Understanding the Benefits of Social Investment Tax Relief

Social Investment Tax Relief (SITR) is an important UK government initiative designed to incentivise private individuals to invest in social enterprises, charities, and community projects through tax relief on investments. This relief provides significant benefits not only to investors but also to the organisations they support.

Investing in social enterprises helps bridge the financing gap that many social enterprises face, thereby enabling them to achieve their social missions. In return for their investment, individuals can claim back a significant portion of their investment through tax relief, making SITR an attractive option for investors looking to make a tangible difference while also enjoying financial benefits.

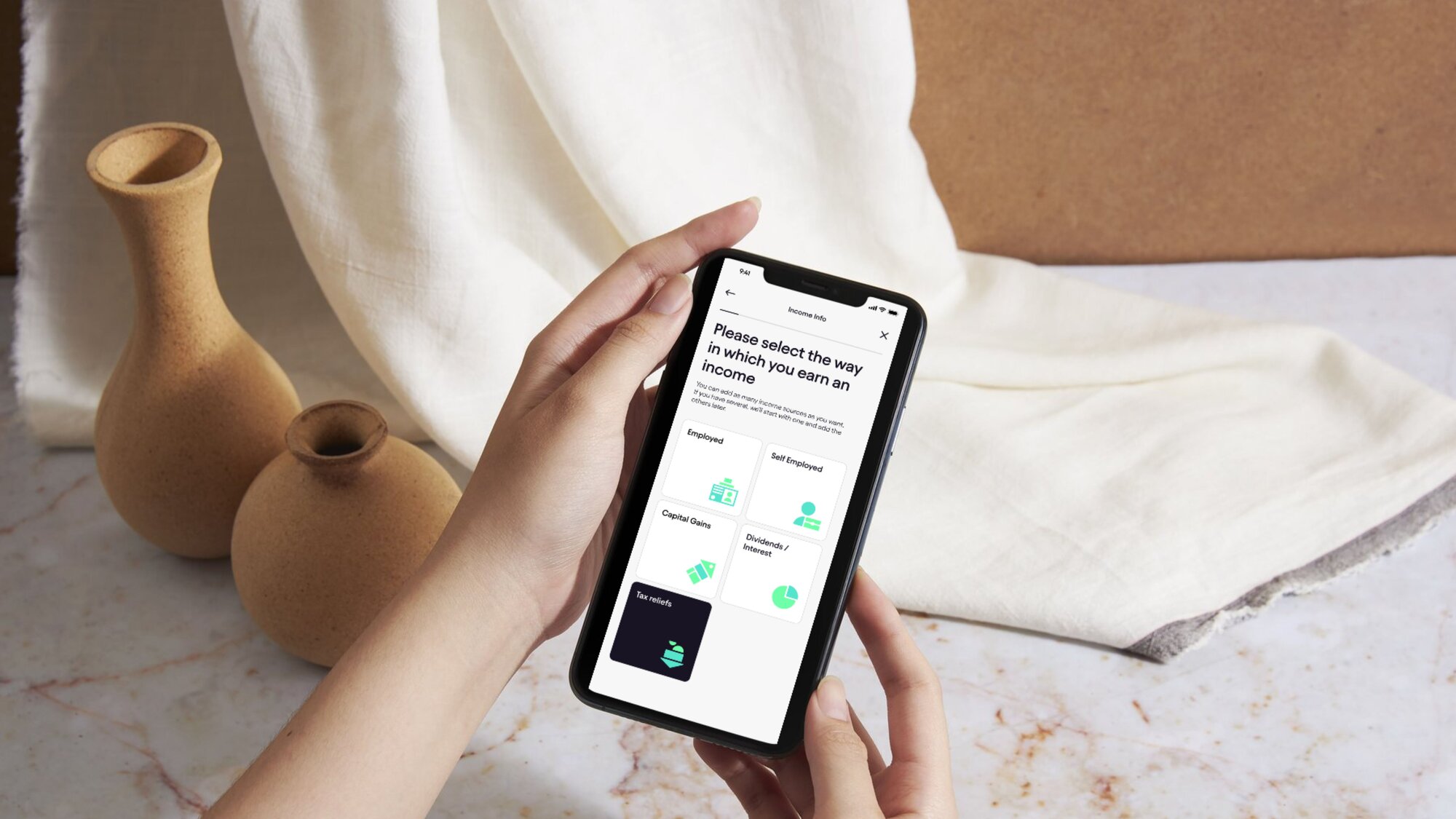

For investors, understanding the finer details of SITR can seem daunting. That’s where the Pie Tax App and the expert tax assistants available on the Pie app become invaluable, helping you navigate the complexities of your SITR claims and ensuring you maximise your entitlements.

Eligibility Criteria for SITR

To be eligible for Social Investment Tax Relief, an investor must meet certain criteria defined by the UK government. Firstly, the investor must not be linked to the social enterprise they are investing in, which generally means not having significant control or influence over that enterprise.

Furthermore, the investment itself must be in the form of debt or equity and should be held for a minimum period of three years. This ensures that the funds significantly contribute to the long-term goals of the social enterprise. These rules are in place to ensure transparency and genuine support for social missions, which aligns with the ethical principle behind SITR.

