Understanding Self-Assessment Tax Returns

Are you a UK taxpayer puzzled about calculating mileage from home or first destination? Worry not! We've got you covered with a comprehensive guide on determining your mileage correctly.

Key Components of Self-Assessment Tax Returns

When you need to calculate mileage for your tax return, it's crucial to understand several key components:

For the tax year ending on April 5th, the deadlines are as follows: Paper tax returns must be submitted by October 31st, while online tax returns are due by January 31st.Important Deadlines

Failing to meet the submission deadlines can result in penalties. There is an automatic £100 fine for late filing, and further penalties increase over time with additional fines for continued non-compliance.Penalties

Keeping accurate records is essential. This includes documenting your income, maintaining detailed records of allowable business expenses, and keeping all relevant paperwork such as receipts, invoices, and bank statements.Record Keeping

How to Submit a Self-Assessment Tax Return

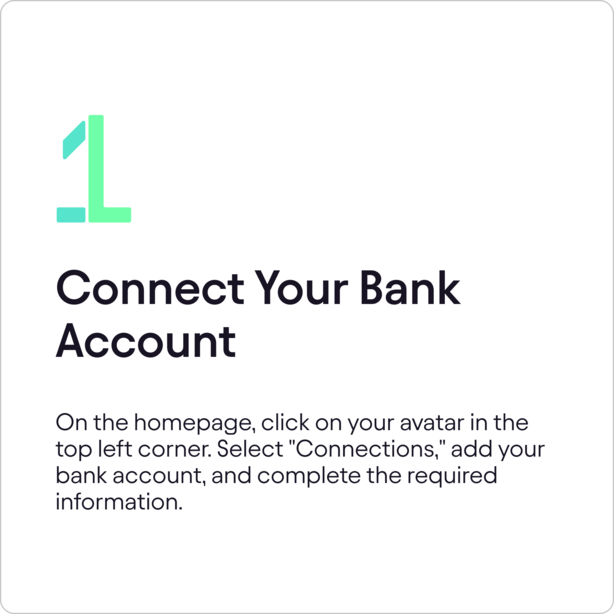

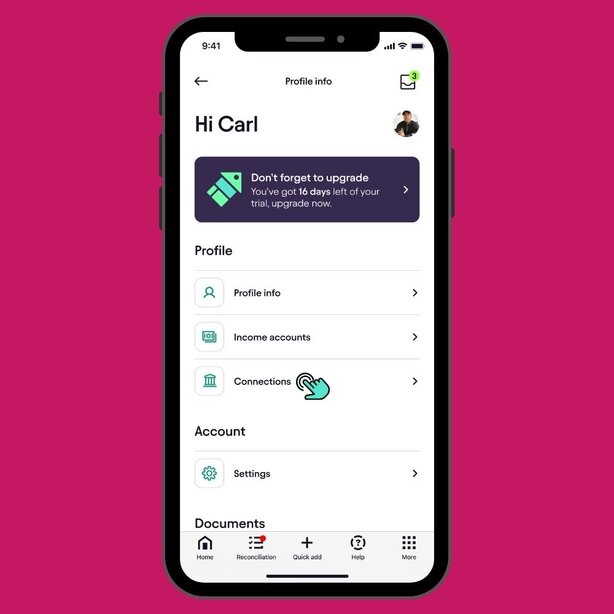

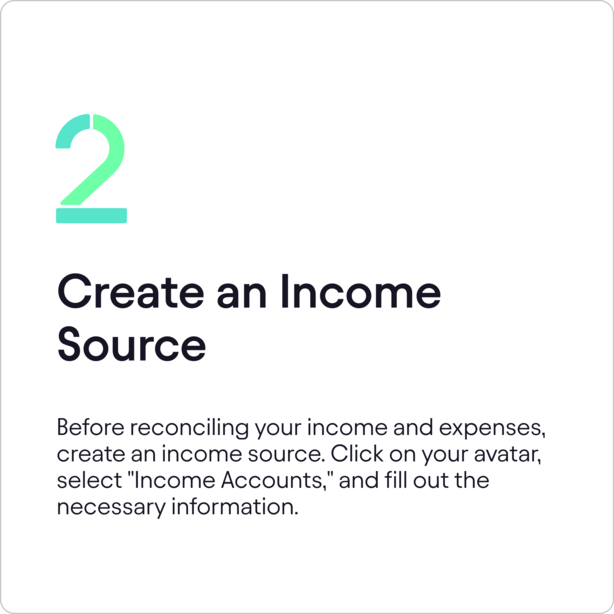

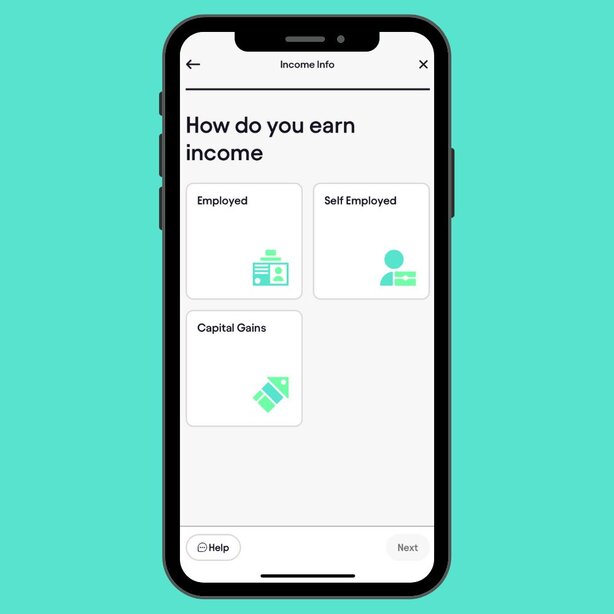

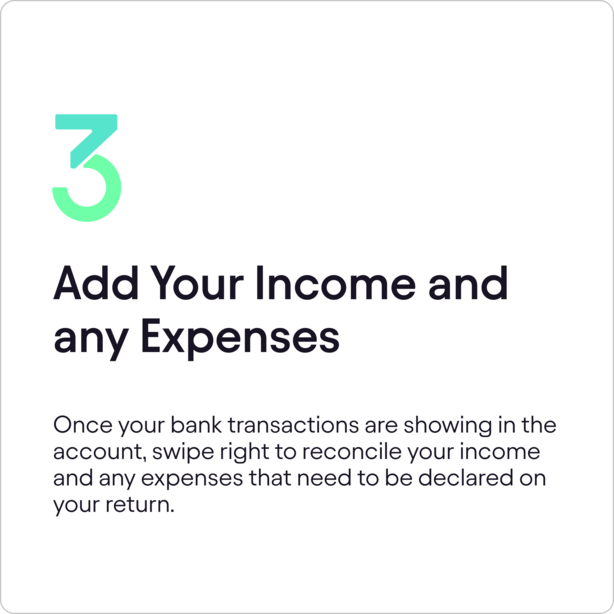

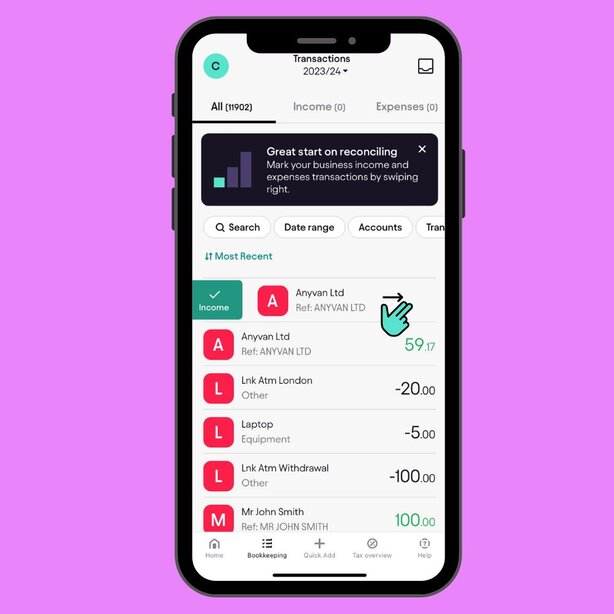

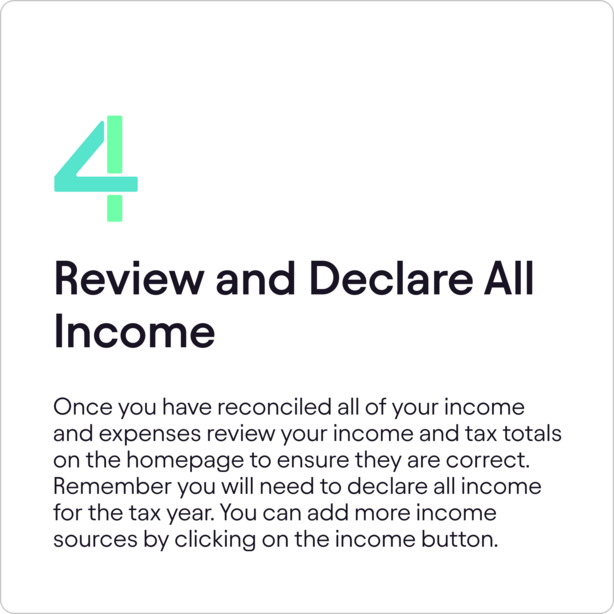

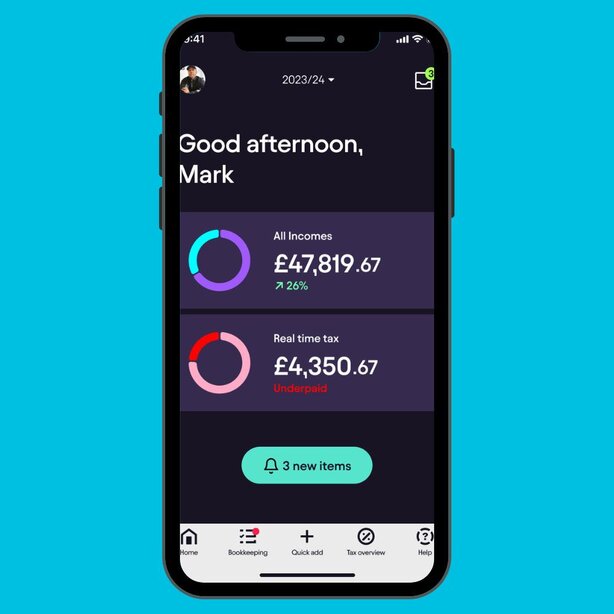

