Understanding the Importance of MTD

Making Tax Digital (MTD) represents a major transformation in the way taxpayers and accountants handle tax submissions to HMRC. The initiative aims to create a more efficient and effective tax system by leveraging digital tools and software. With the recent developments and changes in deadlines, accountants, taxpayers, and businesses must stay informed and prepared.

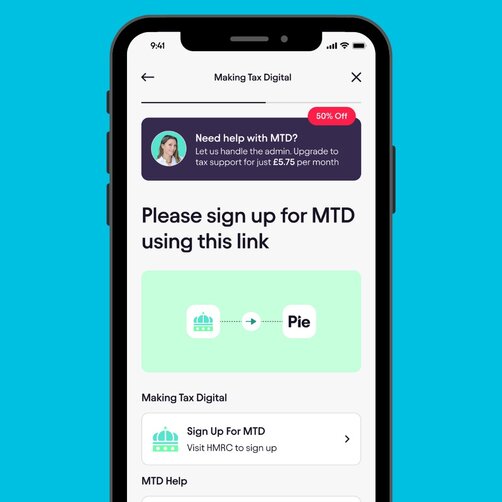

The transition to MTD aims to reduce errors, increase transparency, and streamline the tax process. Considering the importance of tax compliance, the Pie Tax App and Expert tax assistants available on the Pie app are indispensable tools to navigate this digital shift effortlessly.

Starting from April 2026, MTD for Income Tax Self-Assessment (IT) will become mandatory for all self-employed individuals and landlords with a total business or property income above £10,000. This deadline extension provides additional time for taxpayers and accountants to implement necessary adjustments and ensure seamless compliance.

Key Updates on MTD Implementation

With the recent delay in the MTD for IT deadline to April 2026, taxpayers and accountants are granted more time to prepare for this significant transition. This extension offers a vital opportunity to adapt and integrate digital tools into everyday accounting practices, ensuring a smooth and compliant shift to the new system.

The Pie Tax App offers comprehensive features that simplify tax management and ensure seamless compliance with MTD requirements. By using this innovative tool, you can avoid potential pitfalls and make the most out of the extended preparation period.

Advantages of Going Digital

One of the main benefits of MTD is the reduction of human error in tax filings. Digital records and submissions ensure accuracy and efficiency, which significantly minimises the risk of penalties due to incorrect filings. Furthermore, digital tools provide real-time insights into financial health, allowing for better decision-making and financial planning.

The Pie Tax App enhances this experience by offering expert guidance and streamlined processes. With the app, users can easily manage their tax obligations, track expenditures, and ensure timely submissions, making tax management hassle-free and efficient.

Recent data highlights the impact of MTD's phased implementation. As of 2023, over 1.5 million taxpayers have successfully adopted the MTD system for VAT. Additionally, HMRC reports a significant reduction in errors, estimating a decrease of 30% in submission inaccuracies due to digital records. These statistics underscore the importance and benefits of adopting MTD for IT. By leveraging digital tools like the Pie Tax App, taxpayers can join the growing number of compliant and efficient tax filers, ensuring accuracy and reducing stress.Latest Statistics on MTD

Studies indicate that businesses using digital tools for tax management report 20% higher compliance rates compared to traditional methods. Moreover, the adoption of digital tools also correlates with a 15% increase in operational efficiency. These insights highlight the value of integrating digital solutions into tax practices. The Pie Tax App not only aids in compliance but also enhances overall business efficiency through its intuitive and user-friendly interface.Key Insights on Compliance

Detailed Guide to MTD for Accountants

Compliance with MTD for IT requires a thorough understanding of digital record-keeping and submission processes. Accountants play a crucial role in assisting clients through this transition, ensuring that all submissions are accurate and timely. The Pie Tax App is an invaluable resource, providing tools and expert assistance to navigate the complexities of MTD.

By staying updated with the latest guidelines and leveraging digital tools, accountants can offer superior services and compliance assurance to their clients. It's essential to begin preparations now to ensure a smooth transition by the April 2026 deadline.

Transitioning to MTD: A Step-by-Step Approach

Preparing for MTD requires a strategic approach, starting with an assessment of current record-keeping practices and identifying areas for improvement. Transitioning to digital tools involves training staff, integrating software solutions, and establishing workflows that align with MTD requirements. The Pie Tax App offers comprehensive support throughout this process, ensuring a seamless transition for all users.

