What is Remittance Basis Income?

Remittance basis is a way of paying UK tax on your foreign income and gains. If you're a UK resident but not domiciled in the UK, you may be able to pay tax only on the foreign income and gains you bring (remit) to the UK, rather than on your worldwide income.

This type of income is reported on the SA109 form as part of your Self Assessment tax return. The Pie Tax app makes it easy to declare remittance basis income with help from our intelligent Tax Assistant.

Your Step-by-Step Guide

Follow these simple steps to declare your remittance basis income:

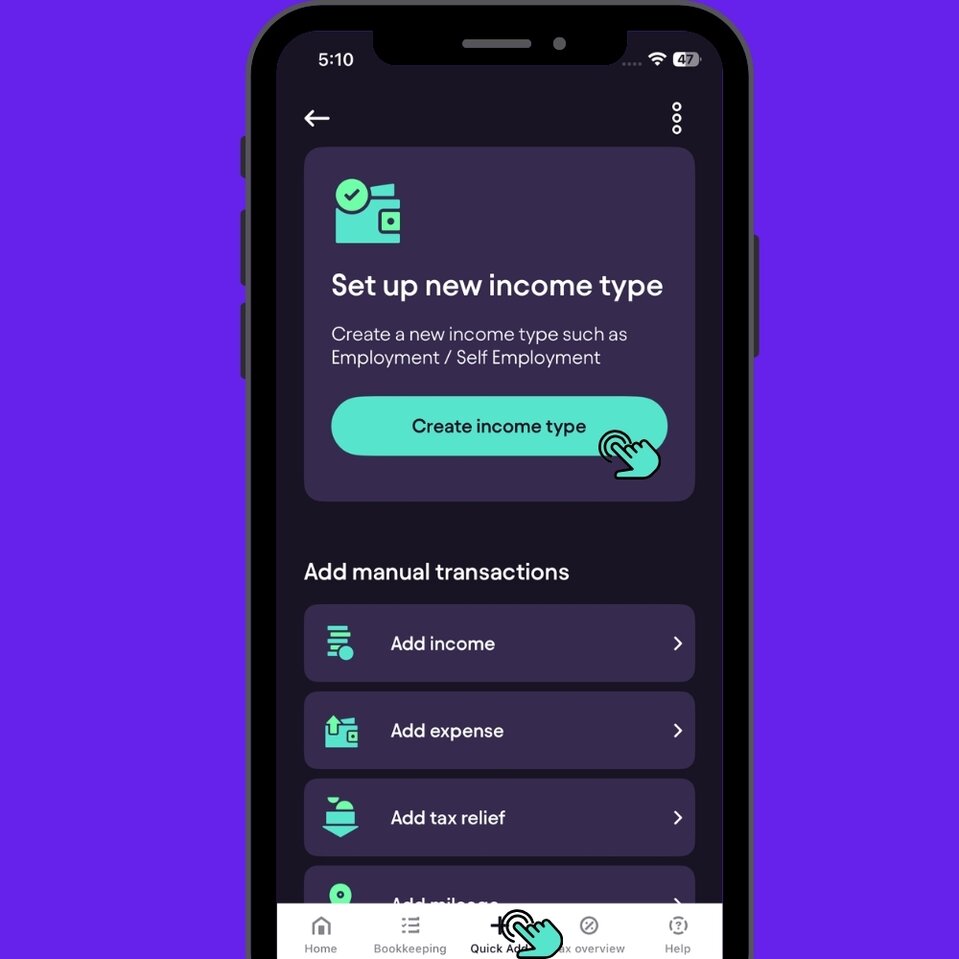

Open the Pie Tax app and navigate to the Add Income section and Create Income Type.Create Income Type

