Understanding the Shift to Digital Taxation

The UK is undergoing a revolutionary change in how taxes are managed. The Making Tax Digital (MTD) initiative is transforming the tax landscape by making the process more efficient and transparent. This transition aims to modernise the tax system, benefiting taxpayers and businesses alike. But what does this mean for you and your personal tax obligations?

Making Tax Digital seeks to reduce errors and improve compliance through digital record-keeping and automated tax filing. However, for many, this shift can be daunting. The good news is that tools like the Pie Tax App and the expert tax assistants available on the Pie app make this transition smoother, ensuring you’re always one step ahead.

In this comprehensive guide, we break down everything you need to know about Making Tax Digital for personal taxes. From understanding key deadlines to leveraging digital tools for seamless tax management, we'll cover it all.

What is Making Tax Digital?

Making Tax Digital (MTD) is an initiative by HM Revenue and Customs (HMRC) to modernise the UK tax system. The goal is to digitise tax records and automate tax submissions, thereby increasing efficiency and reducing the chances of human error.

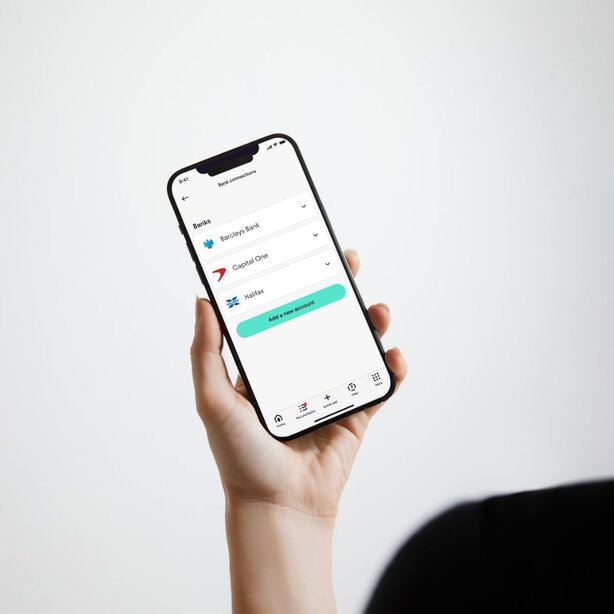

For individuals, MTD means maintaining digital records of income and expenses and submitting returns electronically. While the transition may seem daunting, solutions like the Pie Tax App simplify this process, providing you with a seamless and user-friendly interface. Expert tax assistants are readily available via the Pie app to guide you through each step, ensuring accuracy and compliance.

Why Making Tax Digital Matters

Making Tax Digital is not just a governmental initiative but a significant shift towards modernising how we manage our taxes. Digital records lead to better accuracy, fewer errors, and real-time updates, all contributing to a more transparent tax system.

Moreover, by embracing MTD, you’re not just complying with new regulations but also gaining more control over your tax data. Digital tools like the Pie Tax App streamline this experience, making it easier for you to manage your taxes efficiently. The expert tax assistants available on the Pie app further enhance this by providing tailored advice and support.

2020 Making Tax Digital became mandatory for VAT-registered businesses with a turnover above the VAT threshold in April 2020. From April 2026, MTD will apply to Income Tax Self-Assessment (ITSA) for self-employed individuals and landlords with an income above £10,000.Key Deadlines to Remember

99% A pilot study showed that 99% of users found digital tools helped them understand their tax obligations better. 2 million By the end of 2021, over 2 million businesses and individuals had signed up for MTD for VAT.Impact of Making Tax Digital

Benefits of Pie Tax App

The Pie Tax App is designed to make your life easier when dealing with MTD. It simplifies the process of maintaining digital records and submitting tax returns, ensuring compliance with the latest regulations.

In addition to this, the app provides real-time updates and instant notifications, so you’re always aware of any changes or deadlines. With expert tax assistants readily available, you receive personalised advice and support, making it easier to manage your tax affairs confidently and accurately.

