What is the SA107 Form?

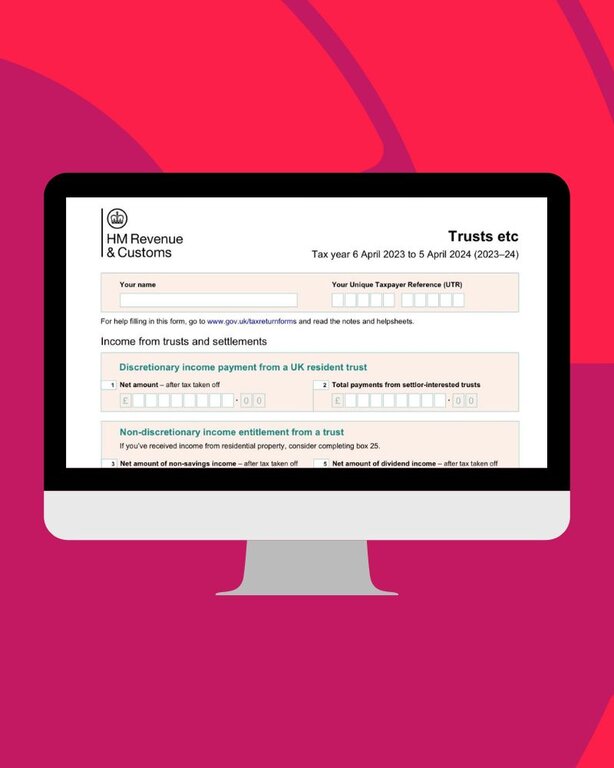

The SA107 form is specifically designed for reporting trust income on your self-assessment tax return in the United Kingdom. Individuals who receive income from a trust or estate are required to fill out this supplementary form to provide HMRC with detailed information about their trust income, thereby ensuring that they are taxed correctly. This crucial document serves as a way to disclose any income that you gain from trust sources and ensures compliance with UK tax laws.

Filling out the SA107 form can be a straightforward task, especially when you understand each section's requirements. However, tax forms can be daunting for many, given the potential complexities involved. This guide aims to simplify the process, making it easier for you to understand and complete the SA107 form accurately and efficiently. Whether you are new to dealing with trust income or have been doing it for years, this guide will ensure you have the knowledge needed to stay compliant and avoid any penalties.

Key Sections of the SA107

The SA107 form is divided into several key sections, each essential for accurately reporting trust income and calculating taxable income. The first section requires you to report all trust income received, such as interest, dividends, and rental income. Accurately recording these amounts is crucial for a clear financial overview. The second section focuses on detailing allowable expenses, which can be offset against your trust income. By thoroughly completing each section, you ensure that all income and deductions are accounted for, helping you comply with tax regulations and avoid potential issues with HMRC.

Importance of Reporting Trust Income

Accurately reporting trust income on the SA107 form is crucial for compliance with UK tax laws and avoiding legal issues or financial penalties. Proper reporting ensures that HMRC can efficiently track your income sources and assess your tax liability correctly. This thorough documentation helps maintain transparency and accountability, reducing the risk of errors or omissions that could trigger audits or investigations. By accurately completing the SA107 form, you contribute to a fair tax system and ensure that you only pay what you owe, safeguarding your financial interests and maintaining good standing with tax authorities.

In 2020, HMRC reported over £3 billion in trust income across the UK, underscoring the substantial role trusts play in personal finances. This figure emphasizes the critical need for accurate reporting to ensure compliance and proper tax assessment.Trust Incomes

A 2021 statistic from HMRC reveals that approximately 1.2 million individuals must report trust income, highlighting the widespread need for UK taxpayers to understand the SA107 form. This underscores the importance of accurate reporting to ensure compliance and proper tax management for a significant portion of the population.Trust Taxpayers

How to Fill Out the SA107 Form

Completing the SA107 form involves several steps. Firstly, gather all necessary documentation, including trust statements and financial records. This will ensure you have all required information at your fingertips. Next, fill out each section of the form methodically, starting with personal details, moving through income received, and detailing any allowable expenses. Use clear, concise figures and double-check calculation accuracy. The Pie Tax App can be an invaluable resource here, providing expert guidance and a step-by-step walkthrough for filling out the SA107 form.

Once you have completed the form, review it carefully for any errors or omissions. Even a small error can result in delays or penalties. When satisfied, submit the SA107 form online via the HMRC portal or through the Pie Tax App, which offers a seamless submission process and confirmation receipt from HMRC.

Common Mistakes to Avoid

While filling out the SA107 form, it’s essential to avoid common mistakes to ensure compliance and accuracy. One frequent error is failing to report all trust income sources, which can lead to discrepancies in your tax return and potential penalties. Always ensure that all income is included, whether it be dividends, interest, or rental income, to avoid issues with HMRC.

Another common mistake is misreporting expenses. Only include allowable expenses and ensure they are accurately documented. These expenses must directly relate to generating the trust income and should be supported with proper proof. Taking the time to meticulously complete these sections can save significant hassle and prevent potential audits or penalties in the future. Accurate reporting not only ensures compliance but also helps in managing your financial records effectively.

Tips for Simplifying the Process

Maintain comprehensive records of all trust-related income and expenses. Organised documentation will make it easier when filling out the form.Keep Detailed Records

If you're uncertain about any aspect of the SA107 form, consider consulting expert tax assistants available on the Pie app. Professional advice can be invaluable.Seek Professional Help

Utilise the Pie Tax App for guided steps in completing the SA107 form, ensuring accuracy and efficiency.Use Technology

A Brief History of Trust Income

Trust income has been subject to taxation since the introduction of income tax in the UK in the 19th century. Originally designed to tax the wealthy landowners, the scope has expanded drastically, making it relevant to many individuals today.

Get Assistance with SA107

Navigating the complexities of the SA107 form can be challenging, but help is available. One effective option is to use the Pie Tax App, which offers expert guidance specifically tailored to self-assessment and trust income tax returns. The app simplifies the process, ensuring all necessary information is accurately reported and submitted on time.

Another valuable resource is seeking the help of expert tax assistants available on the Pie app, who can provide personalised advice tailored to your unique situation. This ensures that all aspects of your trust income are correctly reported and maximises potential deductions, minimising your tax liability.

If you have any questions or concerns, contacting HMRC directly is always an option. They can provide necessary clarifications and assist with particularly complex queries, ensuring you accurately complete your tax forms and fully comply with regulations. Their support can help prevent mistakes and avoid potential penalties, giving you peace of mind in your tax reporting.Contact HMRC

Utilising the Pie Tax App can greatly simplify your tax return process. The app offers step-by-step instructions and expert assistance, ensuring that your SA107 form and other tax documents are completed accurately and efficiently. This reduces the risk of errors, saves time, and helps you stay compliant with HMRC regulations, making the entire tax filing process smoother and more manageable.Pie Tax App

Summary

Understanding and accurately completing the SA107 form is essential for anyone receiving trust income in the UK. By diligently gathering documentation, avoiding common mistakes, and seeking expert advice from sources like the Pie Tax App, you can ensure compliance and streamline your tax return process. Trust income plays a significant role in the UK tax landscape, with billions of pounds reported annually. Properly managing this aspect of your tax return can save you time and stress while ensuring compliance with HMRC requirements.

Whether choosing to go it alone with the guidance available within the Pie Tax App or seeking the assistance of expert tax assistants available on the Pie app, you'll be well-equipped to handle your trust income reporting with confidence.