What is the purpose of the

SA108 form?

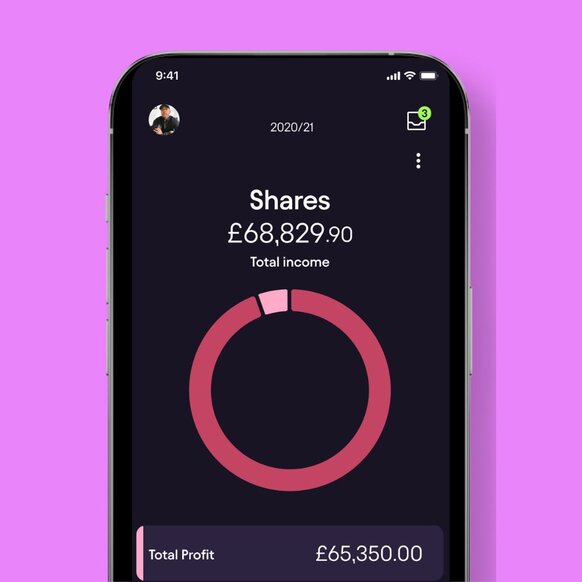

The SA108 form, also known as the "Capital Gains Summary," is used to report any capital gains or losses made during the tax year. The purpose of the SA108 form is to calculate and report your capital gains tax liability to HMRC. It includes sections for detailing various types of capital gains, such as property sales, investments, and assets. The form must be completed and submitted along with your self-assessment tax return if you've made any capital gains during the tax year.

How to Complete the SA108 Form

Gathering Documentation and Providing Personal Details

To complete the SA108 form, start by gathering all relevant documentation. This includes receipts, invoices, and records of asset sales. These documents are essential for accurately reporting your capital gains and losses. Proper documentation ensures that you can substantiate all claims made on the form, reducing the risk of errors and potential issues with HMRC.

Once you have gathered all necessary documents, proceed to complete Part A of the SA108 form. This section requires you to provide your personal details, including your Unique Taxpayer Reference (UTR) and National Insurance number. Accurately filling in this information is crucial, as it ensures that HMRC can correctly identify and process your tax return.

Declaring Gains and Losses, Reviewing, and Submitting

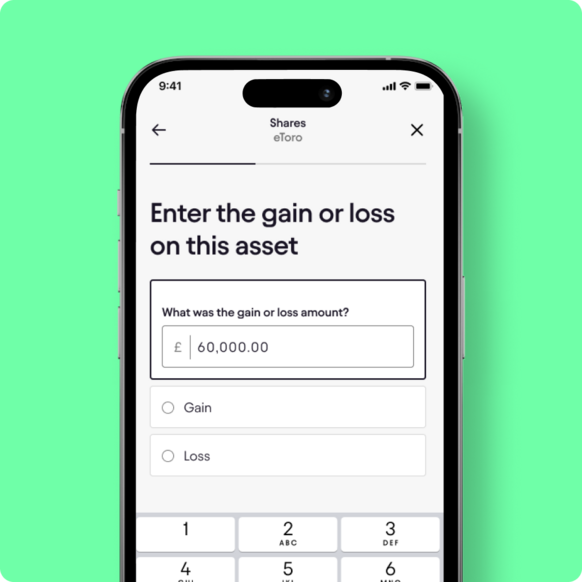

After completing Part A, you need to enter the details of each capital gain or loss in the appropriate sections of the form. This involves providing specific information about each transaction, such as the date of the sale, the amount gained or lost, and any related expenses.

The SA108 form will then automatically calculate the total gains and losses for the tax year based on the information provided. It is important to review the completed form carefully to ensure all entries are accurate and up to date.

Finally, submit your SA108 form electronically along with your self-assessment tax return using the HMRC online portal. Electronic submission is efficient and ensures that your tax return is processed promptly. By following these steps, you can ensure that your capital gains and losses are accurately reported and that your tax return is complete and compliant with HMRC requirements.

Common Mistakes to Avoid

Incorrect Reporting: Ensure that all capital gains and losses are accurately reported on the SA108 form.

Missing Deadlines: Submit the form and tax return before the deadline to avoid late-filing penalties.

Forgetting Attachments: Include all necessary supporting documents when submitting the SA108 form to HMRC.

Seek Expert Assistance

If you're unsure about how to complete the SA108 form or have complex capital gains tax situations, don't hesitate to seek assistance from tax professionals. Expert tax assistants available on the Pie Tax App can provide guidance and support tailored to your individual needs.