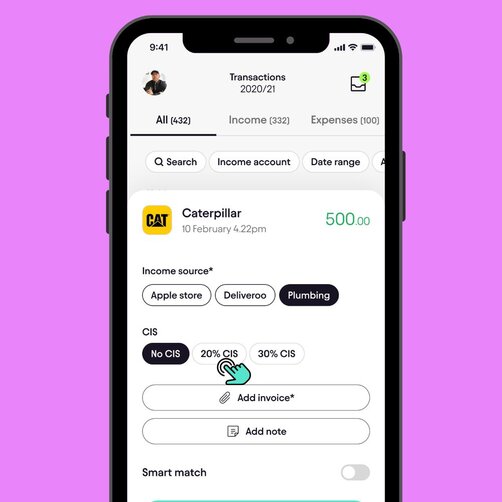

Pie Tax App for UTR Management Lastly, utilise tools like the Pie Tax App to help manage your UTR numbers. The app simplifies record-keeping and ensures easy access to expert guidance.

Fun Fact: Origin of UTR Numbers

Introduced in 1992, the UTR (Unique Taxpayer Reference) system replaced the older tax reference number system, enhancing tax tracking efficiency. Each taxpayer is assigned a unique UTR number, streamlining record-keeping and enabling authorities to monitor tax obligations effectively, marking a significant advancement in tax administration practices.

Handling CIS Payments Efficiently

To handle CIS payments efficiently, ensure that your limited company is properly registered with HMRC. This includes securing your UTR number and verifying it when needed. This registration helps establish your company’s presence within the CIS framework and ensures you can receive payments accurately.

Next, keep meticulous records of all payments and deductions. Use digital tools like the Pie Tax App to maintain an organised and secure record system. This will facilitate smoother end-of-year reconciliations and prepare you for any HMRC audits without stress.

One critical step is to ensure that your registration is confirmed with HMRC. This step is vital because any delay can impact your payments. Prompt communication and verification with HMRC keep your affairs up-to-date.Important Registration Step

Modern tax software like the Pie Tax App can significantly simplify your tax management. This software assists in accurate deduction tracking and ensures that you don’t miss any critical tax deadlines. Using Tax Software

Summary

In conclusion, properly using your limited company UTR number for CIS payments is crucial for staying compliant with HMRC regulations. Ensuring that your business is correctly registered under CIS and keeping clear records can prevent potential legal and financial issues. The Pie Tax App, with its intuitive interface and access to expert tax assistants, can greatly streamline this process, keeping your tax affairs in order.

By separating your personal and business UTRs, you maintain clarity in your financial records and enhance compliance. Whether you’re navigating through contractor payments or handling end-of-year reconciliations, the right tools and guidance are essential for managing CIS payments effectively. Stay organised, use the proper identification instruments and leverage expert advice for a hassle-free tax experience with Pie Tax.

Frequently Asked Questions

Can I use my personal UTR for CIS payments under my limited company?

No, it’s essential to use your limited company’s UTR number for company CIS payments to ensure all transactions are correctly attributed to the business.

What happens if I use the wrong UTR number?

Using the wrong UTR number can lead to misallocated payments and potential legal issues. Always ensure that business-related CIS payments use the company UTR.

How do I register my limited company for CIS?

You can register your limited company for CIS through the HMRC website. Ensure you have your company's UTR ready for the registration process.

What role does the Pie Tax App play in managing CIS payments?

The Pie Tax App helps you organise your tax records, track payments and deductions, and provide access to expert tax assistants for guidance on managing CIS payments.

Is there a deadline for CIS registration?

There is no specific deadline, but it’s crucial to register as soon as your company engages in activities under the CIS umbrella to ensure compliance from the start.