Let’s Break This Down Together...

Feeling frustrated waiting for your HMRC tax refund to arrive? Many taxpayers are facing long delays and confusing timelines this year. This article explains what’s behind the slowdown, how long things really take, and the steps you can follow to check your refund status.

We’ll also cover how to spot potential red flags, when to follow up, and what you can do if your refund seems stuck in limbo. By the end, you’ll know exactly what to expect and how to stay one step ahead of the wait. Let’s dive in.

Why are HMRC tax return delays happening?

HMRC is struggling with a perfect storm of issues that’s causing major backlogs. Staff shortages have hit hard, with many departments running below capacity. In response, HMRC has been allocating extra staff to key departments to help address the backlog.

The tax office is also implementing new digital systems that, ironically, are slowing things down while staff adjust to them. Extra staff have been brought in during peak periods to improve processing times. The availability and workload of HMRC staff directly impact the speed of tax return processing. HMRC staff working on tax return processing have faced increased pressure due to both the volume of claims and changes in digital systems. Covid hasn’t helped either.

The pandemic created unusual claiming patterns and increased fraud attempts, leading to more manual checks. Recent industrial action by HMRC staff has also contributed to delays in processing tax refunds. And let’s not forget the seasonal crush after the January deadline.

How long should tax returns actually take?

In an ideal world, HMRC aims to process online returns within 4-6 weeks. Paper returns traditionally take longer, usually 8-10 weeks, because they require manual handling.

If you’re due a refund, you’d normally expect to see that money about two weeks after your return is processed. But these days, many people report waiting 3-4 months.

The reality is that “normal” processing times have become more of a guideline than a rule. Expectations need to be adjusted accordingly. To help reduce uncertainty, taxpayers can use HMRC's online tools to estimate when they might receive their refund.

Tax return requirements

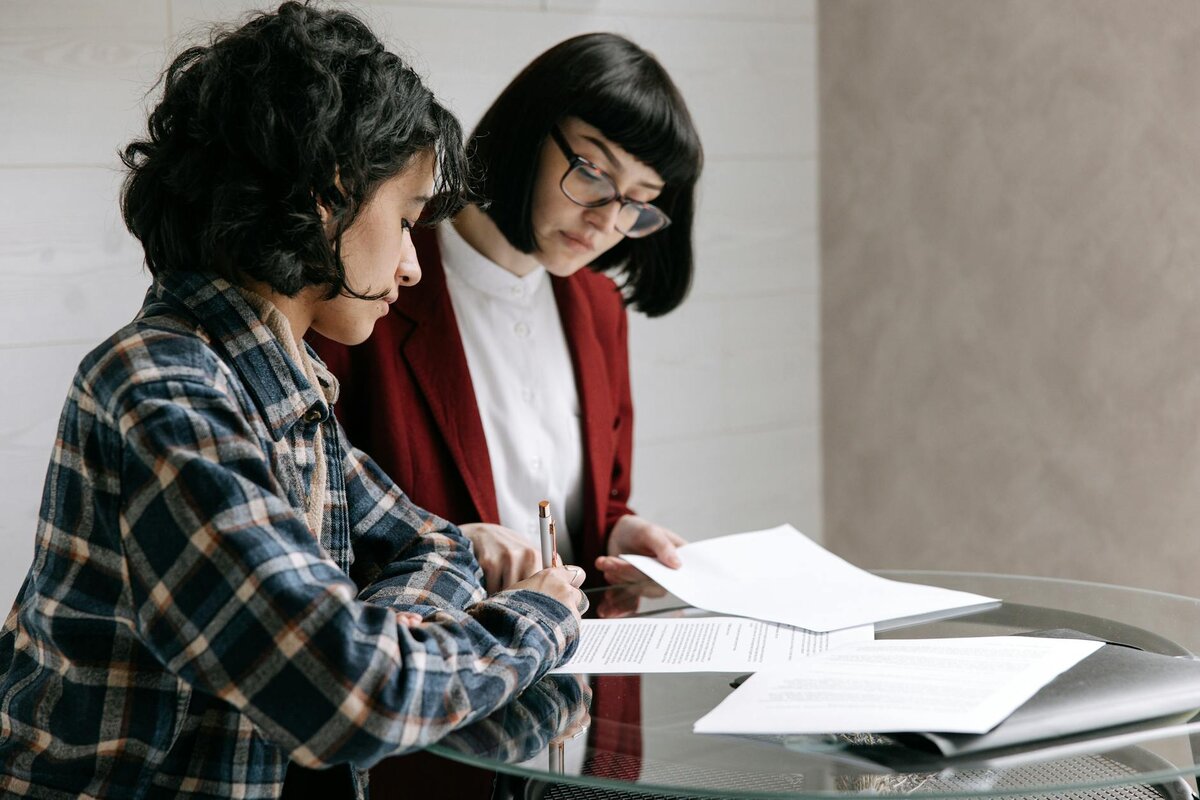

Navigating the UK tax system can be daunting, but understanding the tax return requirements is the first step to ensuring your tax refund isn’t held up by avoidable mistakes. Whether you’re filing a self assessment tax return, claiming PAYE and CIS refunds, or seeking an HMRC tax repayment, accuracy and completeness are key to a smooth process.

