Introduction to the P60 Form

The P60 form is one of the most crucial documents you'll receive as a UK taxpayer. Whether you are employed full-time, part-time, or on a temporary contract, this annual statement summarises your total earnings and the tax that has been deducted from your pay throughout the financial year. Understanding this document is vital to ensure you meet your tax obligations and avoid any surprises from HMRC.

Issued by your employer at the end of each tax year, by 31 May, the P60 form contains detailed information about your salary, any tax reliefs you are eligible for, and National Insurance contributions. The document serves as proof of the tax you've paid and is essential for tasks such as completing self-assessment tax returns or claiming tax credits and refunds. If you need to confirm that you've paid the correct amount of tax, this is your go-to document.

Getting a grip on what your P60 form entails can save you time and headaches during the tax season. Whether it's understanding the numbers on your form or knowing the deadlines, being well-informed increases your likelihood of filing accurate returns and maximising potential refunds.

What Does a P60 Form Include?

A P60 form includes several key details, such as your total earnings for the tax year, the tax you've paid, and any National Insurance contributions. It also outlines pension contributions and any statutory payments, like maternity or paternity pay, providing a thorough summary of your income and deductions.

This information is essential for checking your tax status and can be required when applying for loans, mortgages, or state benefits. Keeping your P60 safe ensures you have accurate records for future reference.

Why is a P60 Form Important?

The P60 form is essential as it provides an official summary of the tax you’ve paid over the tax year. It is commonly needed when applying for a mortgage, loan, or claiming state benefits.

Additionally, the P60 allows you to check that you’ve paid the correct amount of tax. Keeping this document safe is important, as it serves as proof of your earnings and tax contributions, which may be needed for future financial or tax-related queries.

By law, an employer must provide you with your P60 form by 31 May following the end of a tax year. This ensures you have enough time to review your annual earnings and tax deductions before any tax submissions or applications for refunds.Deadline for Receiving P60

With self-assessment tax returns, your P60 provides crucial data. This information is vital for accurate tax filings, helping to avoid errors and penalties. In 2023, 78% of individuals who used their P60 data reported fewer discrepancies in their tax returns.Using Your P60 for Tax Returns

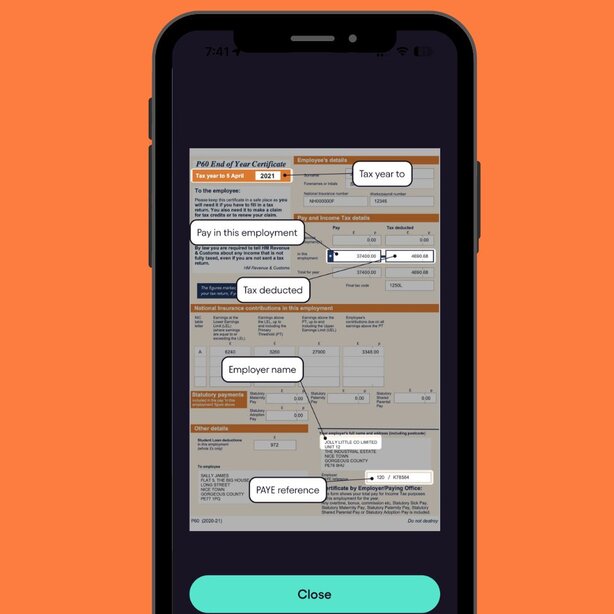

How to Read Your P60 Form

Understanding the P60 form means recognising each section and what it represents. Start with your personal details—name, National Insurance number, and employer information. Next are your total earnings and tax paid, found in boxes 1 and 2, respectively. These amounts should match your payslips.

The National Insurance contributions section summarises your contributions and should be compared with your payslips. Accurately recording these details is important for self-assessment or financial reviews. If discrepancies are found, they can be corrected.

Additionally, the P60 includes statutory payments, like maternity pay and pension contributions, which should also align with your records for complete financial clarity.

Common Issues with P60 Forms

Errors and discrepancies can occasionally surface on your P60 form, often due to procedural mistakes or payroll data mismatches. These may include incorrect tax deductions, missing National Insurance contributions, or inaccuracies in statutory payments such as maternity or paternity pay. If you spot an anomaly, it’s essential to act quickly by contacting your payroll department or employer to resolve the issue promptly.

