So, Looks Like Tax Filing Got a Whole Lot Easier...

Why is it that just when we feel like we’re cruising smoothly, tax season suddenly hits like a BOOM?

Thankfully, apps like Pie.tax and Tax Scouts get it, they’ve felt our pain and done something about it.

Juggling multiple income streams or trying to stay on top of expenses can feel like a looming cloud of tax anxiety.

After years in the finance world, I’ve finally found something that truly changes the game: a self-assessment tax return app that makes tax season feel almost... refreshing.

Here Are the Top 3 Self-Assessment Apps for 2025

1. Pie.tax Best Free App for Robust Real-Time Tax Tracking

- Price: Free!

- Tax support advice: £69/year

- Best for: Self-Employed/Employed, The Saver, Foreign Earner, Investors, Contractors and Landlords

Top Features:

- Smart Match

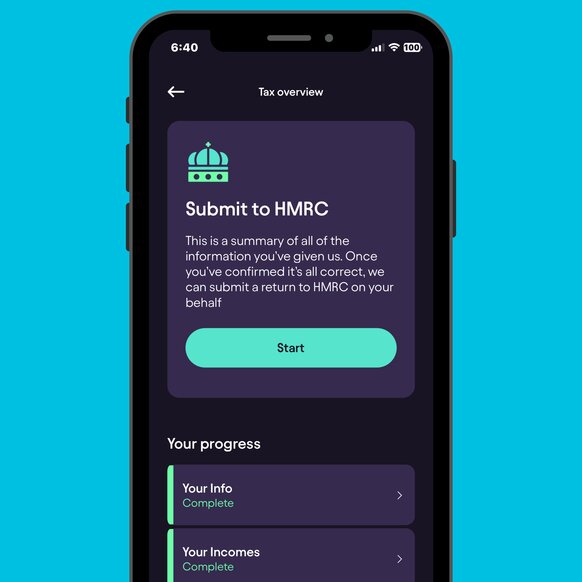

- Direct HMRC Submission

- File your tax return directly through Pie.tax, no need to navigate multiple platforms.

- Open Banking Integration

- Link multiple bank accounts for a streamlined approach to managing your finances.

So what does the expert think?

Using pie tax took the dread out of tax time, which is a miracle in itself.

The real-time tax figures feature meant I knew exactly what I owed at any moment, no more “surprise!” tax bills at the end of the year. It was like having a crystal ball but for my savings.

No other tax app has anything like Smart Match, it’s exclusive to Pie.tax and really sets it apart.

Once I categorised one transaction, it reconciled all the similar ones, saving me from the endless “I swear I’ve logged this already” moments.

It's the kind of automation that makes you feel like someone's actually thought about your sanity for once. You know when an app just clicks with exactly what you need? That's what we've got here.

I'd be doing you a disservice if I didn't mention submitting directly to HMRC - proper game-changer, this.

No more bouncing between different websites or having a mini-meltdown wondering if you've ticked all the right boxes.

Just one click and... done! Remember when we used to have 15 tabs open just to file a return? Feels like ages ago now.

The whole thing's gone from feeling like a proper headache to being surprisingly manageable.

It's like having that one mate who's brilliant with numbers sorting everything out for you.

No brainer for me.

It meant all my accounts were in one place, with everything updating automatically, no more scrambling to check balances across different apps or spreadsheets.

The best part was having real-time figures for my income and expenses, so I always knew exactly where I stood.

It was like finally being in control without any unexpected financial surprises.

And the seamless way it categorised transactions?

A completely different story now.. Once I categorised one, it applied it to all similar ones, saving me time and preventing those “didn’t I already do this?” moments.

It’s automation that just works.

Pie Tax has hit the nail on the head. Its a free app packed with features that are useful, no sleazy upsells or hidden cost, just free value.

Perfect for the small guy, but still powerful enough for medium-sized earners, it’s like having a personal assistant during tax season, without the pay check.

I know something special when I see it! But we are all different. Have a look yourself here ... doesn't cost a penny!

2. Tax Scouts – Easy Filing with Accountant Support

Free Trial: Not available

- Price: £169/year (+ £139 for extra accountant support)

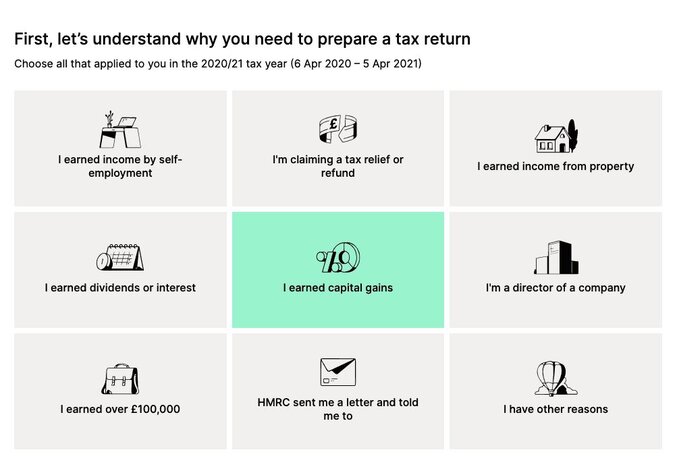

- Best for: Individuals needing simple tax filing help.

- Guided self-assessment tax filing.

- Optional support from certified accountants.

I used Tax Scouts when I first started navigating the self-assessment process, and it definitely took the pressure off. For £169, I had a guided system and an accountant to review everything before submission.

It was easy to fill in the required details without feeling overwhelmed. However, as my tax situation grew more complex, like managing multiple income streams, the lack of advanced features became apparent.

Tax Scouts does offer bank integration, allowing you to link accounts to add transactions, but it doesn’t have features like Smart Match (which automates transaction reconciliation).

This meant I still had to manually categorise and track a lot, making it less convenient compared to platforms like Pie.tax that streamline ongoing tax management.

If your financial situation is more intricate, or if you want features like automated reconciliation, you may find it lacking.

3. QuickBooks – Budget-Friendly for Simple Tax Returns

Free trial available: Yes

Price: £22.50 per month

Best for: Sole traders or freelancers with straightforward tax situation

Top features:

Basic self-assessment tax return filing features

Affordable pricing

If you're looking for a straightforward, budget-friendly solution for self-assessment tax returns, QuickBooks has several options.

The Self-Employed plan starts at £10 per month (initially £2.50 for six months) and offers tools like VAT submissions, Income Tax estimates, and CIS calculations, making it ideal for sole traders with simple needs.

However, it may lack advanced features like real-time tax tracking or Smart Match for automatically reconciling transactions.

While it excels at managing income, expenses, and invoices, you might still need to manually handle some aspects if your tax situation is more complex.

Conclusion:

Tax season always hits like a storm, but self-assessment tax apps like Pie.tax, Tax Scouts, and QuickBooks make it much more manageable.

Pie Tax shines with real-time tax figures to avoid surprise bills and the unique Smart Match tool for automatic transaction categorization. Filing your self-assessment directly to HMRC is now a breeze.

Tax Scouts works well for simple, guided filing, while QuickBooks is budget-friendly for straightforward needs, though both lack Pie Tax’s advanced features.

In the end, I’d pick Pie Tax for sure. Its automation and seamless filing make tax season feel more like a breeze than a storm.

Want to make tax season less of a headache? Give the Pie Tax app a try. Simple as...