When you submit your tax return, HMRC expects all information to be correct and fully documented. Missing or incorrect details, like outdated bank details or incomplete income records, are among the most common reasons for delayed refunds. These errors can trigger additional verification checks, adding weeks to your wait for a tax refund.

For self assessment refunds, HMRC aims to process payments within 5 to 10 working days after your assessment tax return is submitted, but in recent months, significant delays have become the norm, with some self assessment refunds and CIS refunds taking more than four months to arrive.

How to check your tax return status

The easiest way to check your return status is through your Government Gateway account. This shows if HMRC has received your submission. In this context, 'received means' that HMRC has acknowledged your claim or information, but it does not necessarily indicate that your refund has been processed or completed, only that your submission is in their system and awaiting further action.

Keep an eye on your emails too, HMRC should send a “return received” confirmation shortly after you submit. If you’re getting anxious, the HMRC helpline (0300 200 3300) can help.

HMRC’s “Where’s My Reply?” tool on their website gives rough estimates of current processing times. Have your UTR and National Insurance number ready when making enquiries.

Avoid calling on Monday mornings or Friday afternoons when the lines are busiest. Tuesday to Thursday mornings tend to be quieter for phone contact.

When should you start to worry?

If it's been more than 12 weeks since you submitted your online return, it's reasonable to start following up. For paper returns, give it 16 weeks before getting concerned.

No acknowledgment of receipt after a couple of weeks is another red flag. Something might have gone wrong with your submission.

If you're relying on a tax refund for urgent financial reasons, you might need to escalate matters sooner. An incorrect tax code change while waiting can also signal problems.

How to handle lengthy delays

Document everything. Keep submission receipts, reference numbers, and records of any calls you make to HMRC. Track your refund claims closely and follow up regularly on their status to ensure they are being processed. When keeping detailed records, make sure to note the date your request was submitted, as this will help with any follow-up or escalation if delays occur.

If you’ve waited well beyond the normal processing time, make a formal complaint through HMRC’s complaints procedure. For serious financial hardship, don’t hesitate to contact your MP.

Ask about the possibility of an emergency tax refund if you’re facing financial difficulties because of the delay. When calling HMRC, always note the date, time, and who you spoke to.

This paper trail can be valuable if things drag on. It demonstrates your proactive approach to resolving the situation.

Will my tax refund be delayed too?

Yes, tax refunds typically follow the same delayed timeline as the processing of your return. The good news? HMRC automatically pays interest on refunds that take more than 30 days.

However, the cost and costs associated with waiting for tax refunds can add up, increasing financial strain and making it harder to manage cash flow. Delayed refunds can mean individuals and businesses do not have timely access to funds owed to them, which can disrupt payment schedules and impact overall revenue. This is especially challenging if you have overpaid tax and are waiting to be paid back by HMRC, as these funds may be needed to cover upcoming tax bills or maintain business revenue.

How you receive your money matters too. BACS transfers are much faster than waiting for a cheque in the post. It’s important to ensure your payment details are up to date to avoid further delays in receiving funds owed.

Be aware that larger refunds (especially those over £10,000) might trigger additional security checks. If you’ve had to make corrections to your return, this unfortunately restarts the clock.

Final Thoughts

HMRC tax return delays have become an unwelcome reality in recent years, testing everyone's patience. While you can't speed up HMRC's internal processes, you can protect yourself.

Submit early, keep detailed records, and know how to check your status effectively. If you're counting on a tax refund, build extra time into your financial planning.

Remember that delays, while frustrating, rarely mean there's a problem with your actual return. It's usually just the system moving slowly through its backlog.

Staying informed and prepared is your best defence against the uncertainty these delays create.

Simplifying HMRC tax return delays

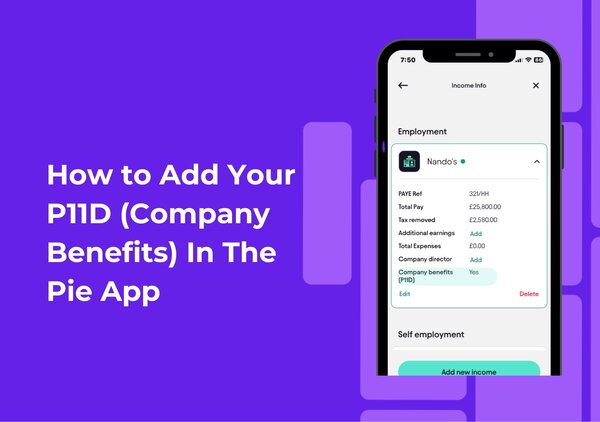

We know how maddening it is to be stuck in HMRC limbo when you need closure on your tax affairs. Pie, the UK’s first personal tax app, offers real-time submission tracking that connects directly with HMRC systems and helps you monitor the progress of your tax refund claim from submission to resolution.

Pie.tax offers a comprehensive range of services, including digital filing assistance and responsive customer support. Keeping it all in one place.

Feel free to explore the PIE app if you’d like to see how we can take the stress out of tax return delays.