It's advisable to create a detailed implementation plan, including key milestones and deadlines, to ensure readiness by April 2026. Continuous monitoring and adjustments will facilitate a smoother transition and better compliance outcomes.

Tips for Effective MTD Implementation

Start Early Begin your preparations well in advance to avoid last-minute rush and errors. Early adoption of digital tools like the Pie Tax App can streamline the transition process.

Training and Support Ensure that all staff members are adequately trained in using new digital tools and understand the requirements of MTD. The Pie Tax App provides expert guidance to navigate any challenges.

Regular Reviews Periodically review your digital records and submission processes to ensure compliance and identify areas for improvement. Regular updates and audits can prevent errors and facilitate smooth operations.

Fun Fact about MTD

Did you know that the implementation of MTD is projected to save businesses £1.2 billion annually in reduced administration costs? By adopting digital tools and processes, businesses can significantly cut down on time spent on manual record-keeping and reporting.

Expert Advice on MTD Compliance

Ensuring compliance with MTD for IT involves several critical steps. Firstly, it’s important to maintain accurate digital records of all transactions. Utilising tools like the Pie Tax App can automate much of this process, reducing errors and saving time.

Secondly, timely submissions are crucial. Late or inaccurate filings can result in penalties. The Pie Tax App offers reminders and alerts to ensure that all deadlines are met without stress. Lastly, continual education and updates are vital to stay abreast of any changes in tax laws and MTD requirements. The Expert tax assistants available on the Pie app provide ongoing support and advice to navigate these updates efficiently.

How to prepare for MTD for IT

While 2026 might seem distant, starting preparations now will make the transition smoother. Research MTD compatible software options that suit your business needs.

Using prewritten templates and digital tools can help save time when communicating with clients about MTD. The software industry is working closely with HMRC to provide solutions for all taxpayers.

Review your current record keeping methods and identify necessary changes. Speak with your accountant about their plans for supporting MTD clients

Maintain accurate and up-to-date digital records of all transactions. The Pie Tax App automates and simplifies this process, ensuring compliance. Always adhere to submission deadlines to avoid penalties. The Pie Tax App offers timely alerts and reminders to keep you on track.Digital Record-Keeping

Navigating the complexities of MTD requires a comprehensive understanding of tax laws and digital tools. The Pie Tax App provides an integrated solution, offering expert guidance and automated processes to ensure compliance and efficiency. Regular updates and continuous support from the Expert tax assistants available on the Pie app ensure that users remain compliant and informed.Navigating Complexities

Summary

Making Tax Digital (MTD) represents a significant shift in the way taxes are managed and submitted in the UK. With the upcoming implementation of MTD for IT in April 2026, it's crucial for taxpayers and accountants to prepare effectively. Utilising digital tools like the Pie Tax App can simplify this transition, ensuring accuracy, compliance, and efficiency.

By leveraging the features of the Pie Tax App and the expertise of the Expert tax assistants available on the Pie app, users can navigate the complexities of MTD with ease. The app provides comprehensive support, from digital record-keeping to timely submissions, making tax management hassle-free and compliant.

You can also click here for more information on Making Tax Digital for Income Tax Self-Assessment for Sole Traders and Landlords / Embrace Making Tax Digital: Stay Ahead with Pie Tax

Frequently Asked Questions

What is Making Tax Digital (MTD)?

MTD is an HMRC initiative aimed at digitising tax submissions to improve accuracy and efficiency. It requires taxpayers to maintain digital records and submit returns using compatible software like the Pie Tax App.

Who needs to comply with MTD for ITSA?

From April 2026, self-employed individuals and landlords with a total business or property income above £10,000 must comply with MTD for ITSA.

How can the Pie Tax App help with MTD compliance?

The Pie Tax App offers tools and expert guidance to maintain digital records, automate submissions, and ensure compliance with MTD requirements.

What are the benefits of using digital tools for tax management?

Digital tools reduce errors, ensure timely submissions, provide real-time financial insights, and save time and resources, improving overall tax management efficiency.

What should I do to prepare for MTD?

Start by assessing your current record-keeping practices, integrate digital tools, train staff, and create a detailed implementation plan to ensure readiness by the April 2026 deadline. The Pie Tax App simplifies this process and offers continuous support.