Understanding Capital Allowances for Business Assets

When running a business, managing costs effectively is crucial, from daily expenses like fuel and stationery to larger, long-term investments such as machinery and computers. These larger purchases, known as assets, differ from regular expenses because they remain with the business for several years. Knowing how to handle these assets can significantly affect your financial bottom line by leveraging capital allowances for tax relief.

Capital allowances apply to assets, sometimes referred to as fixed or capital assets, which are items a business is expected to use for more than a year. Examples include vehicles, computers, and machinery. These assets qualify for capital allowances, a form of tax relief that allows businesses to deduct a portion of the asset's value from their taxable income.

Understanding and applying capital allowances effectively can be complex but offers substantial benefits. This article explores the basics of capital allowances, provides practical examples, and offers tips on maximising tax savings through this valuable form of tax relief.

What Qualifies for Capital Allowances?

Capital allowances can be claimed on various business assets, but it's essential to know what qualifies. Assets are significant investments expected to provide value to a business over several years. Common examples include machinery, vehicles, computers, and even some types of office furniture. These are different from everyday consumables like stationery or fuel because they are not used up quickly but rather retained and used over a longer period.

The primary factor that distinguishes an asset eligible for capital allowances is its long-term use and function within the business. If an item is used repeatedly and contributes to the company's operations over a long duration, it typically qualifies for capital allowances. Identifying these qualifying assets is the first step toward understanding how to reduce your tax bill through capital allowances effectively.

How Capital Allowances Save You Money

Capital allowances are a critical tool for businesses looking to reduce their tax liability. When a business purchases an asset, it doesn't write off the entire cost immediately. Instead, the cost is spread over several years, reflecting the asset's usage and depreciation over time. This approach allows the business to reduce its taxable profits and, consequently, its tax liability.

Different types of capital allowances exist, including the Annual Investment Allowance (AIA), which allows businesses to deduct the full cost of qualifying assets up to a specific limit in the year of purchase. Understanding these various allowances and how they apply is crucial for businesses looking to maximise their tax savings through capital allowances.

Two critical figures to remember when discussing capital allowances are the £1 million Annual Investment Allowance (AIA) threshold and the fact that 100% of qualifying assets' value can be deducted under AIA. These figures highlight the potential for substantial tax savings through capital allowances.Key Numbers on Capital Allowances

Recent statistics reveal that businesses effectively using capital allowances can reduce their tax bills by as much as 30% annually. Additionally, over 80% of small businesses in the UK are eligible for some form of capital allowances, yet many do not fully take advantage of these benefits.Capital Allowances Statistics

Types of Capital Allowances Explained

Several types of capital allowances are available to businesses, each with specific criteria and benefits. The most commonly used is the Annual Investment Allowance (AIA), which allows businesses to deduct the cost of qualifying assets, such as machinery and equipment, up to a £1 million limit in the year of purchase. This immediate deduction can provide significant tax savings, especially for businesses that frequently invest in new equipment.

Another important type is the Writing Down Allowance (WDA), which applies to assets not covered by AIA. WDAs spread the cost of an asset over several years, allowing businesses to deduct a percentage of the asset's value each year. This approach is particularly useful for businesses with large assets used over many years. Understanding which allowance applies to your specific situation is key to maximising your tax relief through capital allowances.

Maximising Your Capital Allowances

To maximise capital allowances, businesses need to carefully plan their asset purchases and fully understand the available options. For instance, strategically timing asset acquisitions can ensure businesses stay within the AIA limit, allowing for maximum deductions. Keeping detailed records of all asset purchases and their use within the business is essential for accurate tax reporting and compliance.

Businesses should also consider seeking advice from a tax expert to explore all potential avenues for tax relief. The Pie Tax App and expert tax assistants available on the Pie app provide valuable guidance in this complex area, helping businesses maximise their investments and remain compliant with HMRC regulations.

