How to Reconcile Income for Your Self-Assessment

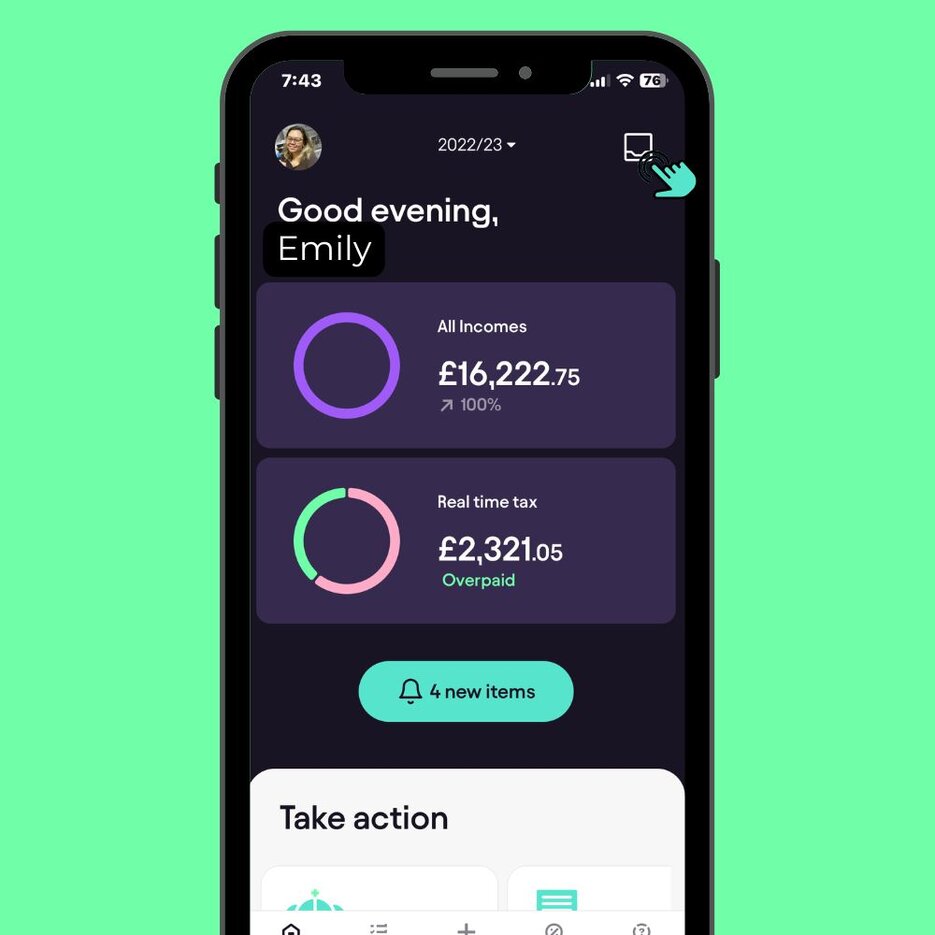

Managing your finances effectively is crucial for individuals, especially when it comes to preparing for your Self-Assessment tax return. One key aspect of this process is matching and sorting transactions, ensuring your income is accurately recorded. This guide will walk you through how to match transactions efficiently, helping you stay organised and compliant with HMRC regulations.

Your Step-by-Step Guide

Begin by ensuring that you have a bank account connected to your app to efficiently sort and match your income and expenses.Bank Account Connection

Once your bank is connected, you can proceed to the bookkeeping section of the app on your navigation bar.Proceed to Bookkeeping

Check if you have selected the tax year you want to file for. Add your income by swiping right on any taxable income you want to declare on your tax return. This will move the transaction into the ‘income tab’.All Transactions

You can review each transaction and designate those that constitute income. If there are multiple self-employed income sources within the tax year, you must indicate which source each transaction belongs to.Reconcile Income

You can select a tax percentage of 20%, 30%, or No CIS (if you are not CIS, this will not apply) and upload an invoice to complete the income information for reconciliation.Tax Percentage

This feature saves time by auto-reconciling transactions. When you select a bank transaction and enable smart match, it automatically marks similar incoming transactions for all tax years.Smart Match

Reconciled incomes are added to the 'Income' section in Bookkeeping. You can add an invoice to complete the income reconciliation. To correct mistakes, swipe left to remove transactions.Income Tab

Use the ‘Quick Add’ feature to manually enter any additional income or expenses not found in your bank transactions for your self-assessment.Adding Income Manually

If you run into an error while adding income. Simply tap ‘Chat to support’ in the app to message one of our friendly Pie team members.In Case an Error Occurs

Troubleshooting Common Issues

Sometimes, issues can arise during the sorting process. Here are some common problems and solutions:

Verify that your bank account is correctly connected to the app to ensure seamless sorting.Ensure Proper Bank Account Connectivity

Cross-check all yearly transactions with your financial records to ensure they are from the correct tax year and to streamline the matching process.Review and Verify Yearly Transactions

Leverage the Smart Match and Multi-Select features to efficiently reconcile transactions and organise expenses, ensuring accurate financial management.Utilise Advanced App Features

Conclusion

Matching and sorting transactions is a crucial step in preparing your Self-Assessment tax return. By following the steps outlined in this guide and using tools like the Pie Tax App, you can ensure your financial records are accurate and up-to-date. For further assistance, our expert tax assistants are available on the Pie app to help you navigate the complexities of tax preparation.

Frequently Asked Questions

Why am missing some transactions from the bookkeeping section of the app?

Try disconnecting and reconnecting your bank account in the 'Connections' section.

Where can I review my yearly transactions in the app?

Once your bank is connected, proceed to the bookkeeping section on the navigation bar to review all your yearly transactions.

How can I reconcile my income transactions?

Review each transaction and designate those that constitute income. If you have multiple self-employed income sources, indicate which source each transaction belongs to.

What is the 'Smart Match' feature and how does it work?

The 'Smart Match' feature auto-reconciles transactions by selecting a specific bank transaction and enabling the smart match option. It will automatically mark all similar incoming transactions for that tax year.

Can I edit or remove transactions once they are reconciled as income?

Yes, transactions reconciled as income can be added to the ‘Income’ section of the Bookkeeping tab, and you can remove or edit them by swiping left if you make a mistake.