In today’s competitive business landscape, having the right accounting software can make all the difference when it comes to managing your finances efficiently. With Xero being a popular choice in the market, exploring top Xero alternatives that cater to your unique business needs is crucial. This blog post will guide you through some of the top alternatives, taking into account factors such as business size and industry-specific features, helping you make an informed decision.

In this article, we will be evaluating the following Xero alternatives:

•Pie

•QuickBooks Online

•Zoho Books

•FreshBooks

•Sage Business Cloud Accounting

•OneUp

•AccountEdge Pro

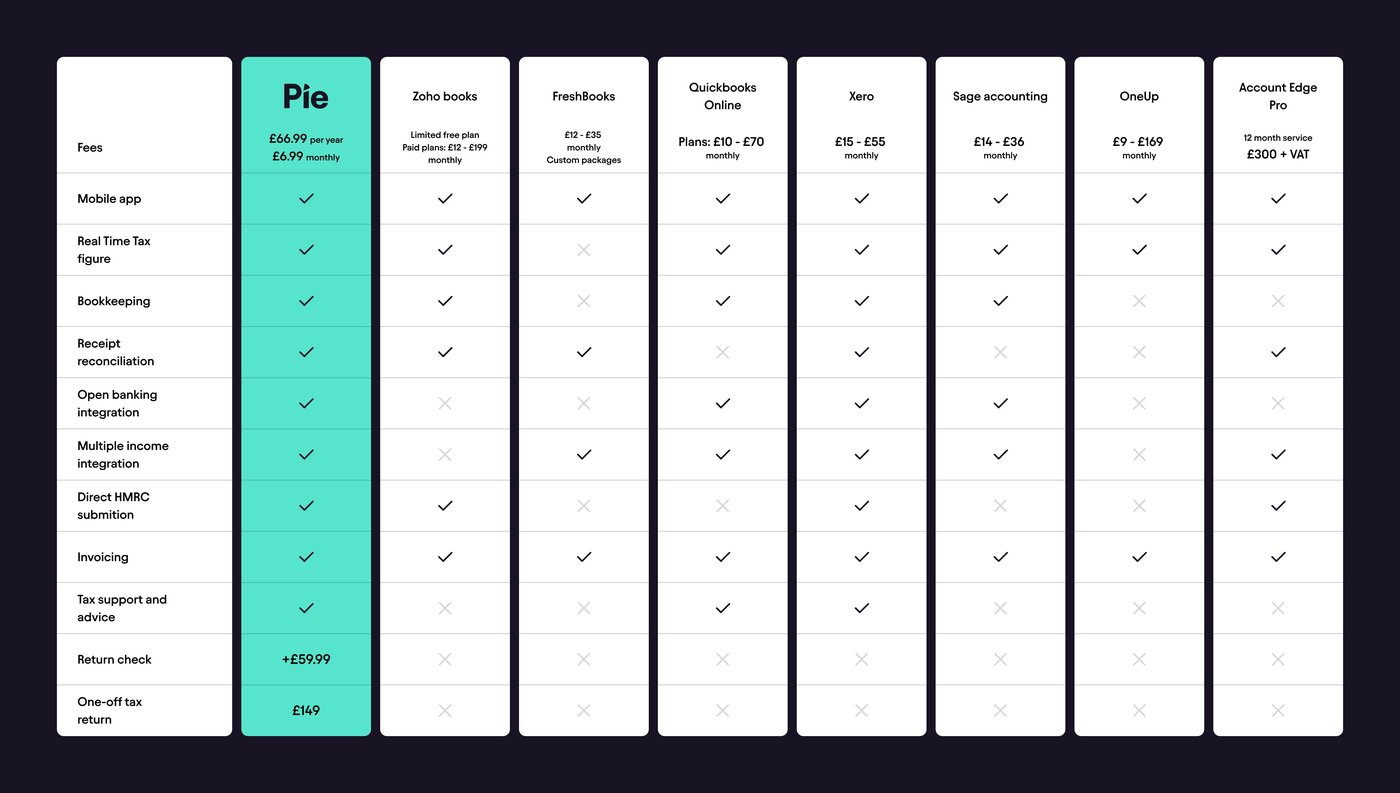

Here is a quick overview of each software’s pricing and features:

*with our premium plan at an extra £3 per month

Evaluating Your Accounting Software Needs

Selecting the best accounting software for your business is not a decision to be taken lightly. The right software can streamline your accounting processes and provide valuable insights into your financial health.