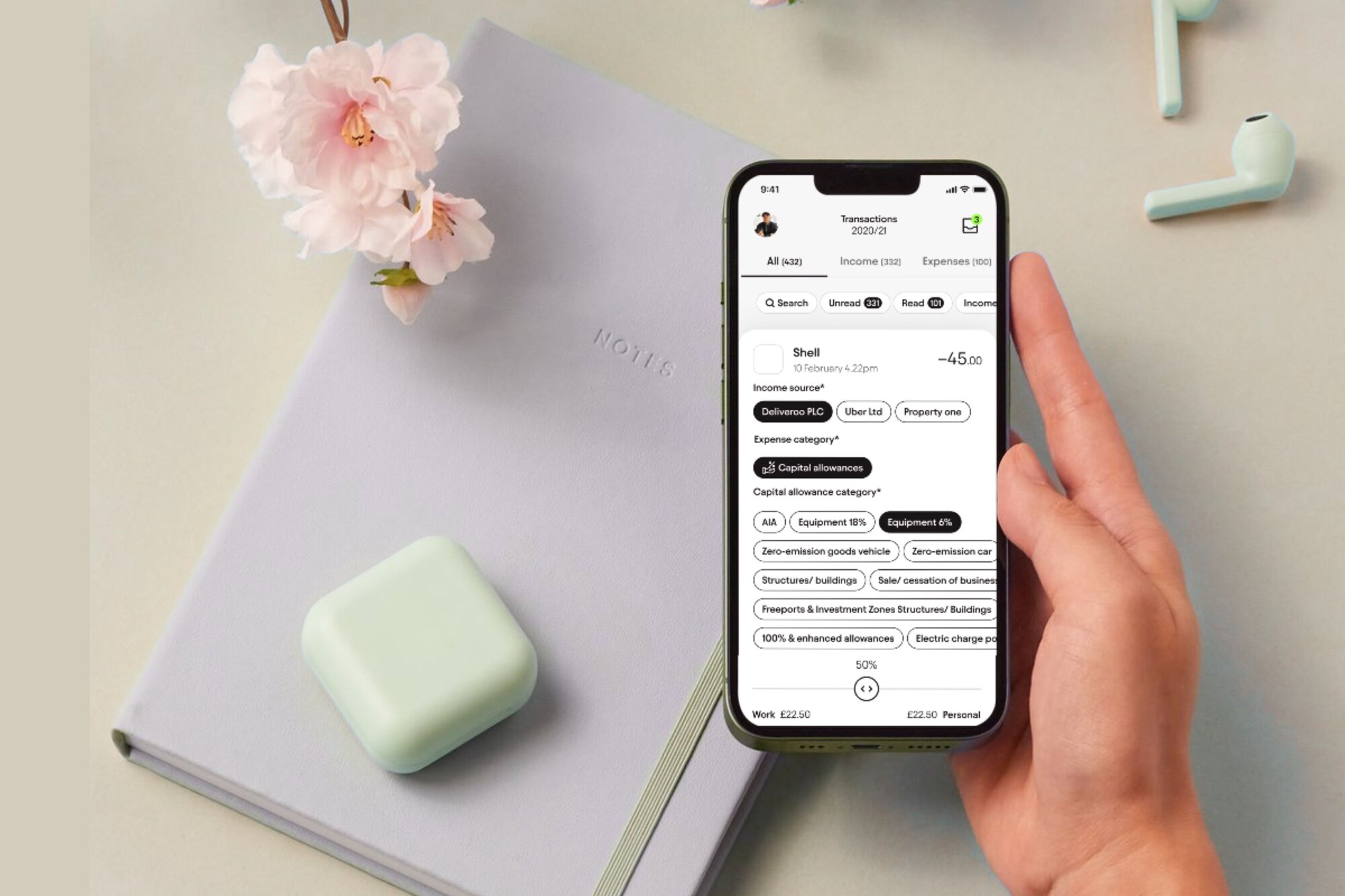

Streamlining Capital Allowances made easy with Pie Tax App

Managing capital allowances is simplified with the Pie Tax App, allowing you to keep track of eligible expenses and maximise your tax savings. The app simplifies the process by offering a user-friendly interface that ensures you accurately record capital allowances for your business assets.

To add a capital allowance, start by navigating the bookkeeping section of the app. Once there, select the option to add a new expense. You’ll be prompted to choose an expense type—select "capital allowance" from the list provided. This ensures that the expense is categorised correctly for tax purposes.