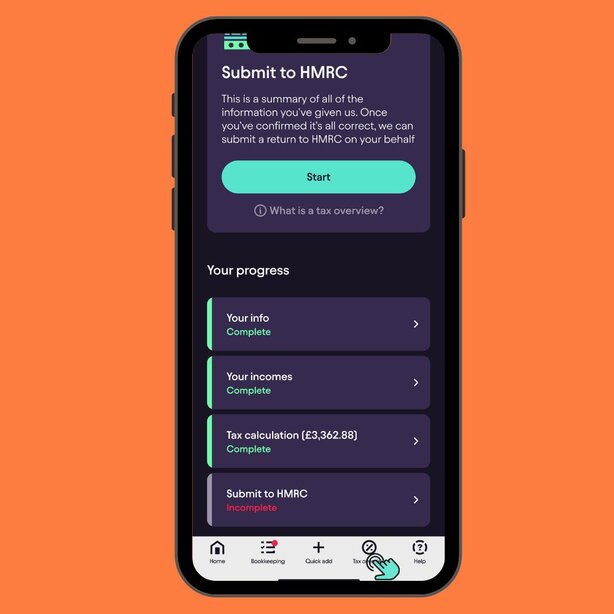

Follow these steps to submit your Self-Assessment seamlessly using the PIE App:

Options for Submitting Your Self-Assessment

Option 1: Paper Submission

Although an option, paper submissions must be completed by October 31st each year, significantly earlier than online submissions. This earlier deadline means less time to gather and prepare your documents. Therefore, many find online submission more convenient. Additionally, online submissions often have fewer errors due to built-in validation checks. This reduces the likelihood of your return being rejected or delayed.

Option 2: Online Submission

Submitting online is quicker and more efficient. You receive instant confirmation of receipt, which provides peace of mind. Additionally, you have more time to file since the deadline is January 31st. This extended period can help ensure accuracy and completeness in your submission. You may use tax software such as Pie Tax to submit your returns with the help of our dedicated Tax Assistants.

Additional Considerations

Be aware of any entitlements to tax reliefs or allowances that could reduce your tax bill. Understanding these can lower your tax liability, saving you a considerable amount of money.Tax Reliefs and Allowances

Always follow HMRC guidelines to ensure accuracy and meet deadlines. This helps avoid penalties and ensures your tax return is processed smoothly.Compliance:

If you are uncertain, it might be beneficial to seek advice from a tax advisor or use tax software to ensure accuracy.Professional Advice:

Expert Assistance with Pie

Navigating the Self-Assessment process can be complex, but with Pie Tax, you have access to expert guidance to help you through the process effortlessly. Try Pie Tax today to simplify your tax return filing.

Over 12 million people file a Self-Assessment tax return each year in the UK.

More than 93% of Self-Assessment tax returns are filed online.

Frequently Asked Questions

Who needs to file a Self-Assessment tax return?

Individuals who are self-employed, partners in a business, or have additional income outside regular PAYE employment.

What happens if I miss the Self-Assessment deadline?

You will incur a £100 automatic penalty, with additional penalties accruing for continued delays.

Can I appeal against a Self-Assessment penalty?

Yes, you can appeal if you have a reasonable excuse for missing the deadline.

What records do I need to keep for Self-Assessment?

Income records, expenses, receipts, invoices, and bank statements must be kept for at least 5 years after the submission deadline.

Is there a way to simplify the Self-Assessment process?

Yes, utilising tax software like PieTax can streamline the process and ensure accuracy, providing guidance at each step.