Learn the Basics of EIS

The Enterprise Investment Scheme (EIS) is a government-backed initiative designed to encourage investment in smaller, higher-risk companies by offering tax reliefs to investors. Introduced in 1994, EIS aims to help small businesses grow by providing an attractive incentive for investors. This scheme is particularly beneficial for entrepreneurs looking to raise capital and investors seeking tax-efficient opportunities.

Another crucial aspect of EIS is the loss relief it offers. If the investment loses money, investors can offset the loss against their income tax, providing an additional layer of financial protection. This makes EIS a compelling choice for those willing to invest in small, growing companies while benefiting from significant tax breaks.

Tax Relief Benefits

EIS offers generous tax relief benefits for investors. One of the most significant benefits is the income tax relief, where investors can claim up to 30% income tax relief on investments up to £1 million per tax year.

This means that if you invest the maximum allowed amount, you can reduce your income tax liability by £300,000. Additionally, EIS investments are exempt from Capital Gains Tax if you hold the shares for at least three years, potentially leading to substantial savings.

Capital Gains Benefit

Another benefit of EIS is its exemption from Capital Gains Tax (CGT). If you invest in an EIS-qualified company and hold the shares for at least three years, any gains made when you sell the shares will be entirely exempt from CGT.

This provides a considerable financial incentive for investors to support smaller companies, as it allows them to enjoy the full benefits of their investments without worrying about losing a portion of their gains to taxes.

In 2022, over £1.9 billion was raised through EIS investments, marking a significant increase from previous years. This shows growing investor confidence in EIS as a tax-efficient investment vehicle.Recent Investment Trends

More than 4,000 companies received EIS funding, highlighting the scheme's impact on supporting small businesses.Key Statistics

EIS rules and eligibility

To be eligible for EIS, both the investor and the company must meet specific criteria. For investors, you must not be connected to the company, meaning you cannot be employed by or own more than 30% of the company. Additionally, the company must not have gross assets exceeding £15 million before the shares are issued and must be a trading company carrying on a qualifying trade.

The company must use the funds raised through EIS for growth and development purposes within two years from the date of investment. This ensures that the capital raised is put to productive use, helping the business to expand and grow. Companies must also meet certain conditions after the investment, such as maintaining their trading status and not becoming listed on a stock exchange during the qualifying period.

Risks involved with EIS

Investing in EIS does come with risks. One primary risk is that the companies eligible for EIS are smaller, often early-stage businesses, which are inherently riskier investments. The potential for high returns comes with an increased risk of losing the money invested. However, the tax reliefs provided by EIS, such as loss relief, can help mitigate these risks.

It's also important to note that the tax advantages of EIS depend on the investor's personal circumstances and can change if tax laws or the company's qualifying status changes. As with any investment, thorough research and professional advice are essential before committing your money to EIS-qualified companies.

The EIS Tax Relief Process

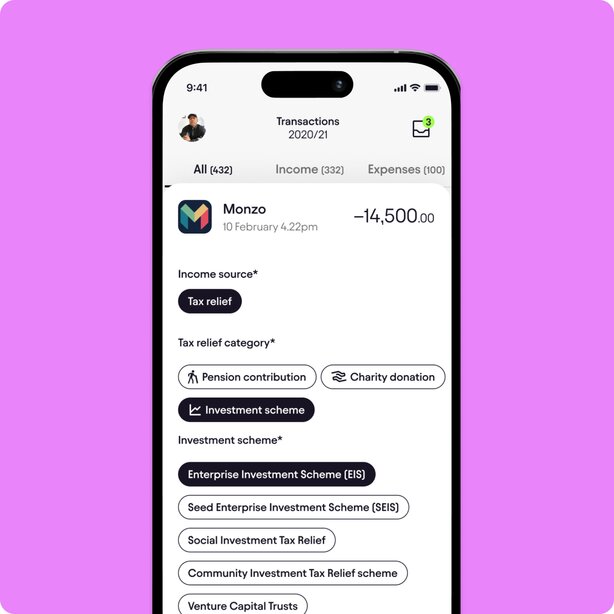

To claim EIS tax relief, the process involves three critical stages. First, the company must apply for EIS approval from HMRC. Once approved, they will receive an EIS compliance certificate which is then forwarded to investors. In the second stage, investors can claim the tax relief either through their annual tax return or by marking the matching bank transaction as 'Tax Relief' in the bookkeeping section of the Pie Tax App.

