Exploring the Tax Implications on Stock Options

Navigating the world of stock options can be a daunting task, especially for those involved in startups. In the UK, startup stock options present unique tax implications that can significantly impact both employers and employees. Understanding these implications is crucial for anyone considering offering or receiving stock options as part of their remuneration package.

This article aims to demystify the tax landscape surrounding startup stock options. From the types of options available to the respective tax treatments, we'll cover everything you need to know to make informed decisions. Whether you're a founder looking to reward your team or an employee weighing the benefits, this guide will empower you with the necessary knowledge.

Types of Stock Options

There are primarily two types of stock options in the UK: Enterprise Management Incentives (EMIs) and non-EMI options. EMIs are specifically designed for smaller companies and offer significant tax advantages. These options are tax-efficient for both the employer and the employee, with gains typically taxed at Capital Gains Tax (CGT) rates rather than Income Tax rates. On the other hand, non-EMI options do not come with the same benefits and are generally subject to Income Tax and National Insurance contributions when exercised.

Tax Treatment on Exercise

Tax rebates can be related to various situations, such as job expenses or incorrect tax codes. Job-related expenses that may be eligible for a tax rebate include Mileage Allowance Payment (AMAP) rates for essential work travel. If an incorrect tax code has been issued, you may also be eligible for a tax rebate.

Additionally, other circumstances may qualify for a tax rebate. Understanding the different types of tax rebates can help you determine if you’re eligible and take the necessary steps to claim your money back.

In 2022, 32,000 small businesses in the UK offered EMI schemes to their employees, highlighting their popularity.

Moreover, over 50% of employees in these businesses opted into the EMI schemes, illustrating the appeal of these tax-efficient options.

How Taxes are Calculated

The calculation of taxes on startup stock options can vary significantly. For EMI options, no Income Tax or National Insurance contributions are typically due either upon grant or exercise if the shares are purchased at market value. The primary tax liability arises when the shares are sold, taxed under CGT rates. This makes EMIs an attractive option for many startups, as they offer significant savings compared to traditional remuneration mechanisms.

On the other hand, non-EMI options are less tax advantageous. When these options are exercised, the difference between the market value of the shares and the exercise price is subject to Income Tax and National Insurance contributions. This can result in a substantial immediate tax burden, which could deter employees from exercising their options until they plan to sell the shares.

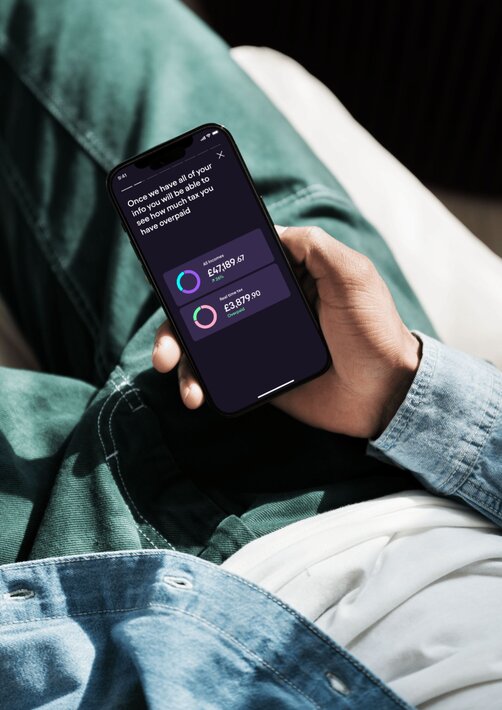

Benefits of Using the Pie Tax App

Leveraging the Pie Tax App can considerably simplify the complex landscape of taxing stock options. The app offers a user-friendly interface where you can input your stock options details and receive tailored advice on the tax implications. This ensures that you remain compliant while maximising your tax efficiency.

Additionally, the expert tax assistants available on the Pie app are always ready to offer personalised advice. They can guide you through the nuances of EMI and non-EMI options, helping you navigate your tax obligations seamlessly. Moreover, they can assist in ensuring all required filings are done promptly, avoiding penalties and costly errors.

Tips to Manage Tax Efficiently

First, plan the timing of exercising your stock options carefully. Exercising options at the right time can significantly reduce your tax liability. For instance, exercising EMIs during a low-income year might offer additional tax savings.

Second, keep meticulous records of all stock option transactions. This includes the grant, exercise dates, and the associated costs. This documentation will be invaluable when filing taxes or if HMRC queries any part of the process.

Lastly, consult with tax experts regularly. The tax landscape is continually evolving, and staying updated on the latest regulations can help you make the most informed decisions. Here, the Pie Tax App's expert tax assistants can prove invaluable.

Handling Your Tax Returns Accurate and timely tax returns are crucial when managing stock options. The Pie Tax App provides clear instructions on forms and deadlines, helping you stay on top of Self-Assessment and HMRC notifications. It also helps you avoid common mistakes that could lead to fines and interest.

Grant vs. Exercise Dates Understanding grant and exercise dates is key. The grant date is when the company gives the option, with no immediate tax. The exercise date, when you buy the shares, often triggers tax. The Pie Tax App helps clarify and manage these dates to minimise your tax burden.

Importance of Record-Keeping Accurate record-keeping is essential for managing your tax efficiently. Keeping detailed records of all stock option activities ensures you are fully prepared for tax filings and audits. The Pie Tax App can serve as a digital diary, helping you keep all necessary documentation organised and accessible.

Fun Facts

Did you know that the EMI scheme was introduced in the year 2000? It was designed to help small businesses attract and retain top talent.

Importance of Understanding Tax Implications for Startup Stock Options

Understanding tax implications for startup stock options is crucial for managing your financial outcomes. The Pie Tax App helps you navigate these complexities by providing clear guidance on when taxes apply and how to handle different types of options. Using the app ensures you make informed decisions and avoid costly mistakes, optimizing your tax strategy.

Stock options can offer significant financial rewards if the startup succeeds, providing the potential for high returns. Additionally, with certain options, such as Incentive Stock Options (ISOs), taxes may be deferred until the shares are sold. This can be advantageous, as holding the shares for at least a year after exercise may qualify them for long-term capital gains tax rates, which are typically lower than ordinary income tax rates.Pros of Tax Implications for Startup Stock Options

Navigating the tax implications of stock options can be quite complex, as the rules differ significantly between Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). Exercising options can also trigger an immediate tax liability, which may result in a substantial tax bill even if the shares are not sold. Additionally, there is a risk of loss if the startup fails, as the options could become worthless, potentially leading to tax issues related to unvested or unsold shares.Cons of Tax Implications for Startup Stock Options

Summary

Understanding the tax implications of startup stock options is crucial for both employers and employees in the UK. EMIs offer considerable tax advantages, making them a popular choice among small businesses. In contrast, non-EMI options tend to be less tax-friendly, often resulting in higher immediate tax liabilities upon exercise.