Let’s Break This Down Together...

Tax rules around business expenses can feel like a puzzle. You’re left wondering what really counts, what doesn’t, and how HMRC views the grey areas.

This article walks you through the essentials from allowable everyday costs and trickier claims like home working, to capital allowances and the records you’ll need. We’ll also flag common pitfalls and how to avoid them.

By the end, you’ll see how smart expense claims can lower your tax bill and keep HMRC off your back. It’s about saving time, money, and stress so you can focus on running your business. Let’s dive in!

Introduction

Business expenses directly impact your tax bill and bottom line. Not all spending qualifies as tax-deductible, even if it feels business-related only those expenses that are wholly and exclusively incurred for business purposes are allowed by HMRC.

Understanding the “wholly and exclusively” rule can save you thousands in tax. HMRC scrutinises certain expense types more than others, especially for self employed individuals, who must ensure their expenses meet specific requirements for accurate reporting and deductions. The rules can also differ for sole traders and limited companies.

The UK’s first personal tax app, Pie tax, automatically categorises your expenses to save you hours of admin work. Or if you’re just here to get to grips with it all, let’s break it down!

What Counts as a Business Expense?

Business expenses are costs incurred “wholly and exclusively” for your business purposes. This HMRC phrase is the golden rule that determines whether you can claim something against your taxes. An allowable expense is a cost that meets HMRC’s criteria and can be claimed to reduce your taxable profit.

For something to qualify, you must have spent the money purely to help your business earn money. Personal benefits can’t be the main reason for the purchase. Sole traders and limited companies follow slightly different rules. Sole traders face stricter tests for some expenses, while limited companies have more flexibility.

You’ll need proper evidence too receipts, invoices, and proof of payment. A bank statement alone typically isn’t enough to satisfy HMRC. Keeping detailed records is essential to support your tax returns and to properly claim business expenses.

Claiming business expenses requires understanding the rules for allowable expenses and maintaining accurate documentation.

Common Allowable Business Expenses

Office costs like rent, utilities, supplies, and printer ink are usually straightforward claims. These direct costs of running your workspace rarely cause issues with HMRC. If your business manufactures or sells goods, the cost of raw materials is also a claimable business cost.

Travel expenses for business journeys are claimable, including business travel, travel costs, and specific expenses like bus fares, but regular commuting to a permanent workplace isn’t. The rule of thumb: if it’s an unusual journey for business, it’s likely allowable. Vehicle expenses can also be claimed, including costs such as vehicle insurance.

Staff costs including employee wages, payments to independent contractors, salaries, benefits, national insurance, national insurance contributions, and training are generally tax-deductible. This includes your own salary and pension contributions if you run a limited company. Allowable staff development expenses include training courses and refresher courses.

Professional fees such as those paid to accountants and solicitors are claimable if they are solely related to business operations. Fees for professional organisation memberships and trade body memberships are also allowable, provided they are directly relevant to your business.

Marketing and advertising costs are almost always allowable. From website costs, domain registration, and hosting fees to business cards and free samples, these expenses directly relate to generating income.

Financial costs such as insurance, bank charges, accountancy fees, and interest and fees on a business loan can be claimed. These are considered necessary for running a business properly.

Most expenses for small businesses and small business owners can be claimed if they are incurred wholly and exclusively for business purposes, so it’s important to keep accurate records and categorise your costs correctly.

For clothing, uniforms and protective gear are allowable, but everyday clothing is not, even if worn for work.

Tricky Areas to Navigate

Working from home expenses need careful handling. You can use HMRC’s simplified expenses, which apply flat rates, or calculate actual costs based on usage of utility bills such as your electricity bill. If you choose to calculate actual costs, you should divide the total cost of utility bills, including the electricity bill, by all the rooms in your home and the amount of time you spend working there, allocating equal amounts to each room or period used for business.

I once claimed home office expenses using the actual cost method and saved nearly £600 more than I would have using the flat rate. The extra calculations were well worth the effort.

Vehicle expenses offer two methods: claiming mileage allowances or calculating actual vehicle costs. For vehicle purchases, consider whether they qualify as capital expenditures and if you can claim a capital allowance. Each method has advantages depending on your circumstances and vehicle value.

Entertainment costs are almost always disallowed, even when they feel business-related. Entertaining clients, such as client meals, sporting events, and theatre tickets, typically can’t be claimed against tax. However, entertainment for employees may be allowable in some cases.

Dual-purpose expenses – items used for both business and personal reasons – require fair apportionment. You can only claim the business portion, and you need to show how you calculated it. It’s important to have the phone contract in your own name or the business’s name for accurate claims. Regular commuting is considered a personal expense and cannot be claimed.

Staff costs can be claimed, but domestic help, such as nannies or carers, is not claimable as a business expense.

Clothing is rarely allowable unless it’s a uniform with your logo or protective gear required for your work. Ordinary clothing isn’t claimable, even if you only wear it for business meetings. Training courses are only allowable if they relate to your current business activities; training for a new business is not an allowable expense.

Always track your expenses by tax year and use an income statement to monitor business running costs, ensuring you categorise and report expenses accurately for tax and financial analysis.

Capital Allowances for Business Assets

Capital allowances are a valuable way for businesses to claim tax relief on major purchases that are used in the business over several years. Unlike everyday business expenses, which you can usually deduct in full in the year you spend the money, capital allowances let you spread the cost of certain assets like equipment, machinery, vehicles, or even some types of business premises across several tax years.

If your business buys a van, computer equipment, or specialist tools, you may be able to claim capital allowances on these costs. This means you can deduct a portion of the asset’s value from your taxable profit each year, helping to lower your tax bill gradually as the asset is used in your business.

