What is Marriage Allowance?

Marriage Allowance is a tax benefit that allows one partner in a marriage or civil partnership to transfer a portion of their Personal Allowance to the other partner. This transfer can reduce the receiving partner’s tax bill by up to £252 per year. Introduced by the UK government, Marriage Allowance aims to provide financial relief to couples, ensuring they take full advantage of their combined allowances.

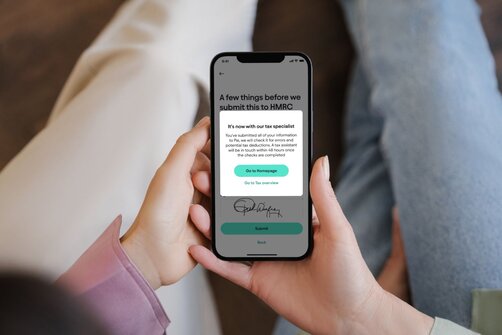

Understanding whether you are eligible and how to apply can significantly impact your savings. The process is straightforward but requires both partners to meet specific criteria. Utilising tools like the Pie Tax App and the expert tax assistants available on the Pie app can simplify the application process, ensuring you don’t miss out on potential tax savings.

Applying for Marriage Allowance involves transferring £1,260 of your Personal Allowance to your partner if your income is below the Personal Allowance threshold and your partner’s income is within the basic rate tax band. This transfer reduces the overall tax liability for the couple, providing a much-needed financial boost.

Eligibility Criteria for Marriage Allowance

To benefit from the Marriage Allowance, there are essential criteria you must meet. Firstly, you and your partner must be either married or in a civil partnership. Unfortunately, couples who are just cohabiting are not eligible for this benefit. Secondly, one partner must have an income less than the Personal Allowance threshold, which currently stands at £12,570. The receiving partner, however, should earn less than £50,270 in the basic rate tax bracket.

Being mindful of these criteria ensures eligibility and prevents the rejection of your application.

How Marriage Allowance Works

Once eligible for Marriage Allowance, one partner transfers £1,260 of their unused Personal Allowance to the other, reducing their tax liability. For the 2022/2023 tax year, this can save up to £252. Apply online via the HMRC website and consider using tools like the Pie Tax App for personalised advice.

2.4 million couples benefitted from Marriage Allowance in the most recent tax year, and these numbers are rising, indicating its increasing popularity.

£252 is the tax benefit per couple that can positively impact household finances.

Benefits of Marriage Allowance

The primary benefit of Marriage Allowance is the potential tax saving of up to £252 per year. This amount may not seem substantial initially, but it can add up over the years. For instance, over a decade, this relief could save a couple around £2,520.

In addition to the financial benefits, Marriage Allowance is about ensuring couples utilise all available resources. This allowance ensures the less-earning partner’s unused Personal Allowance doesn't go to waste, thereby offering better financial planning and tax efficiency for families.

How to Apply for Marriage Allowance

Applying for Marriage Allowance involves a simple online application through the HMRC website. Both partners need to provide essential details like names, dates of birth, and National Insurance numbers. The partner who earns less is typically the one who applies to transfer a portion of their Personal Allowance to the other partner.

Once applied, the effect is generally automatic from the subsequent tax year, and HMRC will adjust tax codes accordingly. However, remember to use the Pie Tax App or consult expert tax assistants available on the Pie app for smooth processing and to ensure all entries are accurate and complete.

Making the Most of Marriage Allowance

Regularly review your financial status to check if you continue meeting the eligibility criteria for Marriage Allowance. A small change in income could affect your eligibility.Monthly Reviews

Utilising apps like the Pie Tax App can simplify financial and tax planning. These tools remain updated with the latest regulations and ensure maximum efficiency in your applications.Automated Tools

Always seek advice from qualified tax professionals like the expert tax assistants available on the Pie app. Their expertise can guide you through any complexities, ensure optimisation of your tax savings.Professional Advice

Fun Facts

Did you know that Marriage Allowance can be backdated for up to four years? This means you could claim up to £1,060 if eligible for past years!

Professional Advice for Marriage Allowance Application

When considering applying for Marriage Allowance, professional advice is invaluable. Tax laws and regulations can be complex and evolving, so staying updated and accurately informed is crucial. Expert tax assistants on the Pie app are well-versed in these intricacies and can guide you through the process efficiently.

Professional advice helps in correctly assessing your eligibility and ensuring all documentation is accurately completed. Mistakes in the application process can lead to rejections or delays, which may impact your ability to benefit from Marriage Allowance in a timely manner. Always seek help from a competent tax professional for a seamless experience.

Documentation Accuracy: Ensure all provided information is up-to-date and accurate. Inaccurate data can delay the process or render your application invalid. Meeting Deadlines: Keep track of deadlines for applications and reapplications each tax year. Missing out could mean losing potential savings.Avoiding Common Mistakes

Yearly Checks: Regularly check with a tax professional or use the Pie Tax App to ensure continued eligibility and compliance with any updated tax rules. Effective Applications: Skilled professionals help in maximizing your application’s efficiency, ensuring you leverage all available tax benefits.Utilising Professional Advice

Summary

Marriage Allowance is a beneficial tax relief aimed at helping married couples or those in civil partnerships save on their taxes. By transferring part of your personal allowance to your partner, you can reduce your overall tax burden significantly. With eligibility criteria focused on earning limits, ensuring both partners meet the required conditions is vital.

Applying for Marriage Allowance can be straightforward, especially with tools like the Pie Tax App and professional guidance from expert tax assistants available on the Pie app. Always ensure your application is accurate, and deadlines are met to avoid potential challenges. Regular reviews and professional advice can help maintain eligibility and maximise tax benefits over the years. This comprehensive guide helps you understand and leverage Marriage Allowance for your financial advantage effectively.

Frequently Asked Questions

Who is eligible for Marriage Allowance?

To be eligible, couples must be either married or in a civil partnership. One partner should have an earnings below the Personal Allowance threshold (£12,570), while the other should earn within the basic rate tax band (£12,570 - £50,270).

How much can we save with Marriage Allowance?

Eligible couples can save up to £252 per year through Marriage Allowance. If eligible for the past years, you could backdate claims and potentially save more.

How do I apply for Marriage Allowance?

Applications are made via the HMRC website. The lower-earning partner usually completes this, transferring a portion of their Personal Allowance to their partner.

Can I backdate Marriage Allowance claims?

Yes, Marriage Allowance claims can be backdated for up to four years, potentially increasing your savings significantly.

What happens if our income changes?

Any significant change in income could affect your eligibility for Marriage Allowance. Regular reviews and consultations with expert tax assistants available on the Pie app can help maintain eligibility.