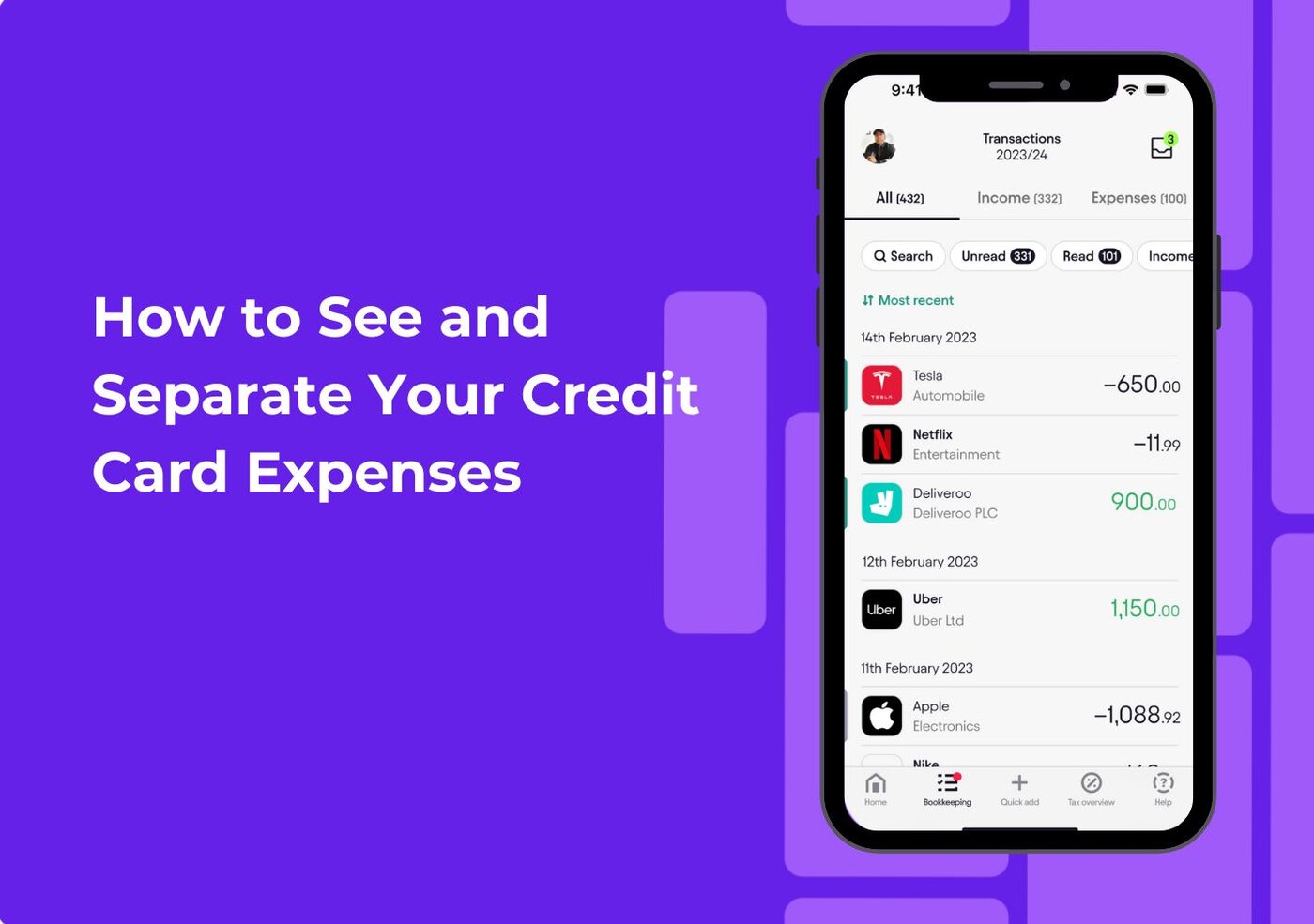

Understanding and Managing Your Credit Card Spending

Keeping track of credit card expenses can be overwhelming, especially when personal and business spending mix together. Without a clear system, it becomes difficult to understand where your money is going or how much you’ve spent in different areas. This guide explains how to view, separate, and organise your credit card transactions so you remain fully in control of your financial activity.

Managing credit card expenses properly is essential for budgeting, financial clarity, and preparing for any tax-related responsibilities. Having a clean overview of your spending habits helps prevent errors, reduces stress, and ensures that nothing important gets missed.

