The Basics of Shares and Stock Market Investing

Investing in shares can seem daunting for beginners, but with a bit of knowledge, anyone can get started. Shares, also known as stocks or equities, represent a unit of ownership in a company. When you purchase a share, you own a small portion of that company and can benefit from its profits and growth. It's an opportunity to increase your wealth over time, but it also comes with risks.

Understanding the stock market is also crucial. The stock market is where shares are bought and sold. It operates through exchanges like the London Stock Exchange (LSE) in the UK. Investors buy shares in companies hoping that their value will increase over time. However, stock prices can fluctuate based on various factors such as company performance, economic conditions, and market sentiment.

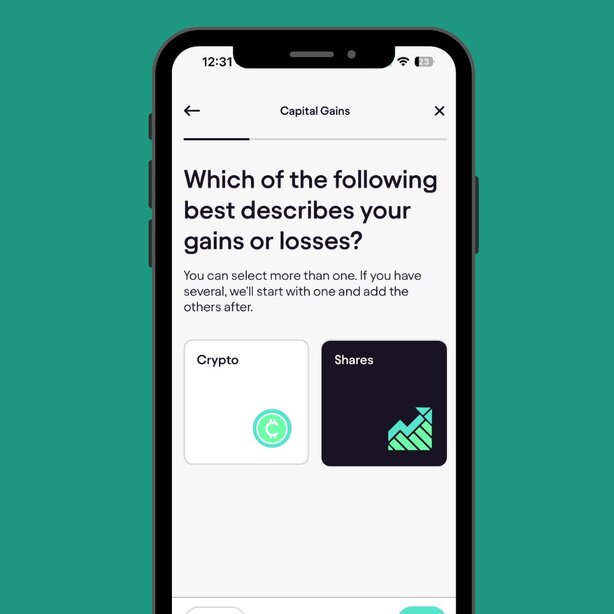

Learning the basics is the first step towards successful investing. Whether you aim to build a diversified portfolio or invest in a specific sector, understanding shares and the stock market will put you on the path to making informed decisions. Fortunately, the Pie Tax App and expert tax assistants available on the Pie app offer tools and resources to help you manage your investments and related tax obligations effectively.

What Are Shares?

Shares represent ownership in a company, giving shareholders a claim on part of the company’s assets and earnings. When a company needs to raise capital, it issues shares to the public, allowing investors to buy a portion of the company.

By purchasing shares, you essentially become a partial owner of the company. This ownership entitles you to a share of the profits, often distributed as dividends, and potentially grants you voting rights on certain corporate decisions.

Why Invest in Shares?

Investing in shares provides the opportunity for significant financial growth, allowing your investments to outpace inflation and increase in value over time.

By purchasing shares, you can earn returns through two main avenues: dividends, which are regular payments made to shareholders from the company's profits, and capital gains, which occur when the value of your shares increases. This dual potential for income and appreciation makes shares a powerful tool for long-term wealth building.

In 2022, the global stock market reached a total value of £94 trillion, showcasing significant growth. This represents an increase of 56% from £60 trillion in 2020, despite market volatility.Recent Market Growth Trends

A recent study found that 40% of millennials have started investing in stocks, triggered by the accessibility of online trading platforms. This is a significant shift from the previous decade.Growing Popularity Among Millennials

How to Start Investing in Shares

Starting your investment journey requires some preparation. First, educate yourself about the types of shares available. Common shares are the most typical form, giving you voting rights and dividends.

Preferred shares, on the other hand, often come with fixed dividends but no voting rights. Understanding these can help you decide which is better suited to your investment goals. Next, choose a reliable brokerage or trading platform. Online platforms have made it easier for beginners to start investing.

Look for platforms with user-friendly interfaces, educational resources, and lower fees. Ensure they are regulated to protect your investments. After setting up your account and funding it, you can start buying shares. Keep in mind that it's wise to start small, diversify your investments, and avoid putting all your money into one stock.