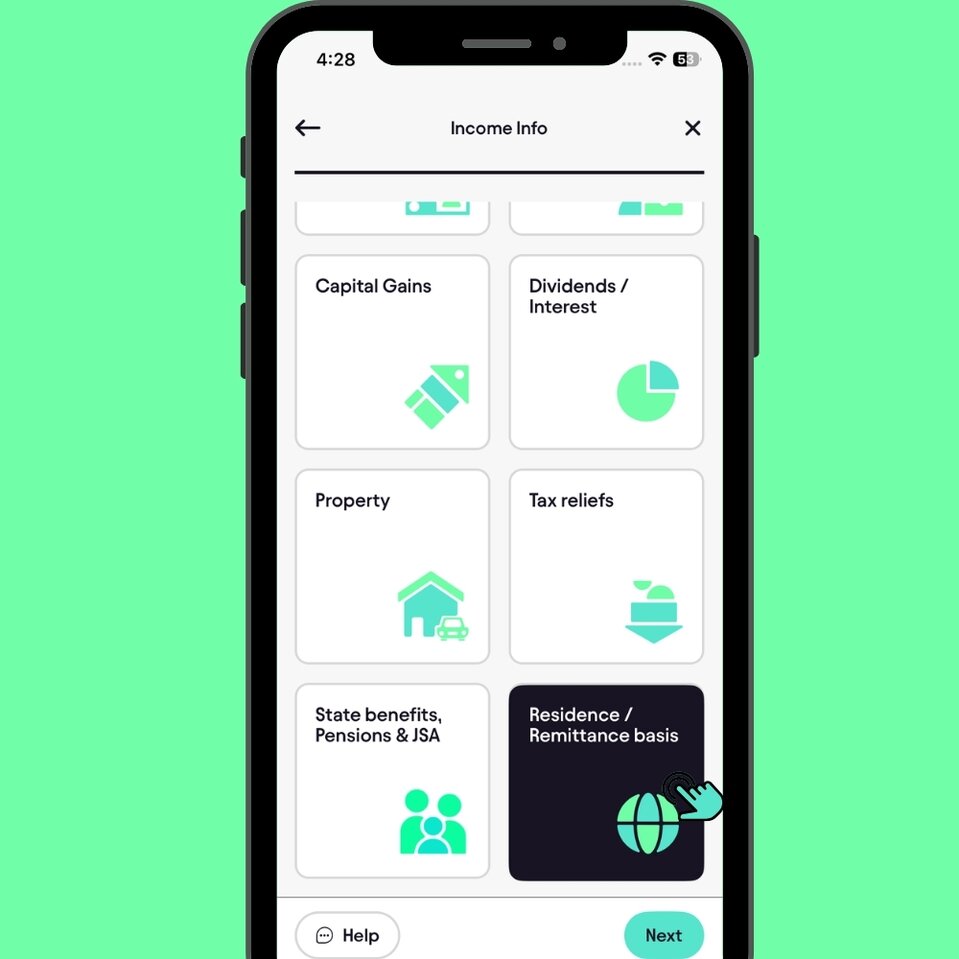

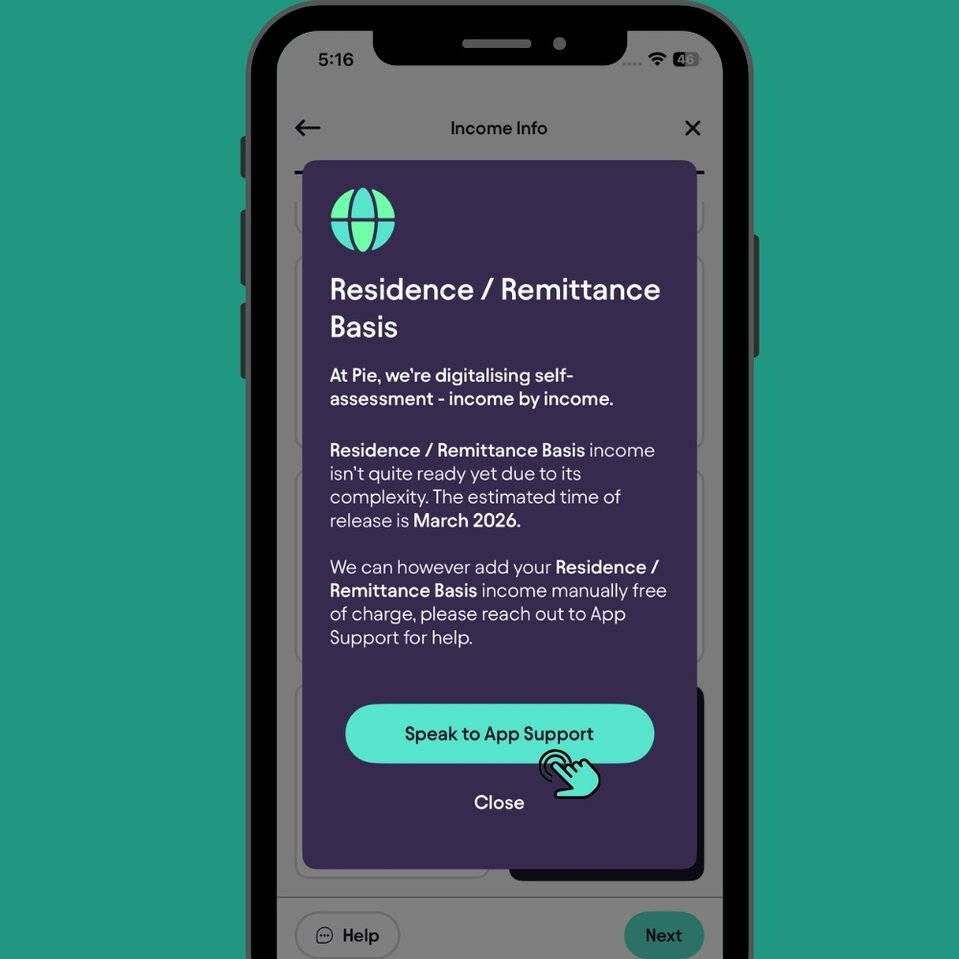

Scroll down to the ‘Remittance Income’ section in the Property income type options your profile. Tap on this Residence/Remittance basis.Select Remittance Income

A popup will appear offering assistance from the Pie Tax Assistant. Tap on the option to get help with declaring your remittance basis income.Seek help from Pie Tax Assistant

The Pie Tax Assistant will guide you through the process of entering your foreign income details and help ensure everything is reported correctly for your SA109 form.

Understanding Remittance Basis Elections

When you choose the remittance basis, you're electing to be taxed only on foreign income and gains that you bring into the UK. This can be beneficial if you have significant foreign income that remains outside the UK. However, there are important considerations to keep in mind.

If you've been a UK resident for at least seven out of the last nine tax years, you may need to pay the Remittance Basis Charge to use this tax treatment. The charge increases the longer you've been resident in the UK. For those who've been resident for seven to eleven years, the charge is £30,000, and for twelve years or more, it rises to £60,000.

Claiming the remittance basis also means you'll lose your personal allowance and capital gains tax annual exemption. This trade-off only makes sense if your foreign income that stays abroad is substantial enough to offset these losses.

What Information You'll Need

Before adding remittance basis income, make sure you have the following information ready:

You'll need details of all your foreign income sources, including employment income, rental income, dividends, or business profits earned abroad. Know the amounts remitted to the UK versus amounts kept overseas, as these are taxed differently.

Have information about the countries where your income originated, along with any foreign tax already paid on this income. If you're claiming the remittance basis charge, be prepared with documentation showing your residency history in the UK.

Keep records of when and how money was brought into the UK, including bank transfers, credit card payments, or any other method of remittance. This documentation is essential for HMRC compliance.

Who Should Use Remittance Basis?

The remittance basis is designed for UK residents who are not UK domiciled and have foreign income. This typically includes individuals who were born abroad and maintain strong ties to another country, or those who have recently moved to the UK for work.