If you ever face challenges around separating business from personal expenses, keeping receipts in order, or understanding your spending categories, the Pie Tax App and the Expert tax assistants available on the Pie app provide a reliable solution to help you stay on top of your financial record-keeping.

Your Step-by-Step Guide

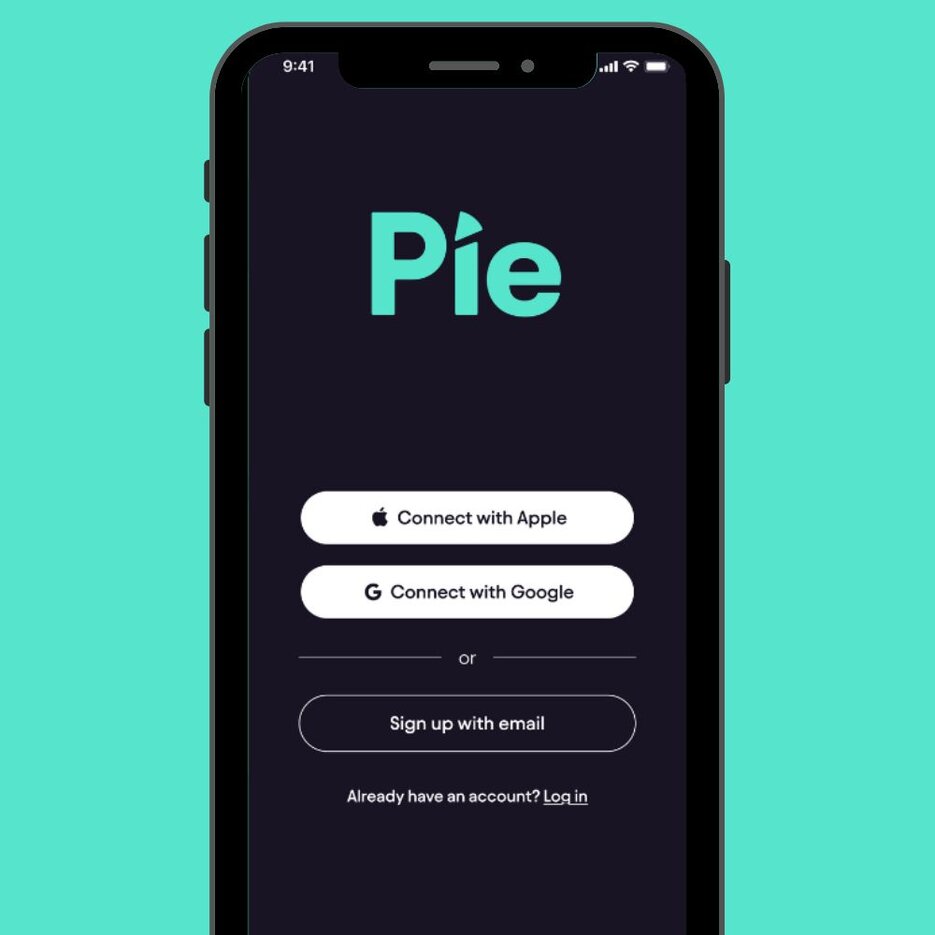

Firstly, ensure that you have downloaded the Pie Tax App from your app store and have created an account. Open the app and log in to your dashboard.Open the Pie Tax App

On your profile, which you can access by clicking on your avatar, look for the 'Connections' option. Then click on 'Add a new account' to start the process.Navigate to Bank Connections

Begin by ensuring that you have a credit card connected to your app to efficiently sort and match your expenses.Bank Account Connection

