How Invoices Improve Business Finances

Understanding how invoices work is crucial for managing and boosting your business finances. An invoice is more than just a document requesting payment; it serves as an essential financial record for both the sender and the receiver. Invoices include critical details such as the description of goods or services provided, the price, and payment terms. They ensure transparency and help maintain a professional relationship with your clients by providing a clear, structured record of every transaction.

Effectively managing invoices can also enhance cash flow and financial planning. By keeping track of issued and received invoices, businesses can monitor outstanding payments and manage their working capital more efficiently. This organisation not only helps in timely payments but is also crucial for tax purposes, including VAT returns. The Pie Tax App and expert tax assistants available on the Pie app make it easier for businesses to stay on top of their invoice management, thereby avoiding penalties and improving overall financial health.

Essential Components of an Invoice

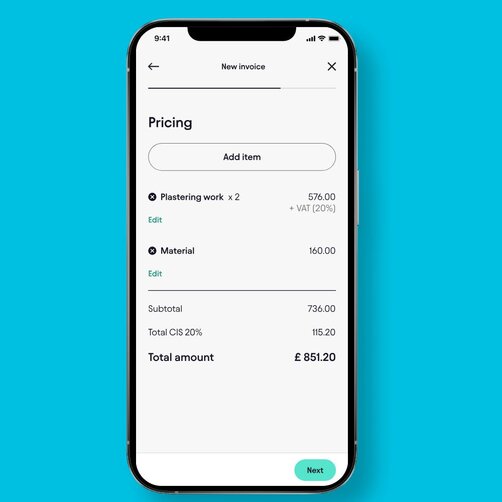

A comprehensive invoice should include several essential components to ensure clarity and professionalism. The header typically features the business name, contact details, and logo, which helps to establish brand identity and provide essential contact information. Each invoice should have a unique invoice number for tracking and reference, making it easier to manage records and address any queries related to specific transactions. Additionally, the invoice should include the date of issue and the due date for payment, providing clear terms for the client. Including the client’s information and a detailed breakdown of the goods or services provided further ensures transparency and accuracy.

Importance of Clear Payment Terms

Clearly defined payment terms are vital for maintaining smooth business operations and ensuring financial stability. Setting a due date is crucial as it provides clients with a clear timeline for when payments are expected, promoting timely payment and aiding in cash flow management. Specifying payment methods accepted minimizes confusion by informing clients about the available options to settle their invoices, which can reduce payment delays. Ultimately, well-defined payment terms contribute to better financial planning and a more predictable revenue stream.

A recent study reveals that 61% of late payments are due to incorrect or unclear invoicing. Ensuring that invoices are accurate and easy to understand can significantly accelerate financial processes, reducing delays and improving cash flow for businesses. Clear invoicing practices are essential for timely payments and efficient financial management.Invoice Payment Efficiency

On average, businesses spend 16 hours a month processing invoices manually. Adopting invoicing software can drastically cut down this time, streamlining the invoicing process and enhancing efficiency. Automated systems help minimize errors, reduce administrative workload, and accelerate payment cycles, allowing businesses to focus on core activities.Invoice Processing Time

Steps to Create Effective Invoices

Creating effective invoices involves a few structured steps. First, ensure all necessary information is included, such as invoice number, date, due date, and a detailed list of products or services provided. Accurate and comprehensive information minimizes disputes and delays in payment processing.

Next, use a professional template or invoicing software that can automate the process and reduce manual errors. Automation tools not only save time but also offer features like recurring invoices and reminders for due dates. Utilising software also allows for easy integration with accounting systems, providing a seamless experience. With the Pie Tax App, businesses can keep their invoicing processes streamlined and compliant with tax regulations.

Streamlining Invoice Management

To efficiently manage invoices, it’s crucial to establish a system that tracks both incoming and outgoing invoices. Storing digital copies in a centralised system ensures easy access and retrieval, reducing the risk of losing important documents. Regularly reconcile invoices with your financial statements to ensure accuracy and completeness.

Additionally, set up a consistent follow-up process for overdue invoices. Implementing automated reminders through invoicing software can encourage clients to pay on time. The Pie Tax App offers a suite of tools that help businesses monitor their invoices systematically, enhancing their overall financial governance and ensuring compliance with tax obligations.

Emerging Trends in Invoicing

Increased Automation: Predictive analytics will soon play a larger role in invoicing, anticipating payment trends.

Blockchain Technology: Blockchain will offer more secure and transparent transaction records.

AI Integration: Artificial intelligence will further streamline the process, minimizing manual intervention.

Fun Fact About Invoices

The first recorded use of an invoice dates back over 5,000 years to ancient Mesopotamia. Merchants of that era used clay tablets to document their transactions, ensuring that business dealings were recorded and tracked. This early form of invoicing laid the groundwork for modern accounting practices and highlights the long history of trade and commerce documentation.

Advice for Managing Business Invoices

Effectively managing business invoices requires a well-organized approach. Establish a clear invoicing schedule to ensure you issue invoices promptly after delivering goods or services. Delays in sending invoices can lead to delays in receiving payments, affecting your cash flow.

Additionally, keep detailed records of all issued and received invoices, including dates, amounts, and payment statuses. Regularly review these records to quickly identify any discrepancies or overdue payments. Using tools like the Pie Tax App can streamline this process, helping you maintain accurate financial records and stay compliant with tax regulations.

Sending invoices promptly after providing a service is crucial for maintaining healthy cash flow. Quick invoicing accelerates the payment process, ensuring you receive funds sooner. This practice supports the ongoing financial stability of your business. Timely invoicing is a key strategy for effective cash flow management.Timely Invoicing is Crucial

Maintaining accurate and detailed records of all your invoices helps in quick reconciliations and ensures you don't miss any payments. It's also crucial for auditing and tax purposes, ensuring compliance and minimising risks.Detailed Record-Keeping is Essential

Summary

Understanding and managing invoices effectively are critical for any business looking to boost its financial health. Invoices serve not only as payment requests but also as essential financial records that aid in maintaining transparency and professionalism. By including all necessary components and clearly defining payment terms, businesses can reduce delays and disputes. The use of automation tools like the Pie Tax App can streamline the entire invoicing process, saving time and reducing errors.

Future advancements in technology, such as AI and blockchain, promise to make invoicing even more efficient and secure. Maintaining timely and accurate invoicing practices ensures a healthy cash flow and simplifies tax compliance. Ultimately, mastering the art of invoicing can have a significant, positive impact on your business's financial stability.