In some cases, your P60 might highlight that your employer has underpaid or overpaid your tax. Identifying these discrepancies early allows you to take corrective action, avoiding potential penalties or interest from HMRC. Furthermore, resolving errors promptly ensures compliance and prevents future complications during self-assessment or when applying for financial services.

It’s advisable to retain your P60 forms for at least six years. This is vital for record-keeping, as these documents may be required for audits, tax reviews, or financial references in the future.

P60 Form Considerations

Always maintain a digital copy of your P60 to ensure secure storage and convenient access to vital tax records whenever needed, it is important for financial information.Digital Copy

Expect HMRC to continually evolve their digital services. Keeping documents like the P60 accessible in formats compatible with new systems will simplify compliance.Evolving Services

Look out for updates in tax regulations. Staying informed helps in understanding how changes may impact the details included in your P60.Tax Updates

Fun Fact About P60s

Did you know that the P60 form got its name from the UK tax year system? The 'P' stands for 'PAYE,' which means 'Pay As You Earn,' and the '60' refers to its form number in the tax documentation series. It's been a critical part of UK tax administration since the PAYE system started in 1944.

Handling a Missing P60 Form

If you did not receive your P60 form by the deadline, don't panic. Contact your employer immediately and request a copy. They are legally required to provide it, and most employers can issue a duplicate without issue. Alternatively, confirm if it was sent to the correct address or if there were any processing delays.

If your employer cannot provide a copy for any reason, you can get assistance from the Expert tax assistants available on the Pie app. They can guide you through the next steps and help you ensure that you have all necessary documentation for your tax filings. It's crucial to act quickly to avoid any potential penalties or complications during the tax season.

If your P60 form has been lost or damaged, you can request a duplicate from your employer. Keep in mind that they may require a written request. It’s essential to keep a record of the communication for your files. Employers are legally obligated to provide a P60 form. If they fail to do so, you can escalate the issue to HMRC. Remember to keep proof of your salary and tax deductions, such as payslips, as they can support your request for a duplicate P60 form.Requesting a Duplicate

In today’s digital age, maintaining an electronic copy of your P60 allows easy access. Employers issue a digital P60, in addition to a physical copy. Make sure to store your digital P60 in a secure, easily accessible location, such as a cloud storage service. This ensures you have a backup in case the physical document is lost or damaged. Digital copies also make it easier to provide quickly when required for financial or tax purposes.Using Digital Copies

Summary

The P60 form is an essential document summarising your financial activities over a tax year. From detailing your total earnings and tax paid to outlining National Insurance contributions, the P60 form provides a comprehensive snapshot of your fiscal year. Ensuring this information is accurate is crucial, as it directly impacts your tax returns and potential refunds.

Keeping your P60 safe, both physically and digitally, will ensure that you have easy access when needed for financial planning, loan applications, or resolving any tax discrepancies. The Pie Tax app can simplify your tax season by offering expert advice and easy-to-use tools for tax management. Whether it's clarifying what's on your P60 or helping you tackle missing forms, Pie Tax can make your tax season hassle-free.

Ensure timely receipt of your P60 by the deadline of 31 May. Act promptly on any errors, requests for duplicates, or other issues to maintain seamless tax compliance. Refer to the Expert tax assistants available on the Pie app for additional support, ensuring all your tax matters are handled efficiently.

Frequently Asked Questions

What should I do if my P60 form has errors?

If you notice discrepancies on your P60 form, contact your employer's payroll department immediately. Correcting these errors promptly helps avoid issues with HMRC and ensures your tax records are accurate.

Can I get a digital copy of my P60 form?

Yes, most employers provide both physical and digital copies of the P60 form. Keeping a digital copy ensures you have an easily accessible and secure backup for your tax records.

Why is my P60 form important for a mortgage application?

Lenders often request your P60 form during the mortgage application process to verify your income and tax payments, ensuring you have the financial stability required for a loan.

What information should I cross-check on my P60 form?

Ensure your personal details, total earnings, tax paid, and National Insurance contributions are accurate. Cross-reference these with your payslips to identify any discrepancies.

How long should I keep my P60 forms?

It's advisable to retain your P60 forms for at least six years. This helps ensure you have all necessary documentation for future tax returns or financial records.