There are different types of capital allowances, including the Annual Investment Allowance (AIA), which lets most businesses claim the full cost of qualifying assets up to a certain limit in the year of purchase. For other assets, you may need to claim a percentage of the cost each year using writing down allowances.

It’s important to keep accurate financial records of all business purchases that might qualify for capital allowances. Not all expenses are eligible capital allowances are specifically for assets that will be used in your business for the long term, not for everyday running costs.

By understanding and claiming capital allowances correctly, businesses can manage their cash flow more effectively and ensure they only pay tax on their true taxable profit. If you’re unsure which assets qualify or how to claim, it’s wise to consult a professional or use a tax app that can guide you through the process.

Record-Keeping Requirements

Digital records are now mandatory for most businesses under Making Tax Digital rules. Paper receipts are fine, but your accounting system needs to be digital.

Keep all records for at least six years. HMRC can investigate that far back routinely, and even further if they suspect serious issues.

Real-time tracking beats retrospective sorting every time. Trying to organise a year's worth of expenses at tax time is stressful and error-prone.

Each expense needs proof of business purpose. A simple note on receipts explaining the business context can save headaches during an HMRC review.

Consistency matters too. Wild fluctuations in expense categories year-to-year can trigger HMRC's automated systems to flag your return for review.

The Golden Rule: Keep It Simple, Keep It Honest

Business expenses represent a legitimate way to reduce your tax bill, but the rules require careful navigation. The "wholly and exclusively" test is your guiding principle.

Good record-keeping is just as important as knowing what you can claim. When in doubt, consult a qualified accountant rather than risking an incorrect claim.

The Smarter Way to Handle Business Expenses

Getting business expenses right shouldn't feel like solving a puzzle. The UK's first personal tax app, Pie tax, automatically sorts your transactions into the right tax categories. Our AI assistants understand different expense rules for specific industries, whether you're a freelancer, landlord, or company director. We flag potential issues before they become HMRC problems.

The app connects directly to your bank accounts and credit cards, pulling transactions automatically. No more manual data entry or searching for missing receipts.

Receipt capture takes seconds, just snap a photo and we'll match it to the right transaction. Everything is stored securely in one place for easy access.

Want to see how simple tax can be? Explore the Pie tax app today to discover a better way to handle your business expenses.

Quick and Easy Guide to Connect Bank Account and Reconcile the Expenses

Follow these steps to sort your transactions into the correct categories.

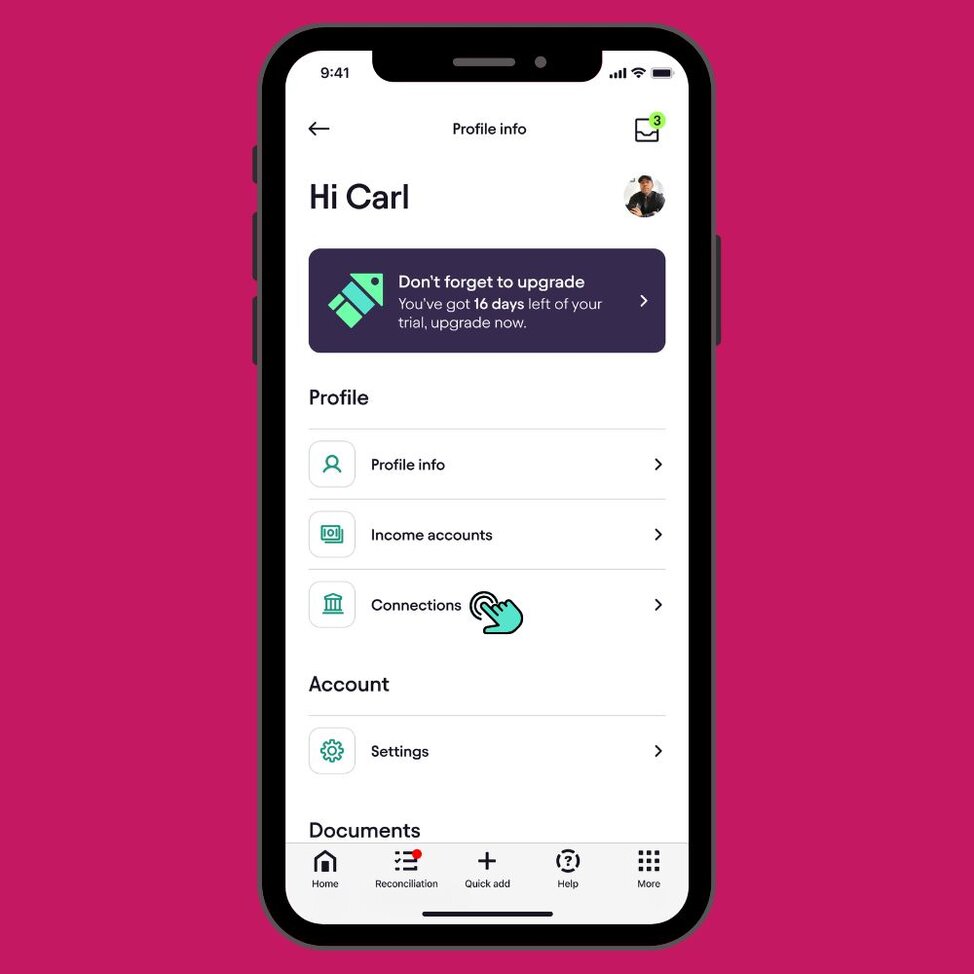

On your profile which you can access by clicking on your avatar, look for the 'Connections' option. Then click on 'Add a new account' to start the process.Step 1

Swipe right on any eligible transaction to add it as an expense, fill in the required details, and choose the appropriate category.Step 2