Lets jump in...

one of several government tax incentives, alongside schemes like venture capital trusts, designed to encourage investment in UK businesses.

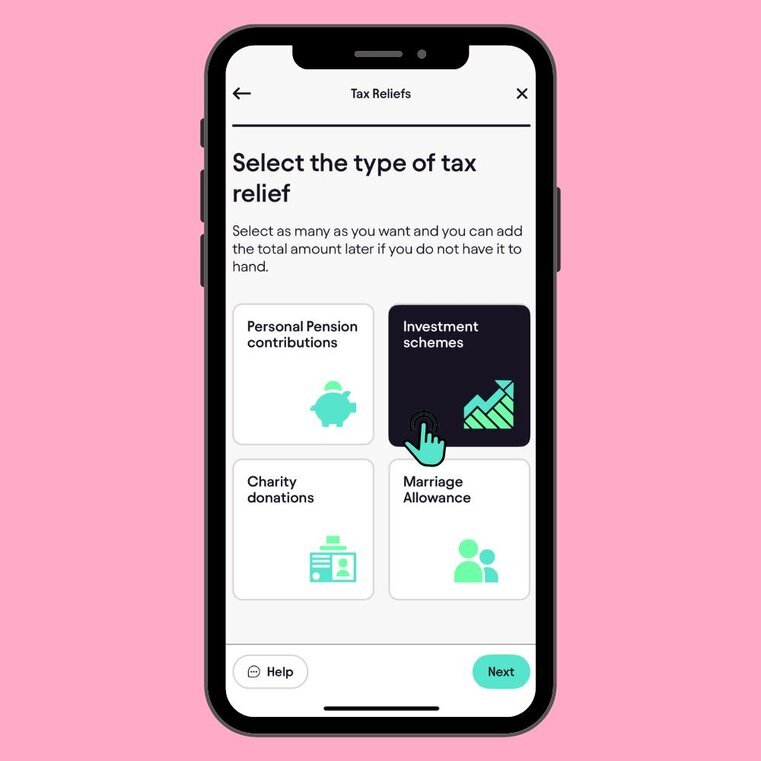

The UK’s first personal tax app, Pie tax, guides you through every relief available without the headache. Or if you’re just here to get to grips with it all, let’s break it down!

What is EIS and why should investors care?

The Enterprise Investment Scheme (EIS) was created by the UK government to encourage investment in early-stage companies. It offers tax reliefs that make investing in smaller, higher-risk businesses more attractive. EIS relief includes both income tax and capital gains tax benefits.

EIS has been running since 1994. It has helped thousands of growing businesses raise capital while rewarding investors with substantial tax perks. EIS tax relief is one of several available, and EIS income tax relief specifically reduces the investor's income tax liability.

For investors facing capital gains tax bills, EIS offers a powerful double benefit. You can both defer existing tax bills and potentially pay no CGT on your EIS investments when you sell them.

Other related schemes include the venture capital trust scheme and the seed enterprise investment scheme, which also provide tax-efficient investment opportunities. Investors can access EIS relief through EIS funds or an EIS fund, which pool investments into multiple qualifying companies.

How EIS capital gains tax relief actually works

There are two main ways EIS helps with capital gains tax (CGT), offering both capital gains tax reliefs: capital gains deferral relief and CGT exemption. Each provides distinct advantages for strategic investors. First, CGT Deferral Relief, also known as capital gains deferral relief, lets you postpone paying capital gains tax on existing gains by reinvesting those gains into EIS-qualifying companies.

You can defer gains made up to 3 years before or 1 year after your EIS investment. This flexibility is particularly valuable for planning purposes and is a key feature of capital gains deferral. Reinvestment relief allows investors to claim relief by reinvesting chargeable gains into EIS shares. Second, Disposal Relief, also referred to as EIS disposal relief, cgt exemption, and cgt relief, means you’ll pay absolutely no capital gains tax (CGT) on qualifying gains when you sell your EIS shares, provided you hold them for at least 3 years.

To claim relief, investors must follow HMRC procedures and meet all qualifying conditions. These CGT benefits come on top of the 30% income tax relief you get upfront. On a £10,000 investment, you immediately save £3,000 on your income tax bill.

Unlike some tax schemes, there’s no maximum limit on how much capital gains tax (CGT) you can defer through EIS investments. This makes it especially powerful for larger gains.

