Chancellor Rachel Reeves has rejected accusations that she misled the public regarding the state of the UK’s finances ahead of the government’s latest Budget announcement. The claims were raised by Conservative leader Kemi Badenoch, who has called for Reeves’ resignation over the issue.

The dispute centres on whether the economic outlook presented by the Chancellor was overly pessimistic in order to justify tax rises and public spending decisions. As debate continues, the government maintains that its approach aims to provide stability, address economic challenges, and protect public services during a period of slower forecasted growth.

Reeves insists on transparency over Budget decisions

Rachel Reeves presented the government’s Budget to the House of Commons, facing both policy criticism and scrutiny over her characterisation of public finances. In her discussions with media, Reeves emphasised that she had been ‘honest and upfront’ with citizens about the need to make financial contributions to protect essential public services.

‘Growth is the number one priority of this government,' she stated, underlining her willingness to defend fiscal decisions. Reeves acknowledged making difficult choices, including asking people to pay more, but argued these were necessary to maintain economic stability in a volatile global context.

She attributed tighter fiscal policy to recent economic turbulence and revised productivity forecasts, maintaining that she would continue to place transparency at the heart of government decision-making.

Political opposition calls for chancellor’s resignation

Opposition leader Kemi Badenoch has publicly called for Reeves to resign, arguing that the Chancellor misrepresented the financial situation ahead of the Budget. During recent interviews and parliamentary debates, Badenoch cited an ‘emergency press conference’ held by Reeves earlier in the month, where she described poor productivity and persistent global inflation.

Badenoch claimed these statements painted an unduly bleak picture intended to justify higher taxes and welfare reforms. Badenoch also confirmed that the Conservative Party had written to the Financial Conduct Authority, calling for an investigation to restore public confidence.

She criticised Labour’s economic leadership, stating there was ‘no growth in this Budget,’ and expressed the view that her role as opposition leader is to hold the government to account.

Economic context and growth forecasts post-Budget

The Budget announcement followed new economic forecasts from the Office for Budget Responsibility (OBR), indicating that UK growth would be slower in upcoming years than previously projected. The OBR increased its growth forecast for the current year to 1.5%, revised up from 1%, but reduced growth expectations for 2026 and subsequent years to around 1.4–1.5%.

These downward revisions were a setback for the government’s pledge to improve economic growth. Reeves responded to these updated figures by reaffirming her commitment to exceed forecasts and create a stable economic environment.

She noted that attracting investment and managing inflation were essential for achieving the government’s growth objectives.

Labour's taxation commitments under scrutiny

During the run-up to the Budget, Labour had pledged not to increase income tax, National Insurance, or VAT. The Budget maintained current income tax rates but introduced a continued freeze on income tax thresholds until 2031. This ‘fiscal drag’ effect draws more earners into higher brackets as wages increase, thus raising additional revenue without altering core rates.

Reeves denied that this measure constituted a breach of Labour’s manifesto commitment, explaining that fiscal constraints required a cautious approach to meet funding needs.

The opposition argued the extended threshold freeze would burden working families, contending that Labour’s approach amounted to an indirect tax rise despite previous assurances.

Key measures and public impact of the Budget

The Budget included several measures affecting households and businesses. Tax thresholds will remain frozen, leading to potential higher tax bills for some as wages rise.

From 2028, new road usage charges will be introduced for electric and hybrid vehicles. The National Living Wage is set to rise to £12.71 per hour for those over 21, offering increased pay for lower-income workers. Energy bills for millions of households are expected to be reduced by approximately £150 per year following the removal of certain levies.

Additional measures include a freeze on regulated rail fares in England until March 2027, the removal of the two-child benefit cap from April next year, and an increase to most benefits and the state pension in line with average wage growth. Prescription charges will remain frozen for a second consecutive year, offering some relief to healthcare users.

Final Summary

The controversy surrounding the government’s recent Budget has centred on whether Chancellor Rachel Reeves presented a truthful assessment of the UK’s fiscal position.

While Reeves defends her approach as transparent and necessary given challenging global conditions, opposition leaders continue to question the intentions and implications of government decisions, with calls for formal investigation ongoing. The Budget itself offers a mix of fiscal restraint, selective increases in benefits and wages, and attempts to address longer-term economic challenges.

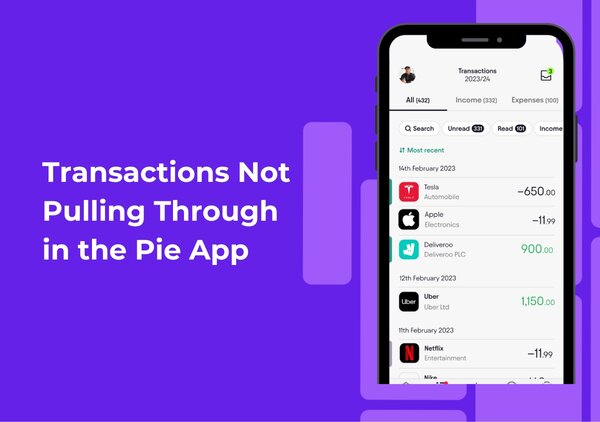

The debate is likely to persist as the economic impact of the Budget unfolds and political leaders position themselves ahead of future elections. For those tracking the latest in UK tax and economic policy, the Pie app can provide timely updates and analysis.