Preparing for Digital Taxation

Preparing for the shift to digital taxation may seem overwhelming, but it doesn't have to be. Start by familiarising yourself with the requirements of Making Tax Digital. Understand what records you need to keep and how often you'll need to submit them.

Next, invest in reliable digital tools like the Pie Tax App to streamline your tax process. The Pie Tax App helps you maintain accurate records and submit returns efficiently, ensuring you never miss a deadline. Additionally, the expert tax assistants available on the Pie app provide valuable guidance and support throughout your tax journey.

Helpful Tips to Get Started

Start Early Begin digitising your records now to ensure a smooth transition when MTD becomes mandatory. Familiarising yourself with the new system will save you time and stress later.

Utilise Digital Tools Invest in digital tools like the Pie Tax App to manage your records and submissions effortlessly. The app simplifies complex tax processes, provides real-time updates, and ensures you stay compliant.

Seek Professional Help Don’t hesitate to seek help from expert tax assistants on the Pie app. They offer personalised advice and support, helping you navigate the intricacies of Making Tax Digital with ease.

Fun Tax Fact

Did you know the first income tax in the UK was introduced in 1799 by Prime Minister William Pitt the Younger to fund the war against Napoleon?

How to Stay Compliant

Staying compliant with Making Tax Digital requires understanding the deadlines and requirements. Begin by maintaining accurate digital records of your income and expenditures. Ensure these records are updated in real-time and stored securely.

Next, utilise tools like the Pie Tax App to handle submissions efficiently. The app automates much of the process, reducing the chances of errors. Alongside digital tools, engage with expert tax assistants available on the Pie app to get tailored advice on staying compliant and ahead of MTD regulations.

Accurate record-keeping is crucial for MTD compliance. Ensure all your financial transactions are documented digitally and stored safely. Digital tools like the Pie Tax App can simplify this process significantly. Regularly updating your records ensures you’re always ready for submissions, reducing the chances of last-minute errors. The expert tax assistants on the Pie Tax App can guide you through best practices for maintaining these records, ensuring you stay compliant with MTD regulations.Maintain Accurate Records

Timely submissions are critical under MTD. Ensure you’re aware of all relevant deadlines and plan your submissions accordingly. Missing deadlines can result in penalties and additional stress. The Pie Tax App provides instant notifications and reminders for upcoming deadlines, ensuring you never miss an important date. Additionally, expert tax assistants on the Pie app offer personalised guidance and support, helping you manage your submissions effectively and on time.Submit Returns on Time

Summary

Making Tax Digital marks a significant shift in the UK tax system. While the transition may appear daunting, understanding the requirements and utilising reliable digital tools can ease this process. Solutions like the Pie Tax App and the expert tax assistants available on the Pie app play a crucial role in helping taxpayers stay compliant and confident.

By starting early, maintaining accurate records, and seeking professional help, you can smoothly transition to digital taxation. The Pie Tax App provides the features you need to manage your tax obligations efficiently, ensuring you’re always ahead of deadlines and regulations. Embracing MTD not only ensures compliance but also offers greater control and transparency over your tax data.

Frequently Asked Questions

What is Making Tax Digital?

Making Tax Digital (MTD) is an initiative by HMRC to digitalise tax records and automate tax submissions. It aims to improve efficiency and reduce errors.

Who needs to comply with MTD?

As of April 2026, all self-employed individuals and landlords with an income over £10,000 must comply. Others include VAT-registered businesses above the VAT threshold.

How does the Pie Tax App help with MTD?

The Pie Tax App simplifies digital record-keeping and automated submissions, providing real-time updates and access to expert tax assistants for personalised support.

What are the key deadlines for MTD compliance?

For VAT, MTD became mandatory in April 2020. For Income Tax Self-Assessment, it will apply from April 2026 for qualifying individuals and businesses.

Why should I start using digital tools now?

Early adoption ensures a smooth transition to MTD, helping you familiarise yourself with new processes and stay ahead of deadlines. Tools like the Pie Tax App simplify this journey.