Understanding Making Tax Digital for ITSA

Making Tax Digital (MTD) for Income Tax Self-Assessment (ITSA) represents a significant change for sole traders and landlords in the UK. The new system aims to simplify the tax process, ensuring accurate record-keeping and prompt submissions. By transitioning to MTD for ITSA, taxpayers can avoid penalties and gain better visibility of their tax obligations throughout the year.

Sole traders and landlords, who often manage their business or property income, stand to benefit from the real-time nature of MTD. By shifting away from annual self-assessment returns to quarterly updates, taxpayers can maintain up-to-date records and receive a more accurate picture of their tax liabilities. This streamlining will also help in managing cash flow and avoiding unexpected tax bills.

The need for digital record-keeping also opens the door for leveraging modern accounting software and tools like the Pie Tax App. Expert tax assistants available on the Pie App can offer personalised advice and ensure you're compliant, making the transition to MTD smoother and more efficient.

Benefits of Digital Record-Keeping

Digital record-keeping under MTD enhances accuracy and reduces the risk of errors. By using digital tools like the Pie Tax App, sole traders and landlords can automate many aspects of their record-keeping, from invoicing to tracking expenses. This not only saves time but ensures that all necessary information is readily available for quarterly updates. Additionally, having digital records can simplify audits and provide consistent, reliable documentation for tax submissions.

Real-Time Tax Monitoring

Real-time tax monitoring allows taxpayers to track their tax position throughout the year, avoiding end-of-year surprises. With MTD for ITSA, quarterly submissions ensure that sole traders and landlords can monitor their income and expenses as they go, leading to a more

informed understanding of tax liabilities. The Pie Tax App provides real-time insights and alerts, helping users stay on top of their tax affairs, ultimately leading to better financial management.

Transitioning to MTD for ITSA

Transitioning to MTD for ITSA involves several key steps. Initially, sole traders and landlords must ensure they have compatible digital tools and software, such as the Pie Tax App, which integrates seamlessly with HMRC systems. Next, updating and maintaining digital records is crucial. This involves digitising receipts, invoices, and other relevant documents, ensuring they're regularly updated and readily accessible for quarterly submissions.

Moreover, understanding the submission deadlines is vital. Timely quarterly updates prevent surprises and avoid penalties. HMRC offers several resources, and the expert tax assistants available on the Pie App can provide tailored advice and support during the transition, ensuring compliance and accuracy.

Streamline Your Tax Process

The Pie Tax App can play a pivotal role in streamlining the tax process for sole traders and landlords. The app not only facilitates digital record-keeping but also provides real-time tax insights through an easy-to-navigate interface. Expert tax assistants are always on hand, offering customised advice and addressing specific tax queries.

This personalised support helps taxpayers maximise their benefits under MTD for ITSA, paving the way for a smoother, worry-free tax experience.

Tips for MTD for ITSA

Stay Updated on Deadlines Ensure you're aware of all MTD for ITSA deadlines. Missing important dates can lead to penalties and stress. Keep a calendar handy!

Invest in Reliable Software Choose MTD-compliant software to streamline your tax submissions. Good software will save you time and help avoid costly errors.

Seek Professional Guidance Choose MTD-compliant software to streamline your tax submissions. Good software will save you time and help avoid costly errors.

Interesting tax fact

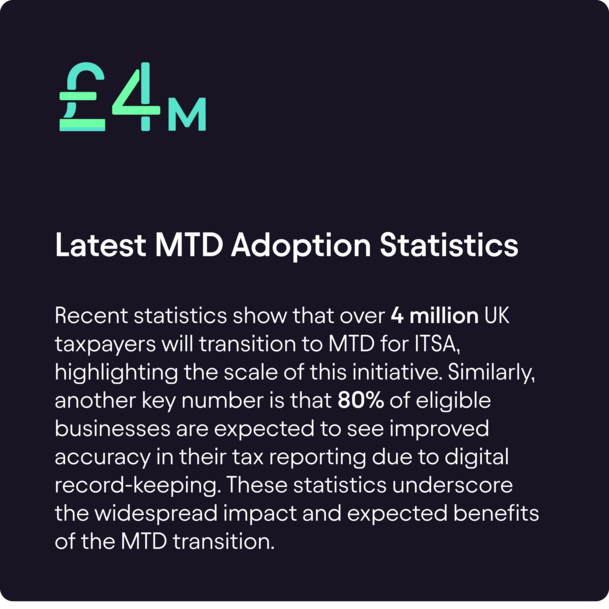

Did you know that MTD for ITSA is expected to generate significant administrative savings for UK businesses, up to £1.2 billion annually by 2025?.

How to Comply with MTD for ITSA

To comply with MTD for ITSA, start by ensuring you have compatible software like the Pie Tax App. This digital tool is HMRC-approved and facilitates seamless record-keeping and quarterly submissions. Next, digitise all relevant tax documents, such as receipts, invoices, and bank statements, and make it a habit to update these records regularly.

Familiarise yourself with the quarterly submission deadlines to avoid penalties. Making timely updates ensures that your tax records are current and accurate, which mitigates the risk of errors. Finally, consult the expert tax assistants available on the Pie App for personalised advice and support. Their insights can guide you through the nuances of MTD compliance, making the process straightforward and manageable.

Summary

In conclusion, Making Tax Digital for Income Tax Self-Assessment represents a significant shift for sole traders and landlords, bringing numerous benefits and streamlining the tax process. By transitioning to MTD for ITSA, taxpayers can enjoy more accurate record-keeping, real-time tax monitoring, and reduced administrative burdens. The Pie Tax App, alongside its expert tax assistants, provides essential tools and support for a smooth transition, enabling compliance and optimising the tax experience.

The future of MTD for ITSA looks promising, with further integration of digital tools and potential enhancements through AI and machine learning. Technology will continue to drive the evolution of the tax system, making compliance easier and more efficient for all taxpayers.

With the right tools and expert support, complying with MTD for ITSA can be a straightforward and beneficial process. Understanding the requirements, meeting submission deadlines, and leveraging expert assistance are key to maximising the benefits of this digital transformation.

Frequently Asked Questions

What is Making Tax Digital for ITSA?

Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) is a government initiative aimed at modernising the tax system by requiring digital record-keeping and quarterly submissions.

Who needs to comply with MTD for ITSA?

Sole traders and landlords with an annual income above £10,000 are required to comply with MTD for ITSA. This involves using compatible digital tools, such as the Pie Tax App, for record-keeping and submissions.

How does the Pie Tax App help with MTD compliance?

The Pie Tax App facilitates digital record-keeping, offers real-time tax monitoring, and provides access to expert tax assistants who can provide personalised advice and support for a seamless MTD transition.

What are the submission deadlines under MTD for ITSA?

Taxpayers are required to make quarterly updates to HMRC. These updates replace the traditional annual tax return, making it essential to stay on top of submission deadlines to avoid penalties.

What are the benefits of transitioning to MTD for ITSA?

Benefits include improved accuracy in tax reporting, better cash flow management, reduced administrative burdens, and access to real-time insights into your tax position.