Understanding HMRC Online Portal Access Issues

Are you a UK taxpayer struggling with accessing your HMRC online portal? Worry not! We've got you covered with a comprehensive guide on regaining access and managing your tax affairs effectively.

Reasons Why You Might Be Unable to Access Your HMRC Online Portal

When you encounter difficulties accessing your HMRC online portal, it's crucial to understand the following components:

Forgotten credentials are a common issue. Knowing how to recover or reset them can save you a lot of hassle and time.Forgotten Username or Password

After several failed login attempts, your account may be locked. Understanding this can help you take proper steps to unlock it.Account Lockout

Sometimes, server or browser issues can impede access. Recognising this helps you troubleshoot appropriately.Technical Issues

How to Resolve HMRC Online Portal Access Issues

Follow these steps to regain access seamlessly:

Verify your internet connection and try accessing the portal from a different browser.

Click on the "Forgot your password?" link on the login page to reset your password via email.

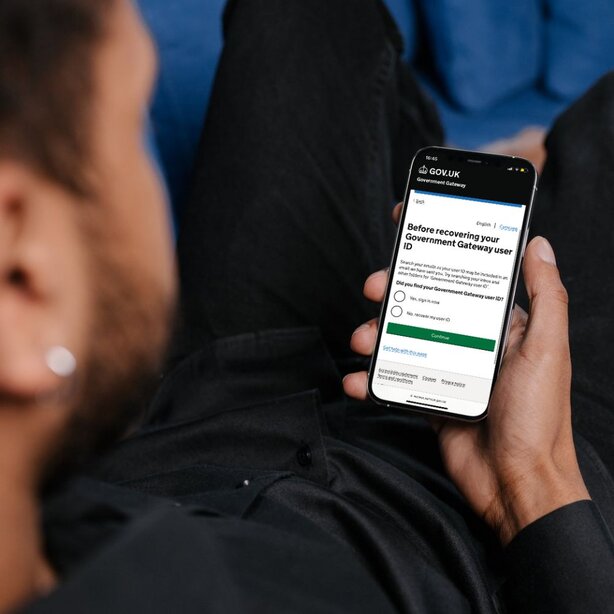

If you’ve forgotten your username, use the "Forgot your username?" link and follow the prompts to recover it.

Clear your browser cache and cookies, then try logging in again.

Contact HMRC support directly if the issue persists, and have your ID and personal information ready for verification.

Options for Managing Without Portal Access

Option 1: Phone Support

HMRC offers phone support, enabling you to manage your queries and issues through a direct conversation with their customer service representatives. This method allows you to receive personalised assistance and immediate responses to your questions, which can be particularly helpful for complex or urgent issues. The representatives can guide you through specific processes, provide clarifications on tax regulations, and help resolve any problems you may encounter.

Option 2: Online Submission

If online access and phone support are unavailable, HMRC also accepts postal correspondence for resolving issues. This traditional method allows you to submit detailed queries and receive written responses, which can be useful for record-keeping and documentation purposes. Ensure that you include all relevant information and your tax reference number in your correspondence to facilitate a prompt response.

Additional Considerations

It's important to store your HMRC login details securely to protect your personal and financial information from unauthorised access while ensuring they are readily accessible for timely tax submissions and management.Securely Store Login Details

Keeping your contact information and security settings up to date with HMRC ensures you receive important notifications and maintain the security of your account.Update Contact Info and Security Settings

Activating two-factor authentication on your HMRC account adds an extra layer of protection, making it harder for unauthorised users to access your personal and financial information.Enable two-factor authentication

Expert Assistance with Pie

Navigating the budgeting for your Self Assessment tax bill can be complex, but with Pie Tax, you have access to expert assistance. Our software makes it easy to track your income, expenses, and tax obligations, ensuring you always stay ahead.

According to a recent survey, 20% of UK taxpayers experience issues accessing their HMRC online portal annually.

Over 15% of these issues are resolved through HMRC's phone support within 24 hours.

Frequently Asked Questions

What should I do if I forget my HMRC online portal password?

Use the "Forgot your password?" link on the login page to reset your password via email.

How can I recover my HMRC username?

Click on the "Forgot your username?" link and follow the prompts for username recovery.

What if I get locked out of my HMRC account?

Wait for 2 hours before trying to log in again or contact HMRC support to unlock your account.

How do I clear cache and cookies in my browser?

Go to your browser settings, find privacy or history settings, and select the option to clear cache and cookies.

Who do I contact for technical issues with the HMRC portal?

Contact HMRC's technical support via their official contact numbers or online support forms.