SITR Investment Conditions

Social Investment Tax Relief is unique because it specifically targets investments in social enterprises and qualifying community interest companies. To qualify, these organisations must use the investment to carry out a qualifying trade, typically one that directly benefits the community.

In addition, the total amount of money that can be raised via SITR-qualifying investments is capped, ensuring that funds are fairly distributed among various deserving enterprises. This mechanism ensures that smaller and newer social enterprises can also benefit from this type of investment, promoting a more equitable distribution of resources.

According to recent data, over £11 million has been invested into social enterprises through SITR. This figure demonstrates the growing awareness and application of SITR among UK investors, highlighting the successful uptake of the scheme. Further statistics reveal that more than 60% of investors using SITR reported a high satisfaction rate with their investments due to the dual benefits of social impact and tax relief. These statistics underscore the attractiveness of SITR among socially conscious investors.Recent Statistics on SITR

Social Investment Tax Relief offers myriad benefits. For starters, 30% of the investment can be claimed back as income tax relief, making it a financially advantageous choice. Additionally, there is no capital gains tax on profits if the investment is held for three years, making SITR not just socially responsible but also tax-efficient. This combination of tax savings and social impact offers a unique proposition to investors looking to blend philanthropy with financial prudence.Key Benefits to Consider

Navigating the SITR Application Process

Applying for Social Investment Tax Relief involves several steps. First, investors need to ensure that they meet the eligibility criteria outlined by HMRC. This generally means verifying that neither they nor any connected persons have substantial control over the social enterprise in question.

After verifying eligibility, the next step involves the actual investment in a qualifying social enterprise. Whether it's in the form of shares or debt, this investment must be retained for at least three years to maintain the tax-relief status. Using the Pie Tax App can simplify this process, providing you with clear guidelines and expert advice right at your fingertips.

Maximising Your SITR Benefits

To maximise your SITR investments, careful planning and strategy are key. Start by choosing social enterprises that align with your values, and conduct thorough research on their operations, financial health, and social impact.

After investing, maintain detailed records and closely monitor your holdings. Effective management is crucial to ensuring you fully benefit from the available tax reliefs. Professional tools and guidance can help streamline this process, making it easier to manage your investments and submit claims seamlessly.

Tips for Successful SITR Investing

Do Your Research Before making an investment, thoroughly research the social enterprise. Understand its mission, financial stability, and the potential for social impact.

Seek Professional Advice Consult with tax professionals to navigate the complexities of SITR. The expert tax assistants available on the Pie app can offer guidance and ensure compliance.

Keep Detailed Records Maintain comprehensive records of your investments and communications related to SITR. This will simplify the claim process and ensure you receive the maximum benefit.

Fun Fact About SITR

Did you know that SITR allows you to claim back 30% of your investment as income tax relief, making it not only a charitable act but also a savvy financial move?

Advice on Handling SITR Claims

When it comes to handling SITR claims, preparation is key. Start by ensuring you are fully aware of the eligibility criteria for both the investor and the social enterprise. This involves understanding the relationship rules and investment types that qualify for relief.

Next, make sure all required documentation is accurately completed and submitted. This includes maintaining proper records of your investment and securing the SITR compliance statements from the social enterprises. The Pie Tax App simplifies this process by offering expert advice, making tax claims as seamless as possible.

Proper documentation is crucial for successful SITR claims. Ensure you have detailed records of all your investments and related correspondence. Good documentation helps in smooth processing and claim validations.Document Your Investments

Expert guidance can significantly simplify the complex SITR claim process. With qualified professionals advising you, the chances of a successful claim increase greatly.Seek Expert Guidance

Summary

Social Investment Tax Relief (SITR) provides a valuable opportunity to support social enterprises while gaining significant tax benefits. Whether you're an individual aiming to contribute to social causes or an investor looking to diversify, SITR aligns financial incentives with social impact.

MaximiSing the benefits of SITR requires thorough research, precise documentation, and professional advice. Expert assistance can streamline the process, from verifying eligibility to claiming tax relief, ensuring a smooth and successful SITR experience.

Frequently Asked Questions

What is Social Investment Tax Relief (SITR)?

Social Investment Tax Relief is a UK government initiative designed to encourage private investment in social enterprises by providing considerable tax reliefs.

How can an investor qualify for SITR?

An investor must not be connected to the social enterprise, and must invest in approved ways like equity or debt held for at least three years. Seek professional advice through the Pie Tax App for more details.

What types of organisations can benefit from SITR?

Charities, community interest companies, and social enterprises undertaking qualifying trades can benefit. These organisations must meet specific criteria set by HMRC.

What are the main financial benefits of SITR?

Investors can claim up to 30% of their investment as income tax relief and enjoy capital gains tax exemptions if the investment is retained for three years.

Why should I use the Pie Tax App for my SITR claims?

he Pie Tax App simplifies the SITR process by offering step-by-step guidance, document management, and the expertise of experienced tax assistants, ensuring you maximise the benefits of your investments.