This claim must include the EIS compliance certificates. The Pie Tax App can simplify this process by guiding you through the process and ensuring you qualify for relief. In the final stage, it's important to maintain your investment for at least three years to fully benefit from EIS. Selling your shares earlier can lead to a clawback of the relief claimed. Consistent adherence to EIS rules ensures continued compliance and maximisation of tax savings.

Tips for EIS investment

Consulting with experts familiar with EIS can provide valuable insights and help you navigate the complexities of the scheme.Seek professional advice

To mitigate risks, spread your investments across several EIS-eligible companies rather than putting all your eggs in one basket.Diversify your investments

Regularly review the performance of your investments and the companies you've invested in to ensure they meet the EIS qualifying criteria.Monitor your investments

Fun Facts

Did you know that the EIS scheme has been running for nearly 30 years? It was established in 1994 and has helped thousands of businesses grow through investment.

How to apply for EIS funding

If you're a business looking to take advantage of the EIS scheme, the process involves several steps. First, ensure your company meets the qualifying criteria, including size, trading status, and growth potential. Next, apply for advance assurance from HMRC, which confirms that your company is likely to qualify for EIS investment.

Once you've received advance assurance, you can start seeking investments from eligible investors. Make sure you provide comprehensive information about your business, including your growth plan and how you intend to use the funds. This helps investors understand the potential of your company and increases the likelihood of securing investment.

To apply for EIS funding, begin by ensuring your company meets the necessary criteria. The business should not have more than £15 million in gross assets and should be a qualifying trade. Once eligibility is confirmed, apply for advance assurance from HMRC, which provides a preliminary assessment of whether your company qualifies for EIS investment. This assurance can significantly improve your chance of attracting investors.EIS application process

Once your company has received advance assurance from HMRC, it's time to attract investors. Prepare detailed investment documents that outline your business plan, financial projections, and how you will use the funds. Share these documents with potential investors and communicate the tax advantages of investing in your company through EIS. Highlight the potential for up to 30% income tax relief, CGT exemption, and loss relief if the investment doesn't perform as expected.Attracting EIS investors

Summary

The Enterprise Investment Scheme (EIS) is a valuable tool for both investors and small businesses. For investors, EIS offers substantial tax reliefs, including up to 30% income tax relief and exemption from Capital Gains Tax. Additionally, investors can benefit from loss relief, which provides further financial protection. For small businesses, EIS can be a crucial source of funding, helping them to grow and expand.

However, investing in EIS-eligible companies comes with risks, given the early-stage nature of these businesses. Thorough research and professional advice are essential to minimise risks and maximise benefits. The Pie Tax App can assist you with expert tax assistants available on the Pie app to navigate EIS complexities.

The Pie Tax App offers a convenient and efficient solution for managing your tax affairs. With expert tax assistants available on the Pie app, you can get personalised advice and support, ensuring that you make the most of your EIS investments and other tax-related matters.

Frequently Asked Questions

Who qualifies for the Enterprise Investment Scheme?

Both individual investors and companies can qualify for EIS. Investors must not own more than 30% of the company, and the company itself must be a trading company with gross assets not exceeding £15 million before investment.

How much can I invest in EIS?

You can invest up to £1 million per tax year in EIS-eligible companies. This can go up to £2 million if you invest in Knowledge-Intensive Companies, providing you with significant tax reliefs.

What are the tax relief benefits of EIS?

EIS offers up to 30% income tax relief on investments up to £1 million per tax year. Investments are also exempt from Capital Gains Tax if held for at least three years. Additionally, loss relief helps mitigate risks by offsetting investment losses against your income tax.

What risks are involved in EIS investments?

EIS investments are inherently riskier due to the early-stage nature of eligible companies. However, tax benefits like loss relief can help offset these risks. Always consult with tax experts to understand potential pitfalls.

How can Pie Tax App assist me with EIS?

The Pie Tax App offers comprehensive support for managing your EIS investments, providing personalised advice and services to navigate the complexities of the scheme. With expert tax assistants available on the Pie app, you can ensure you maximise tax benefits while minimising risks.