Tips to Maximise Capital Allowances

Clearly define which purchases qualify as assets and understand how to categorise them for tax purposes to maximise your capital allowances.Identify eligible assets

Timing is everything when it comes to asset acquisition. Buying at the right time can maximise your eligibility for capital allowances.Plan asset purchases strategically

Navigating the complexities of capital allowances can be challenging. Seeking professional advice can optimise your tax position and prevent costly errors.Consult with a tax expert

Fun Fact About Capital Allowances

Did you know that capital allowances can also apply to "green" assets, such as energy-efficient equipment? This means that investing in sustainable technology not only benefits the environment but can also provide significant tax savings through capital allowances!

Navigating Complex Capital Allowances

Understanding the complexities of capital allowances can be daunting, especially with various rules and allowances to navigate. To maximise these opportunities, businesses should keep meticulous records of all asset purchases, including acquisition dates, costs, and intended use. Proper documentation is crucial for claiming the correct capital allowances and ensuring compliance with tax regulations.

It's also vital to stay updated on changes to tax laws that could impact your eligibility for capital allowances. The Pie Tax App offers real-time updates and tailored advice, helping businesses stay compliant and maximise their tax savings.

Effectively managing business assets and understanding the various types of capital allowances can significantly reduce your tax burden. By strategically planning asset purchases and maintaining accurate records, businesses can maximise their tax relief opportunities through capital allowances. Additionally, consulting with tax professionals and utilising resources like the Pie Tax App can provide critical insights into optimising your asset management strategy. Remember, effective tax planning is not just about compliance; it's about using every available opportunity to enhance your financial position.Key Points

One essential piece of advice for businesses is to be proactive in their tax planning. Waiting until the end of the tax year to assess asset purchases and calculate capital allowances can lead to missed opportunities for tax relief. Instead, integrate tax planning into your regular financial strategy, consistently reviewing asset usage and eligibility for capital allowances. Understanding the specific requirements for different types of capital allowances is crucial to avoid errors in tax filings. Knowing the distinctions between AIA and WDA, for example, and when each applies, can help maximise tax relief while staying compliant with HMRC guidelines.Important Advice

Summary

Maximising capital allowances is a strategic way to reduce your tax bill and improve your business's financial health. By understanding which assets qualify, leveraging different types of capital allowances, and consulting with tax experts, businesses can optimise their tax position.

Staying current with tax law changes, keeping detailed records, and integrating tax planning into your ongoing business strategy are all vital steps to ensuring you fully benefit from available capital allowances. The Pie Tax App and its expert tax assistants provide essential support in navigating these complex rules, ensuring maximum savings and compliance with HMRC. The Pie Tax App is completely free to use, find out what features are included here:

How is Pie different?

Pie is the only app for self assessment with tools for bookkeeping, your live tax figure, easy tax returns and helpful advice when you need it.

Save £168 per year vs Quickbooks, file your self assessment today for free with Pie

FREE

£89

+£59

£126

Quickbooks

£168

per year7 features

TaxScouts

£169

per year4 features

Accountant

£450

avg per year5 features

* Optional add on

Frequently Asked Questions

What are capital allowances, and how do they help businesses?

Capital allowances are tax reliefs that businesses can claim on the value of certain assets. They reduce taxable profits, thereby lowering the amount of tax owed.

Which business assets qualify for capital allowances?

Assets like machinery, vehicles, and computers typically qualify for capital allowances. The key is that they must be used for business purposes and have a useful life of more than a year.

What is the Annual Investment Allowance (AIA) for capital allowances?

The AIA allows businesses to deduct the full cost of qualifying assets from their taxable profits, up to a limit of £1 million in the year of purchase.

How does the Pie Tax App assist with capital allowances?

The Pie Tax App provides expert guidance and real-time updates to help businesses navigate the complex rules around capital allowances, ensuring maximum tax savings.

Why is it important to keep records of asset purchases for capital allowances?

Maintaining detailed records helps businesses accurately claim capital allowances and ensures compliance with HMRC regulations, preventing potential issues during audits.