This tax treatment is most beneficial when you have significant foreign income that you don't need to bring into the UK. If most of your foreign income stays in overseas accounts and you only remit small amounts to cover UK expenses, the remittance basis could reduce your UK tax liability.

However, if you're bringing most of your foreign income into the UK anyway, or if your foreign income is relatively small, the standard arising basis where you pay tax on worldwide income might actually work out better. This is especially true when you factor in losing your personal allowance and the potential remittance basis charge.

Common Questions About Remittance Basis

Many users wonder whether they must claim the remittance basis or if it's optional. The remittance basis is an election you can choose to make each tax year. If your unremitted foreign income and gains are less than £2,000, you're automatically treated as using the remittance basis without needing to claim it formally.

Another common question is whether you can switch between remittance basis and arising basis from year to year. Yes, you can change your election annually depending on your circumstances. However, each time you switch, you need to carefully consider the implications for your personal allowance and annual exemptions.

People also ask about what counts as a remittance. A remittance includes bringing money to the UK, using foreign income to pay UK debts, or bringing assets purchased with foreign income into the UK. Even using a foreign credit card for UK expenses can count as a remittance if the card is paid from accounts containing foreign income.

Get Expert Help from Pie Tax Assistant

Declaring remittance basis income can be complex, especially when calculating the remittance basis charge or determining what income has been remitted versus kept offshore. That's why the Pie Tax app includes intelligent assistance specifically designed to help with SA109 forms.

The Pie Tax Assistant walks you through each section, asks the right questions about your foreign income, and helps ensure you're claiming the remittance basis correctly. You don't need to be a tax expert or understand HMRC forms to get it right.

Need More Help?

If you're unsure whether the remittance basis is right for your situation, or if you need personalized guidance on declaring foreign income, visit our Help section in the app or contact our support team. Our tax experts can review your specific circumstances and help you make the best decision for your tax return.

For more information on managing your Self Assessment tax return, explore our other guides in the Tax-pible section.