Who Qualifies as a Taxpayer?

Taxpayers are individuals or entities, such as businesses or corporations, that are obligated to pay taxes to governmental authorities. Taxes come in various forms, including income tax, corporate tax, sales tax, property tax, and more. In the UK, taxpayers fund essential public services like healthcare, education, and infrastructure through their contributions. Understanding the qualifications for being a taxpayer helps in comprehending the scope and breadth of tax responsibilities.

Every resident or entity that earns income, owns property, or conducts business in the UK is subject to tax regulations. It's important to know that even non-residents who have income from UK sources may also be required to pay taxes here. This broad definition ensures that everyone benefiting from public services contributes to their upkeep.

Taxpayers play a pivotal role in a country's economy by providing the necessary funds for development and welfare activities. Without their contributions, many public services would face significant challenges in operation and sustainability.

Role in Public Services

Taxpayers' contributions play a vital role in funding essential public services, including healthcare, education, and transportation. These financial inputs ensure that communities have access to necessary resources and infrastructure, which in turn supports overall societal well-being.

By funding healthcare, taxpayers help maintain public health and provide medical services; in education, they contribute to schools that shape future generations. Additionally, funding transportation improves connectivity, enabling people to access jobs and services, thereby enhancing the quality of life for all citizens.

Legislative Influence

By participating in tax payments, taxpayers indirectly influence legislation and policy-making. The contributions made by taxpayers help determine public funding decisions, shaping laws and initiatives that affect various sectors.

When taxpayers fulfil their obligations, they provide the government with the resources needed to address community needs, invest in infrastructure, and implement social programs. Consequently, taxpayer contributions play a crucial role in guiding priorities and ensuring that legislation reflects the financial capabilities and interests of the community.

Recent statistics show that 29 million individuals in the UK pay income tax annually, contributing to the nation's revenue. This funding supports vital services and governmental projects.Income Tax Numbers

The business sector pays a considerable amount in taxes, with £73.2 billion paid in corporate taxes in the fiscal year 2021/2022. This propels the economy by providing funds for public infrastructure.Business Tax Impact

Legal Obligations of Taxpayers

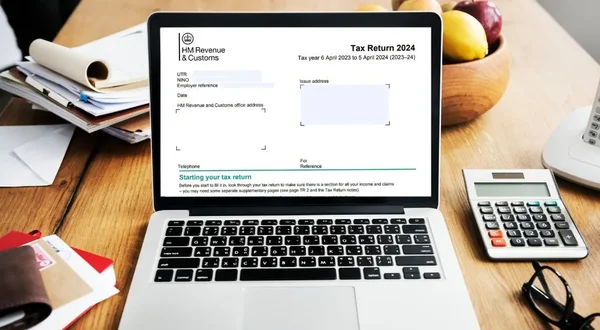

Taxpayers are legally required to comply with tax regulations, which involves accurate reporting and timely payments. Failing to meet these obligations can result in penalties and legal repercussions. In the UK, the legal framework ensures that taxpayers report their earnings through the self-assessment system or through PAYE (Pay As You Earn) for employed individuals.

Compliance with tax laws also means keeping abreast of any changes or updates to tax regulations. Utilising services like the Pie Tax App can potentially alleviate the complexity associated with tax filing and ensure that all legal requirements are fulfilled without hassle.

Financial Responsibilities

Taxpayers have a responsibility to manage their financial affairs diligently. This involves maintaining comprehensive records of income, expenses, and any tax-deductible activities throughout the year. Proper documentation is essential not only for accurate tax filing but also to avoid potential disputes or discrepancies with tax authorities. Keeping well-organised records ensures that all necessary details are available for review.

The Pie Tax App offers powerful tools designed to help taxpayers efficiently track their financial activities. With its intuitive interface, users can easily organise their fiscal data, reducing the time and stress typically associated with tax preparation. By enhancing accuracy in tax submissions, the app supports individuals in meeting their tax obligations confidently and with ease.

Top Tips for Taxpayer Trends

Digital tax solutions are becoming more prevalent, making tax filing simpler.Digital Solutions

Increased transparency in tax laws can help taxpayers understand their obligations better.Transparency in Tax Laws

Customised financial tools like the Pie Tax App will continue to play a significant role.Customised Tools

Fun Fact About Taxes

Did you know that in Ancient Egypt, taxes were paid in the form of labour and goods such as grain? This was essential for constructing monumental works like the pyramids and sustaining Egyptian society. Today, we have more sophisticated methods, but the principle of contributing to societal needs remains timeless.

Handling Tax Challenges

Managing taxes can be overwhelming, but there are several ways to ease this burden. One effective method is seeking assistance from tax professionals. These experts can help you understand the intricacies of tax laws, ensuring that you are compliant without overpaying.

Using technology, like the Pie Tax App, is another excellent way. The app simplifies the process by providing guidelines, reminders, and tools to help you track your financial activities. This ensures that you stay on top of your tax obligations with minimal stress.

Consulting with expert tax advisors available on the Pie Tax App can help you navigate complex tax issues. They offer tailored advice suited to your financial situation, ensuring you maximise your tax benefits and comply with regulations. The expert assistance can save you time and provide peace of mind, knowing your taxes are managed accurately.Expert Tax Advisors

Modern tax solutions like the Pie Tax App offer innovative features for tax management. The app provides easy access to everything from tax calculators to financial tracking tools. By digitising your tax process, you can reduce errors, make timely submissions, and ensure you never miss a deadline. The Pie Tax App is an invaluable resource for the modern taxpayer.Modern Tax Solutions

Summary

Understanding who taxpayers are and why they matter is crucial for appreciating the role they play in society. Taxpayers fund essential public services and contribute to the economic stability of a nation. From individuals to businesses, everyone has a role to play in supporting the community through taxes.

Effective management of tax obligations is vital for maintaining compliance and maximising benefits. Using tools like the Pie Tax App simplifies the process, providing valuable resources and expert assistance. As tax laws evolve, staying informed and utilising modern solutions will continue to be essential for every taxpayer.

Frequently Asked Questions

Who is considered a taxpayer in the UK?

A taxpayer in the UK includes individuals, businesses, and even non-residents earning income from UK sources. All these entities must fulfil their tax obligations as outlined by HMRC.

What types of taxes do taxpayers pay?

In the UK, taxpayers pay various taxes including income tax, corporate tax, VAT, property tax and more. Each type of tax serves to fund different public services and infrastructure.

How can I ensure I'm compliant with UK tax laws?

Utilising digital tools like the Pie Tax App and consulting with tax professionals can help ensure compliance. These resources provide guidance on accurate reporting and timely submissions.

How do taxpayers affect public services?

Taxpayers' contributions are essential for funding public services such as healthcare, education, and transportation, enabling the government to maintain quality and accessibility.

What are the benefits of using the Pie Tax App?

The Pie Tax App offers features like financial tracking tools, tax calculators, and expert assistance. It simplifies tax management, reduces errors, and helps ensure timely submissions.