Introduction to Claiming Tax Refunds

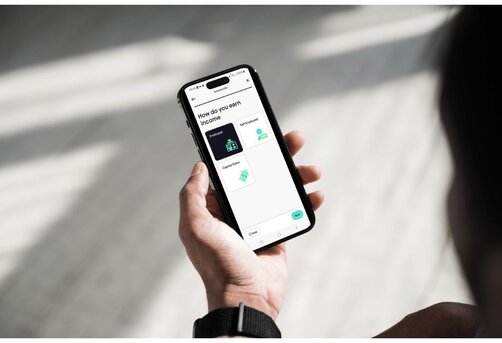

Claiming a tax refund can be daunting, but it doesn't have to be. This guide will simplify the process, helping you understand the steps needed to claim your refund efficiently. Many people overpay tax due to various reasons like changes in income or tax code errors. The Pie Tax App, along with expert tax assistants available on the Pie app, can help you navigate this process smoothly. With accurate guidance and a clear step-by-step approach, you can ensure that you're reclaiming the money you're owed without unnecessary stress or confusion.

Understanding Tax Overpayments

Tax overpayments often occur due to changes in income or incorrect tax codes. When your income fluctuates, your tax code may not be updated immediately, leading to overpayment. Additionally, not claiming eligible allowances and reliefs can result in paying more tax than necessary.

It's essential to regularly review your tax code and financial circumstances to ensure accuracy. By doing so, you can promptly identify overpayments and take action to reclaim them.

Common Reasons for Overpayments

Overpayments can arise from various situations such as job changes, multiple income sources, or emergency tax codes. For instance, if you switch jobs and your new employer uses an emergency tax code, you might overpay taxes until the code is corrected.

Similarly, receiving income from multiple sources can complicate tax calculations, leading to overpayments. Understanding these common scenarios can help you stay vigilant and avoid unnecessary tax payments.

According to recent statistics, HMRC issues tax refunds totaling over £300 million annually. This significant amount highlights the prevalence of overpayments among taxpayers. Approximately 20% of taxpayers are eligible for a tax refund each year due to various factors such as changes in employment, incorrect tax codes, or unclaimed allowances.Statistics on Tax Refunds

The Pie Tax App can save you up to 90% of the time spent on tax filing compared to manual processes. Users of the Pie Tax App have reported average refunds of over £1000 due to accurate calculations and timely submissions.Key Benefits of Using Pie Tax App

Step-by-Step Guide to Claiming Your Refund

To claim your tax refund, first, gather all relevant financial documents such as payslips, P60s, and P45s. Next, log into the Pie Tax App and enter your income details.

The app will automatically check for overpayments and calculate your refund.Submit your claim directly through the app to HMRC for processing. The Pie Tax App streamlines this entire process, making it efficient and user-friendly.

Using Pie Tax App for Maximum Efficiency

The Pie Tax App is designed to simplify tax filing and ensure accuracy. It features a user-friendly interface where you can easily input your financial data and track your refund status.

The app also provides real-time updates and notifications, keeping you informed throughout the process. By using the Pie Tax App, you can avoid common mistakes and ensure that you receive your maximum refund without any hassle.

Essential Tips for Claiming a Tax Refund

Keep Accurate Records Maintaining detailed financial records throughout the year simplifies the tax refund process. Use the Pie Tax App to organise and store all your receipts and invoices.

Review Your Tax Code Regularly check your tax code to ensure it's correct. An incorrect tax code can lead to overpayments. The Expert tax assistants available on the Pie app can help verify this for you.

Claim Eligible Expenses Identify and claim all allowable expenses to maximise your refund. The Pie Tax App can guide you on which expenses are deductible for self-employed individuals.

Fun Facts

Did you know that the largest tax refund ever issued by HMRC was over £1 million? This refund was issued to a business that had overpaid its VAT due to a clerical error. This highlights the importance of accurate tax calculations and the potential for significant refunds when mistakes are corrected.

Expert Advice on Handling Tax Refunds

When handling tax refunds, it’s crucial to stay organized and proactive. Keep all financial records in order and regularly review your tax code. If you suspect an overpayment, use tools like the Pie Tax App to quickly identify and claim your refund. The Expert tax assistants available on the Pie app can provide valuable guidance and support throughout the process, ensuring you maximize your refund potential.

Keeping your financial documents organized is essential for accurate tax filing. Use digital tools like the Pie Tax App to store and manage your documents, making it easier to identify overpayments and claim refunds.Stay Organized

Regularly reviewing your tax code and financial situation can help you avoid overpayments. Set reminders to check your tax status and use the Pie Tax App for real-time updates and notifications.Review Regularly

Summary

Claiming a tax refund doesn’t have to be complicated. By staying organized, regularly reviewing your financial situation, and using tools like the Pie Tax App, you can efficiently identify and claim any overpayments. The Pie Tax App simplifies the entire process, from data entry to submission, ensuring accuracy and maximizing your refund. With expert support and real-time updates, you can navigate the tax refund process with confidence. Embrace digital tools and proactive management to keep your finances in check and reclaim your hard-earned money.

Frequently Asked Questions

How do I know if I am due a tax refund?

If you’ve overpaid taxes due to incorrect tax codes or unclaimed allowances, you may be eligible for a refund. The Pie Tax App can help you identify any overpayments.

What documents do I need to claim a tax refund?

You’ll need payslips, P60s, P45s, and any other relevant financial documents. The Pie Tax App allows you to upload and manage these documents easily.

How long does it take to receive a tax refund?

Once you submit your claim through the Pie Tax App, HMRC typically processes refunds within a few weeks. The app provides real-time updates on your claim status.

Can I claim a tax refund for previous years?

Yes, you can claim a refund for up to four previous tax years. The Pie Tax App can help you check for overpayments in past years and submit your claims.

Is the Pie Tax App secure?

Absolutely. The Pie Tax App uses the latest encryption protocols and is GDPR compliant, ensuring your data is secure and protected.