Maximise Your Uniform Tax Refund Today

Charlotte Baroukh

Tax Expert @ Pie

3 min read

Understanding Uniform Tax Refunds in the UK

Uniform tax refunds can be a hidden treasure for many UK workers who wear uniforms as part of their job requirements. Whether you're a healthcare worker, a hospitality professional, or work in retail, understanding how to claim your entitlement can significantly boost your annual savings. This guide will walk you through the steps to maximise your refund effectively.

The concept of uniform tax refunds is relatively straightforward yet often overlooked. If you are required to wear a uniform or specific clothing for your work and have to launder, repair, or replace it yourself without any reimbursement from your employer, you could claim a tax refund. This tax relief helps to mitigate the costs incurred from maintaining workwear, offering a financial reprieve that can be quite substantial over time.

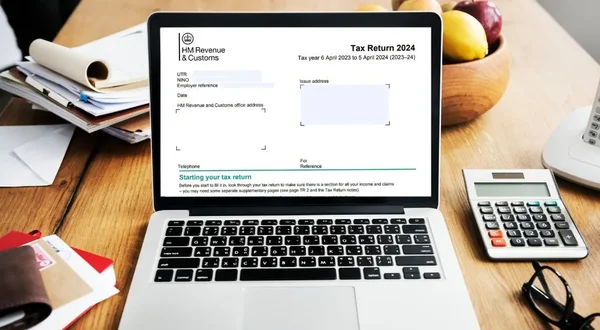

Despite its simplicity, many eligible individuals fail to claim their refunds due to a lack of awareness or the perceived complexity of the claim process. The Pie Tax App assists in simplifying this procedure. By guiding users through the application, supported by expert tax assistants available on the app, individuals can easily lodge their claims and ensure they're not missing out on money owed to them.

Important Criteria for Claiming

To qualify for a uniform tax refund, a few criteria must be met. Firstly, the uniform must be mandatory for your role and feature a company logo. Additionally, you should not have been reimbursed for cleaning or repairing these items by your employer.

Knowing Your Entitlements

The refund isn't limited to high-vis safety gear or fully branded uniforms. Items like special shoes and protective gear, which are necessary for your job, are also considered. It's vital to keep accurate records of expenses related to maintaining your work apparel.

According to recent reports, over 80% of eligible workers fail to claim their uniform tax refund annually. Remarkably, this amounts to an estimated £100 million left unclaimed every year, money that could significantly benefit eligible claimants.Recent Insights into Tax Refund Claims

Each eligible worker could receive up to £60 per year on average if they claimed their uniform tax relief, highlighting how beneficial and accessible this financial support is. Moreover, with multi-year backdated claims, individuals have the potential to reclaim up to £300.Essential Figures Related to Uniform Tax Claims

Navigating the Claim Process

The process of claiming your uniform tax refund can appear intimidating but is primarily straightforward. First, confirm with your employer whether you are not reimbursed for your uniform-related costs. Next, gather any receipts or documents detailing your expenses.

Once prepared, utilise the Pie Tax App, which effortlessly guides you through each step, formulating the claim and submitting it to HMRC. Leveraging technology ensures accuracy and efficiency, minimising errors that might occur when handling it manually.

Maximising Refund Opportunities

The key to obtaining your full refund entails maintaining meticulous records. Note the frequency of your expenses and any significant replacements or repairs. The Pie Tax App can serve as a comprehensive tool for tracking these transactions and reminding you when to claim.

Additionally, staying informed about policy changes or credits that may affect your eligibility or the total refund amount is crucial. Expert advice offered within the app ensures that users are constantly updated with such valuable information.

Tips for Successful Claims

While HMRC doesn't demand proof for claims under £50, maintaining receipts is good practice.Keep your receipts handy

Make it a habit to lodge your claim annually to prevent missing out on potentially significant refunds.File promptly

When unsure, consult the expert tax assistants on the Pie app, ensuring your claim is accurate.Seek professional advice

Fun Facts

Uniform tax refunds can be claimed back for the past four years, allowing those who were previously unaware to recuperate significant amounts. The system enables a backdated claim, which could amount to several hundred pounds depending on your circumstances.

Expert Advice on Handling Refunds

Handling uniform tax refunds efficiently involves understanding the nuances and eligibility criteria involved. Partnering with services like Pie Tax simplifies this, as experts are always on hand to provide support and guidance. This ensures that your claims are processed smoothly and without issue.

Anticipating potential common errors can also be advantageous. For instance, ensuring that your tax code is correctly adjusted post-claim is vital to prevent incorrect tax deductions in subsequent periods. A reliable app can help oversee these changes automatically, sparing you a potential administrative headache.

Ensure that you keep an eye on any notifications from HMRC or consult with Pie Tax's expert advisors if anything seems amiss. Moreover, understanding your past tax documents can offer insights into other areas where tax relief may be applicable, which is another benefit of working with an informed service provider.Navigating Past Claims

While claiming uniform tax refunds, it is essential to consider your larger financial context. Examining other potential refund areas ensures you are maximising all available benefits. Imagine everything you could reclaim over a few years with consistent oversight and advice—potential savings worth investigating.Consider Your Finances Holistically

Summary

In conclusion, uniform tax refunds represent a valuable, though often overlooked, financial benefit. By understanding your eligibility, maintaining careful records, and utilising resources like the Pie Tax App, you can ensure your claims process is both seamless and comprehensive.

The service provides access to expert advice, streamlining the process and maximising your refunds. Take advantage of this opportunity to reclaim funds rightfully owed to you, thereby enhancing your savings effortlessly.

Frequently Asked Questions

Can I claim a uniform tax refund if I'm self-employed?

Uniform tax refunds apply primarily to employed individuals. As a self-employed person, different tax deductions may apply.

What documentation is necessary to file a claim?

Necessary documents include receipts for laundry or repair expenses, but for claims under £50, HMRC typically does not require proof.

How often can I claim for my uniform expenses?

Claims are usually annual, but you can also make backdated claims for up to four years if you missed previous periods.

What if my employer provides laundry services?

You cannot claim a refund for expenses covered by your employer, including instances where they provide laundry services.

How long does it take for a claim to be processed?

Processing times can vary, but claims are generally processed within a few weeks. Utilising an app like Pie Tax can expedite this by ensuring accuracy and completion.