Understanding Capital Gains Tax on Classic Cars

Selling a classic car in the UK isn't just about finding the right buyer; it also involves understanding how it affects your taxes. Many people are unaware that selling a collectible vehicle can trigger Capital Gains Tax (CGT), which might lead to a substantial tax bill. Therefore, being informed about the tax implications can save you from unexpected financial burdens.

Capital Gains Tax is essentially a tax on the profit you make from selling an asset that has increased in value since you first acquired it. This rule often applies to classic cars if they were bought as an investment rather than for personal use. While your years of cherishing and maintaining that vintage beauty may pay off, you need to be aware of the corresponding tax obligations.

The first step in navigating this complex scenario is recognising whether your classic car sale is subject to CGT. Not all car sales result in a taxable event, but if your classic car was purchased as an investment, you need to be prepared for the tax implications. Let’s delve deeper into the details to understand this better.

Rules for Capital Gains Tax

One of the crucial aspects to consider when selling a classic car is the rule surrounding Capital Gains Tax (CGT). If the car is considered an asset that has appreciated in value and is sold at a profit, CGT may be applicable. The current CGT rates are 10% for basic rate taxpayers and 20% for higher rate taxpayers.

However, it's important to note that cars not purchased as investments and used largely as private assets often fall outside the purview of CGT. Documentation and usage history will be crucial in proving this exemption. Check your car's classification to avoid unnecessary payments.

Claiming Allowable Expenses

When calculating CGT, claiming allowable expenses can help reduce your tax bill. These expenses may include costs related to maintenance and improvement of the classic car, as well as any costs incurred during the sale. Proper documentation is essential to substantiate these claims. Expertise from Pie Tax's expert tax assistants available on the Pie App can help you identify and claim all permissible expenses efficiently.

Classic cars have seen varied market trends in the last few years. According to Statista, the market value for classic cars in the UK was estimated at £1.8 billion in 2022. Moreover, the Hagerty UK Price Guide indicates a 15% increase in classic car values over the past year.Classic Car Market Trends

The average classic car held for more than a decade appreciates by 20%. Approximately 80% of classic car sales involve private collectors, indicating a strong market influence by individual buyers rather than dealerships.Key Market Statistics

Calculating Your Capital Gains Tax

Calculating your Capital Gains Tax involves several steps. Firstly, identify the amount you acquired your classic car for and the price at which it was sold. The difference between these amounts is your capital gain. Next, subtract any allowable expenses and your annual CGT allowance, which stands at £12,300 for individuals in 2023.

For example, if you purchased your classic car for £50,000 and sold it for £80,000, your initial gain is £30,000. Let's say you spent £5,000 on restoration. After subtracting the allowable expenses and CGT allowance, your taxable gain would be £12,700. Your tax rate would depend on your income tax bracket.

Reporting CGT on Your Tax Return

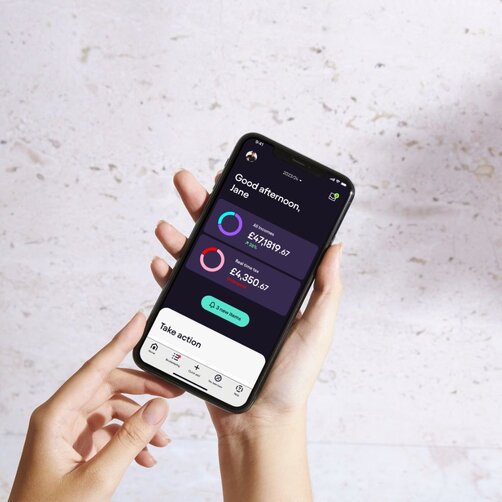

Reporting your Capital Gains Tax is straightforward using the Pie Tax App. Ensuring you report all transactions within the same tax year is crucial to avoid penalties.

The process involves using the Capital Gains section on your self-assessment tax return, inputting all relevant figures including acquisition and disposal dates, and the costs involved. The Pie Tax App simplifies this with user-friendly steps and expert tax assistants available on the Pie app, ensuring compliance without stress.

Tips for Accurate Tax Reporting

Keeping detailed records of your car's purchase price, sale price, and any related costs is essential. Accurate records simplify the process of calculating and reporting Capital Gains Tax.Maintain Detailed Records

Even if you use the Pie Tax App, consulting with a tax professional can save you from potential pitfalls. They offer tailored advice suited to your specific situation. They help you navigate complex regulationsConsult a Tax Professional

The Pie Tax App is an invaluable tool for managing your taxes efficiently. It streamlines tax filing and ensures you claim all applicable deductions and exemptions. Additionally, it simplifies complex calculations.Use the Pie Tax App

Fun Facts

Did you know? The most expensive classic car ever sold is a 1962 Ferrari 250 GTO, auctioned for £52 million in 2018.

Managing Classic Car Investments

Selling a classic car involves more than just handing over the keys to a new owner. It demands a proper understanding of the tax implications to avoid financial surprises later. Start by assessing whether the car qualifies as an asset subject to CGT. Keeping up-to-date financial records can assist you greatly during tax season.

Moreover, consider consulting with tax advisors, especially those available through the Pie app, to get professional advice that aligns with your specific circumstances. Using the Pie Tax App, you can easily navigate the complex web of CGT, claiming all relevant deductions and exemptions while accurately filing your tax return.

When assessing your asset, it's important to determine if the sale of your car is liable for Capital Gains Tax (CGT). Ensure you maintain all relevant financial records for accurate reporting. Proper documentation is crucial for verifying the details of the transaction and calculating any potential tax liabilities.Key Steps to Handle CGT

Use technology to streamline your tax filing by utilising the Pie Tax App for a seamless experience. Additionally, seek expert help through the app, where professional assistants can provide tailored advice to address your specific needs and ensure optimal tax outcomes, minimising errors and maximising benefits. Efficient Tax Reporting

Summary

Selling a classic car in the UK can bring in a substantial profit, but it also comes with the responsibility of understanding and handling Capital Gains Tax. Being well-informed about the rules, exemptions, and the process of reporting CGT can save you from unexpected financial burdens. Using the Pie Tax App and consulting with expert assistants available on the Pie app can help simplify this process, ensuring you remain compliant and efficient in your tax filings. The app provides a streamlined service for accurate tax reporting, making it an invaluable asset for classic car sellers.

Frequently Asked Questions

What is Capital Gains Tax on classic cars?

If you sell a classic car for a profit, it might be subject to Capital Gains Tax, depending on its usage and investment status.

How do I calculate Capital Gains Tax?

Identify your car's purchase price, sale price, and subtract allowable expenses and the CGT allowance. Calculate the tax based on your income tax bracket.

Are there any exemptions for CGT on classic cars?

Cars not purchased as investments and used mainly for personal purposes are often exempt from CGT. Proper documentation is essential.

When should I report CGT to HMRC?

Report your CGT in the same tax year the sale happened, using the self-assessment tax return. Penalties may apply for late submissions.

How can Pie Tax App help with filing CGT?

The Pie Tax App simplifies the tax filing process with step-by-step guidance and expert tax assistants available on the Pie app for tailored advice.