Qualifying for the tax relief

To benefit from EIS capital gains tax reliefs, both you and the company must meet certain conditions. These requirements ensure the scheme supports genuine business investment. The company must be a UK-based EIS qualifying company and relatively small. Generally, it should have gross assets under £15 million and be carrying on a qualifying trade.

Only investments in qualifying assets, such as shares in qualifying trading companies, are eligible for EIS relief. Most normal business activities qualify for EIS. However, some sectors like property development and financial services are excluded from the scheme.

As an investor, you can’t be connected to the company. This means you can’t be an employee or own more than 30% of the shares. You must hold your EIS shares for at least 3 years to keep the tax reliefs. This minimum holding period encourages patient capital. EIS shares may also qualify for inheritance tax relief through business property relief if held for at least two years, making them useful for estate planning.

The minimum investment required to qualify for EIS relief is typically £500. You can make a maximum investment of up to £1 million in EIS companies each tax year. This maximum investment increases to £2 million if you have invested in knowledge intensive companies focused on research and innovation.

Real-world examples of EIS tax savings

Let’s say you sold a buy-to-let property and made a £100,000 gain. This is a chargeable gain for CGT purposes. At 20% CGT, you’d normally owe £20,000 in tax to HMRC. By investing that £100,000 into EIS companies, you can defer the entire £20,000 tax bill on the chargeable gain. You won’t pay until you eventually sell your EIS shares.

You’d also get £30,000 in income tax relief (30% of your investment), provided you have received income tax relief on the full amount. This can provide the maximum tax reduction allowed under EIS rules, effectively reducing your net investment to £70,000. If your EIS shares grow in value and you hold them for 3+ years, you’ll pay no CGT when you sell them. This tax-free growth can significantly enhance your returns.

I once advised a client who deferred a £50,000 capital gain from selling his rental property. By investing in an EIS-backed tech startup and obtaining full income tax relief, he not only postponed his tax bill but eventually paid nothing when the company was acquired three years later. In this case, the relief could also have been carried back to the previous year if it was more beneficial.

Even if your investment performs poorly, EIS offers loss relief. You can offset any losses against either income tax or capital gains tax, and you have the flexibility to set the loss against income in the year of disposal or the previous year, providing valuable downside protection.

Timing considerations for maximum benefit

Timing your EIS investments strategically can maximise your tax advantages. Planning carefully helps you get the most from the scheme. If you’ve recently made a significant gain, you have a 3-year window for EIS investments. This flexibility gives you time to find the right opportunities to defer that tax liability.

Many investors make their EIS investments just before the tax year end (5th April). This approach secures income tax relief quickly while maintaining options.

When claiming relief, it is important to pay careful attention to both timing and eligibility. Investors should ensure they have sufficient income tax liability to benefit from the reliefs, as reducing the investor's income tax liability to nil may limit or prevent access to certain exemptions. Obtaining an advance assurance letter from HMRC before investing can provide confidence that the investment will qualify for EIS relief, helping investors make informed decisions before committing funds.

You can carry back the relief to the previous tax year if that’s more beneficial. This feature provides additional planning flexibility. Remember that the 3-year holding period for disposal relief starts from when the company issues the shares. If the company begins trading later, the period starts from that date.

Final Thoughts

EIS capital gains tax relief offers one of the most generous tax breaks available to UK investors. It combines deferral of existing gains with tax-free growth on new investments. While the tax benefits are impressive, it's vital to remember the underlying risks. EIS investments are in early-stage companies, which carry significant risks alongside growth potential.

Always consider the investment case first, with tax advantages as a bonus. The best EIS investments combine strong business fundamentals with valuable tax relief. Seek professional advice if you're unsure about any aspect of EIS investing. The rules can be complex, and mistakes might compromise your tax position.

Pie tax: Simplifying EIS Capital Gains Tax Relief

Keeping track of your EIS investments and their various tax implications can quickly become complicated.

This is especially true when managing multiple investments across different tax years. The UK's first personal tax app, Pie tax, helps you monitor all your EIS investments in one place. It automatically calculates both your income tax relief and capital gains tax benefits.

Why not explore how Pie tax could simplify your investment tax planning and help you make the most of these valuable reliefs?

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief and track your real time tax figures

To add EIS tax relief, simply tap on 'Quick Add' on the home screen on the Pie App. Select the specific investment scheme you want to claim.Step 1

Once you’ve added all the information, you can view your real-time tax figures on the "Homepage" of the Pie App. Step 2