Risks and Rewards of Stock Investments

Investing in shares entails certain risks, as stock prices can be highly volatile. Share prices are influenced by various factors including market conditions, the performance of individual companies, and broader economic trends.

It is essential to understand and manage these risks by carefully selecting investments and diversifying your portfolio to spread potential risks. Despite these risks, the potential rewards are significant. Historically, shares have delivered higher returns compared to other investment options like bonds and savings accounts, particularly over the long term.

The benefits of investing in shares include receiving dividends and achieving capital gains as the value of your shares increases. Utilising tools like the Pie Tax App can help you navigate your tax obligations, and expert tax assistants available on the app can assist in maximising your investment returns.

Tips for Share Investments

Changing the investment landscape, making it more accessible and transparent. Technologies like AI and Big Data are offering more profound insights and predictive analytics.Digital advancements

As climate awareness grows, investing in environmentally responsible companies is becoming increasingly popular and potentially profitable.Green investments

Staying informed about geopolitical events can help investors make better decisions. Economic shifts can open or close investment opportunities rapidly.Global economics

Fun Fact About Shares

Did you know that the oldest stock is from the Dutch East India Company, issued in 1602? This historical company was the pioneer of the modern stock market, introducing the concept of public investment in a company.

Practical Investment Tips

Start small and diversify your investments to spread risk. Investing in a mix of sectors and asset types can reduce the impact of a poor-performing investment on your overall portfolio.

Stay informed by following financial news and updates. Understanding market trends and company performance can help you make more informed decisions.

Use the Pie Tax App to track your investments and tax obligations. With expert tax assistants available on the Pie app, managing your portfolio becomes much more straightforward, ensuring you’re compliant and optimizing your tax situation.

One of the fundamental principles of investing is diversification. By spreading your investments across different sectors, industries, and asset types, you can mitigate risk. This means that if one investment performs poorly, others may still perform well, balancing your portfolio’s overall performance. Diversification often leads to more stable returns over time.Diversify Your Portfolio

Financial markets are dynamic, influenced by various factors, including economic indicators, corporate earnings, and geopolitical events. Staying updated with market news helps you understand these influences and make informed decisions. Regularly reading financial news, following expert analyses, and leveraging financial apps can provide real-time insights into market conditions.Stay Updated On Market News

Summary

Understanding shares and stock market investments can be a game-changer for your financial future. Shares represent ownership in companies, offering the potential for growth through dividends and capital gains. However, investing comes with risks, and it’s crucial to manage them wisely by diversifying your portfolio and staying informed.

Starting small and choosing the right brokerage platform are critical first steps. Equipping yourself with knowledge about different types of shares and leveraging digital tools like the Pie Tax App can streamline your investment process and tax management.

From recognising recent market trends to staying updated with financial news, each aspect contributes to making sound investment decisions. The future of investments looks promising with innovations and a growing emphasis on sustainable investments.

The Pie Tax App and the expert tax assistants available on the Pie app can help you stay on top of your investments and related tax obligations, ensuring a balance between risk management and potential rewards. Take the first step towards informed investing today.

Frequently Asked Questions

What are shares and how do they work?

Shares represent ownership in a company. When you purchase a share, you own a part of that company and may benefit from its profits.

What are the risks associated with investing in shares?

Stock prices can be volatile due to market conditions, economic factors, and company performance. It’s crucial to diversify your portfolio to manage these risks.

How can I start investing in shares?

Begin by educating yourself about shares, choose a reliable brokerage platform, and start small. Diversify your investments and leverage tools like the Pie Tax App for tax management.

What are dividends?

Dividends are a portion of a company’s earnings distributed to shareholders. They can be a source of regular income from your investments.

How does the Pie Tax App help investors?

The Pie Tax App helps investors manage their portfolio and tax obligations. Expert tax assistants available on the Pie app provide guidance to optimize your investments and ensure compliance.