Strategies to Keep Your Tax Return Trouble-Free

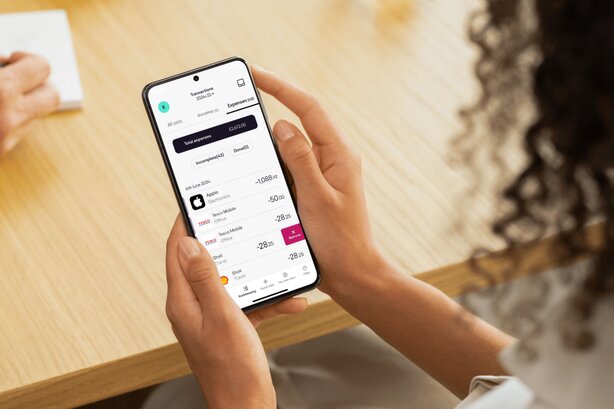

Filing your tax return can be a daunting task, particularly when the fear of triggering a red flag with HMRC looms over. Small errors or inconsistencies may result in scrutiny, leading to stressful audits. It's paramount to ensure accuracy in every detail of your tax documentation. Using advanced tools like the Pie Tax App can dramatically reduce these risks, as it is designed to catch common mistakes even before submission. Additionally, having expert tax assistants available ensures you have the guidance needed for every question or fine detail.

Common Tax Return Mistakes

Many taxpayers overlook vital information such as reporting all sources of income. They might also misclassify expenses, which is a significant oversight. Staying vigilant about these common misconceptions can prevent future complications.

Importance of Accurate Record-Keeping

Meticulous record-keeping is essential. Keeping organised records simplifies the tax filing process and ensures you can substantiate your claims if questioned by HMRC.

In the last year, approximately 5% of self-assessment tax returns were subject to audits. These audits often originate from discrepancies in reported income and claimed deductions.Recent HMRC Audit Statistics

Recent data suggests 8% more filing errors from the previous tax year, largely attributed to misunderstandings in tax codes and allowances. Ensuring you understand these aspects is crucial.The Rise in Filing Errors

How to Ensure a Clean Tax Return

Achieving a flawless tax return begins with understanding your financial activities throughout the year. Using tools like the Pie Tax App to track expenses and document all sources of income removes much of the manual work and helps automate accuracy checks. Often, taxpayers forget to report less obvious income sources, like rented properties or dividends, leading to inconsistencies.

In addition to keeping detailed records, double-check against HMRC guidelines before submission. This extra level of diligence reinforces your compliance with rules and reduces the possibility of audits that can result from seemingly small mistakes that pile up.

Navigating Complex Deductions

Certain deductions can be tricky and are more likely to attract HMRC scrutiny if not accurately accounted for. Seamlessly tracking and validating deductible and non-deductible expenses is crucial to ensure they adhere to guidelines. Consulting with expert tax assistants provides an added layer of reassurance.

Understanding which deductions are appropriate and how to substantiate them is important. The combination of technological tools and expert advice offers a comprehensive approach to handling these complexities.

Red Flag Avoidance Tips

To ensure a smooth tax return, start by thoroughly documenting all income sources. This includes less obvious forms of income, such as dividends or rental earnings.Key Strategies for a Flawless Tax Return

Organised records are crucial for substantiating claims. Clear documentation streamlines filing and enhances your position if questioned by HMRC during audits.Importance of Diligent Record-Keeping

Always report all income accurately and verify claimed expenses. Consulting with tax professionals can further reduce the likelihood of errors that lead to audits.Tips for Avoiding Common Audit Triggers

Fun Tax Facts

Did you know? In some countries, tax evasion carries heavier penalties than tax avoidance, which is technically legal. The UK takes both seriously and expects full compliance. Using reliable tools can help ensure your returns are accurate and HMRC-friendly.

Expert Advice for Tax Filing

For those navigating self-assessment tax returns, staying informed and updated with guidelines is crucial. Regularly consulting HMRC resources or expert tax assistants can help you avoid potential pitfalls. Additionally, pre-filing planning can prevent mistakes; aim to organise financial records as early as possible for a smoother filing process.

Understand your eligible deductions well in advance of filing. A preliminary review by tax professionals can help ensure you’re not missing potential claims. Knowing the appropriate allowances can optimise your tax returns and prevent unnecessary complications.Deductions & Allowances

Understanding how audits work can demystify the process and lessen anxiety. Most audits arise from detectable inconsistencies identified by algorithms. Utilising available tools can provide checks that alert you to potential risks, allowing for proactive corrections.Regular Audits Understanding

Summary

Tax filings should be approached with detailed accuracy and foresight to stay free from HMRC red flags. Utilising tools like the Pie Tax App ensures refined accuracy by automatically recognising mistakes and providing comprehensive guides for seamless filing. Importantly, maintaining detailed records and staying informed about the ever-evolving tax guidelines will lay the foundation for a trouble-free tax experience.

For broader support, Pie Tax's specialist assistants offer clarity and peace of mind, empowering you with the knowledge required to assertively deal with complexities. Let the combination of innovative technology and professional expertise guide you to submit accurate, red flag-free tax returns. The Pie Tax App is completely free to use, find out what features are included here:

How is Pie different?

Pie is the only app for self assessment with tools for bookkeeping, your live tax figure, easy tax returns and helpful advice when you need it.

Save £168 per year vs Quickbooks, file your self assessment today for free with Pie

FREE

£69

+£59.99

£149

Quickbooks

£168

per year7 features

TaxScouts

£169

per year4 features

Accountant

£450

avg per year5 features

* Optional add on

Frequently Asked Questions

What common mistakes trigger HMRC audits?

Errors like unreported income or improperly documented deductions often lead to audits. Utilizing effective tools can help mitigate these errors by checking for conformity before submission.

Is record-keeping important for tax returns?

Absolutely. Proper documentation defends your claims in the event of an audit. The Pie Tax App can assist in maintaining clear and accurate records.

How can technology assist in tax filing?

Tools provide a streamlined process for tracking income and expenses, identifying potential discrepancies, and reducing the risk of red flags.

Can experts help in tax assessment?

Yes, Pie Tax offers expert tax assistants who provide advice and clarity on complicated tax issues, ensuring a more secure filing process.

What should be included in my tax return documentation?

All income, claimed deductions, and supporting evidence should be carefully documented to ensure thorough compliance.