Introduction

Newly appointed Chancellor Rachel Reeves has firmly ruled out the introduction of a wealth tax, as well as other property-related levies, in her first major public statements since Labour’s general election victory last week.

Addressing public concerns about the cost of living and pension security, Reeves reaffirmed Labour’s commitment to maintaining the state pension triple lock, ensuring pensions will continue rising in line with inflation, earnings, or by 2.5%, whichever is highest.

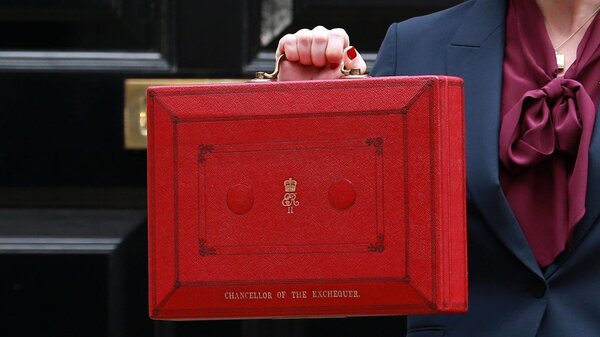

The Chancellor’s announcements, made on Tuesday in the aftermath of Labour’s return to government, clarified the party’s immediate economic priorities amid speculation about potential new tax measures. Reeves’s statements provided reassurance to pensioners and property owners, following days of market scrutiny and public debate about Labour’s economic policy direction.

Labour Rules Out Wealth Tax and New Property Levies

Chancellor Rachel Reeves explicitly ruled out the introduction of a new wealth tax, ending speculation that Labour might consider such a policy as part of efforts to increase government revenue.

Speaking publicly on Tuesday, Reeves said, “We will not be imposing a wealth tax or increasing taxes on family homes,” addressing concerns that new fiscal measures could target higher-value assets. The Chancellor further dismissed any plans to introduce fresh levies on property, including on main residences, second homes, or high-value estates.

She clarified that Labour’s focus remains on supporting economic growth and stability rather than implementing additional taxes on wealth. The announcement followed days of concern in the business and property sectors about Labour’s potential fiscal strategy. Wealth taxes, which are periodically debated in the United Kingdom but have never been implemented, typically involve an annual or one-time levy on individuals with assets above a certain threshold.

Such taxes can be politically contentious, with critics arguing they might discourage investment and drive capital overseas. With Reeves’s clear rejection, Labour distances itself from this long-debated policy.

Commitment to the State Pension Triple Lock

Alongside her comments on wealth and property taxes, Reeves reaffirmed Labour’s commitment to the state pension triple lock, a guarantee introduced by a prior government to ensure the basic state pension rises each year by the highest of inflation, average earnings growth, or 2.5%.

This commitment is a central concern for millions of current and future retirees. According to the latest figures from the Department for Work and Pensions, more than 12 million people receive the state pension in the UK. Maintaining the triple lock is significant as it directly affects retirees' income each April and provides certainty for long-term retirement planning. Prime Minister Keir Starmer has repeatedly pledged during the election campaign that Labour would retain the triple lock.

Speaking alongside Reeves, he said the policy “underpins the dignity and security of retirement for everyone who has worked and contributed throughout their lives.” The government’s confirmation aims to reassure pensioners who have faced questions about the future sustainability of this costly guarantee.

Economic Pressures and Policy Priorities

Labour faces significant economic headwinds, with high inflation, rising interest rates, and ongoing pressure on public services. Recent data from the Office for National Statistics underscores challenges in government borrowing and the strain on the public sector as the new administration seeks to balance fiscal responsibility with social commitments.

Chancellor Reeves has repeatedly stressed her focus on economic growth as the principal means of increasing tax revenues and funding investments in public services. “Our priority must be creating good jobs, improving infrastructure, and supporting families through periods of economic uncertainty,” she told reporters. The Chancellor reiterated that Labour’s economic strategy would not involve increasing National Insurance, income tax, or VAT the three main pillars of the UK tax system.

Instead, Reeves highlighted plans to close legal loopholes and strengthen HM Revenue & Customs’ enforcement to ensure everyone pays their fair share. This approach seeks additional revenue without directly increasing personal taxation rates.

Industry and Public Reactions

The financial markets and UK business community broadly welcomed Reeves’s immediate clarifications. The London Stock Exchange maintained stability in the hours following her statement, and business lobby groups, including the Confederation of British Industry, noted their support for the government’s focus on stability.

Industry analysts argue that removing the prospect of a new wealth or property tax may help avoid capital flight or reduced investment in the UK. Laura Suter, head of personal finance at AJ Bell, said, “Wealth taxes consistently raise concerns about impacts on investment and entrepreneurship. By removing that uncertainty, the Chancellor provides greater predictability for savers and businesses.” Pensioners and advocacy groups also reacted positively to the triple lock reaffirmation.

Jan Shortt, General Secretary of the National Pensioners Convention, called the assurance “vital” for pensioner confidence. However, some anti-poverty campaigners raised concerns about the affordability and fairness of the triple lock, citing intergenerational equity issues and ongoing debates about pension reform.

The Political Landscape and Historical Context

Labour’s policy positions reflect a significant point in the ongoing national debate over wealth and property taxation. The wealth tax has been a topic of academic and political debate for decades in the UK, but its introduction has always faced major practical and political barriers.

Most European nations have phased out similar levies owing to difficulties in administration and enforcement. Previous Labour leaderships considered wealth taxes, especially during periods of high government borrowing, but ultimately prioritised other avenues for fiscal reform. In the party’s 2019 manifesto, for example, there was a pledge to review taxation options, but no firm commitment to a wealth tax.

The triple lock, meanwhile, was introduced by the Conservative-Liberal Democrat coalition government in 2010 and has steadily increased the real value of the state pension. Public debates on taxation have intensified since the pandemic, as the government seeks ways to recover from record levels of public borrowing. Reeves’s approach signals a desire to avoid controversial new levies while focusing on economic recovery and targeted crackdowns on tax avoidance.

Final Summary

The Chancellor’s firm rejection of a new wealth tax and confirmation that the state pension triple lock will remain in place set the tone for Labour’s approach to economic management. By prioritising stability, growth, and clear fiscal rules, the new government aims to reassure markets, pensioners, and homeowners alike.

The decisions around taxation and pension benefits reflect Labour’s broader commitment to building economic confidence while delivering on high-profile election promises. Debates about the future of wealth and property taxation and the sustainability of pension commitments are far from over.

As economic pressures and demographic changes persist, the government will face ongoing challenges in balancing fiscal responsibility with social support. The public discourse is likely to continue, especially as new budgets are prepared and reforms are debated in Parliament.

For individuals navigating complex tax and pension questions in a shifting policy environment, resources like Pie provide up-to-date insights and easy-to-follow guidance to help make informed financial decisions.