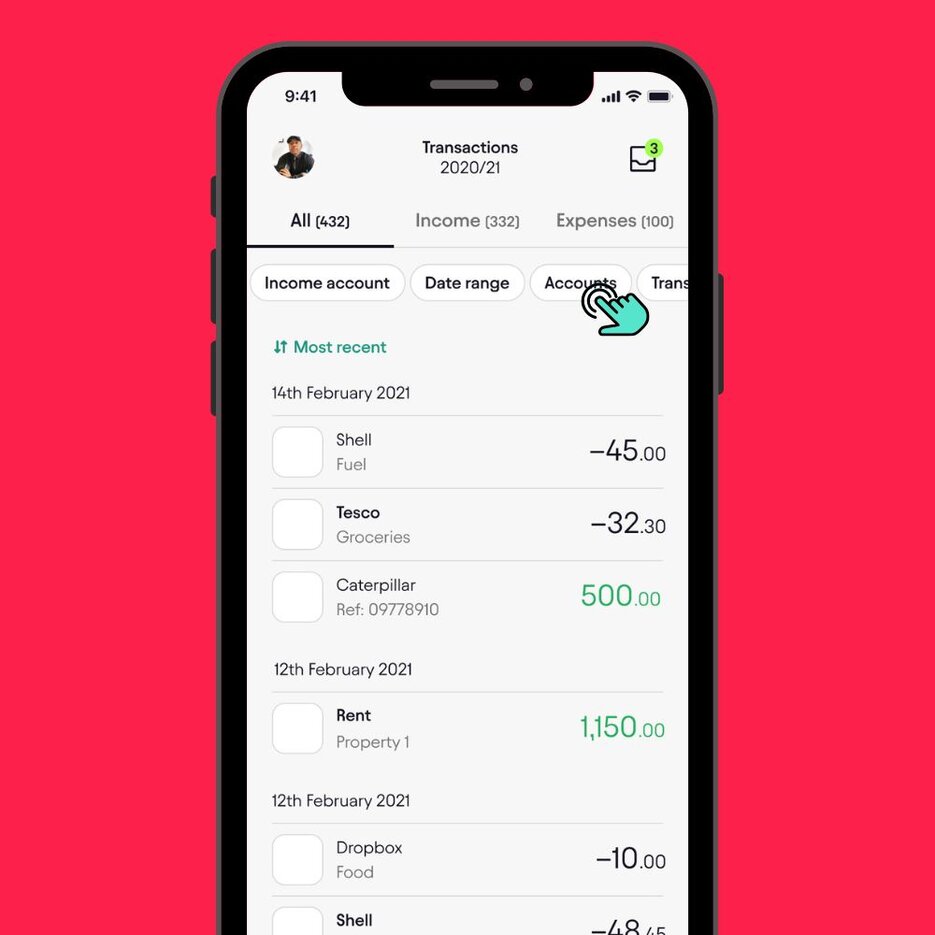

Once your bank is connected, you can proceed to the bookkeeping section of the app on your navigation bar.Proceed to Bookkeeping

Inside Bookkeeping, select the Accounts filter and choose your credit card account. This narrows down your transaction list so you only see credit card activity.Selecting Accounts (Filtered to Credit Accounts)

Once your credit card transactions appear on screen, you can start reconciling them. Swiping right on a transaction marks it as reconciled, confirming that it has been reviewed and categorised correctly. Reconciling Expenses by Swiping Right

Troubleshooting Common Issues

Sometimes, issues can arise during the sorting process. Here are some common problems and solutions:

Verify that your bank account is correctly connected to the app to ensure seamless sorting.Ensure Proper Bank Account Connectivity

Cross-check all yearly Credit card transactions with your financial records to ensure they are from the correct tax year and to streamline the matching process.Review and Verify Yearly Transactions

Leverage the Smart Match and Multi-Select features to efficiently reconcile transactions and organise expenses, ensuring accurate financial management.Utilise Advanced App Features

Conclusion

Seeing and separating your credit card expenses doesn’t need to be difficult. By following the six steps laid out in this guide from opening the app to filtering your credit card activity, you can manage your spending more effectively and maintain complete clarity over your financial habits. Proper organisation ensures that your credit card records are detailed, accurate, and easy to review.

This process prevents errors, reduces stress, and gives you more confidence when managing your finances. If you want an easier, more convenient way to manage and separate expenses, the Pie Tax App offers a streamlined and user-friendly solution designed to support your financial needs.

Frequently Asked Questions

How do I view only my credit card transactions?

Use the Bookkeeping section and select the Accounts filter, then choose your credit card. This isolates only card-related transactions.

Can I separate business and personal purchases?

Yes. You can use the proportion feature to ensure your personal and business expenses remain clearly separated

How often should I reconcile expenses?

Reconciling weekly is recommended to avoid large backlogs and ensure your financial data remains clean and accurate.

Why is filtering important when checking expenses?

Filtering helps prevent mixing different account types, allowing you to focus specifically on credit card spending

What if a transaction looks incorrect?

You can edit or recategorise any transaction directly in the Bookkeeping section to maintain accurate records.