Making the right decision involves evaluating your business’s specific needs, which can be based on factors such as the size of your business and the industry-specific features required.

Size of Business

The size of your business plays a significant role in determining the most suitable accounting software. For instance, businesses with a small number of employees may only require basic features, while larger businesses may need more advanced capabilities, such as vendor and bill management.

Understanding the scale of your small business can help in streamlining your options and selecting a software solution that aligns with your unique requirements.

Industry-Specific Features

Every industry has its unique financial requirements, and not all accounting software solutions cater to these specific needs in the accounting software market. For example, retail businesses may require robust inventory management features, while service-based businesses may prioritise expense tracking and online payments.

Recognising the crucial features your industry demands can guide you towards a Xero alternative that satisfies your accounting needs and fosters your business’s growth.

Xero Alternatives for Small Businesses

We have compiled a list of the top Xero alternatives for small businesses, all of which boast a unique set of features and various pricing options. Each of these solutions caters to different business requirements and offers a range of features, such as unlimited invoices, expense tracking, and online payments.

To help you make an informed decision, we recommend utilising the 30-day free trial offered by most of these providers. This will give you a hands-on experience with the software and help you determine if it’s the right fit for your business.

Pie: User-Friendly and Superb Value

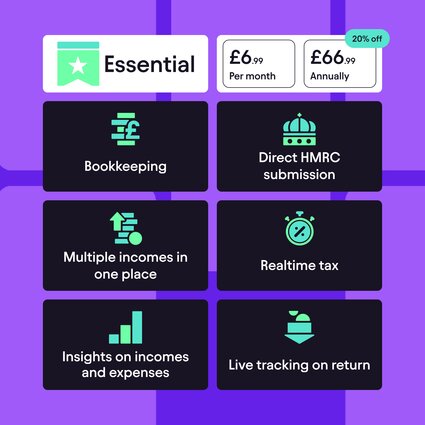

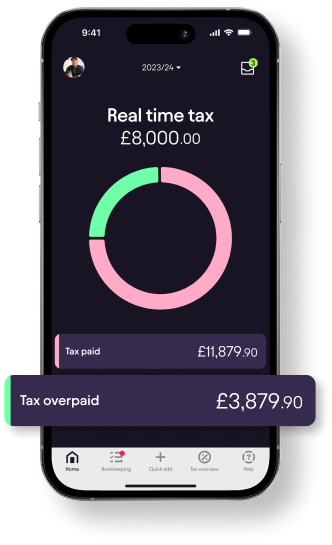

Pie is an excellent Xero alternative which offers comprehensive, real-time tax information via a handy, user-friendly mobile app. The app presents users with a straightforward dashboard containing all relevant details in one place, ensuring that the sorting of expenses and income is fully streamlined. Pie has two pricing options, both of which represent excellent value:

- Essential: £6.99 per month

- Premium: £9.99 per month

For anyone that wants to spend some time testing out and exploring the app before signing up, Pie offers a 60-day free trial.

Aside from the useful mobile app, Pie also has many other advantages. The company is FCA regulated, and Pie is both HMRC and CIMA approved. Using Pie grants you access to the following features:

- Real time tax

- Bookkeeping

- Multiple incomes in one place

- Sector specific tax assistants

- Invoicing tools

- And much more…

Dealing with multiple streams of income is a much easier task when using Pie, and having access to industry-specific tax assistants makes for a valuable resource. Crucially, the interface of the mobile app is highly intuitive and user-friendly, providing a smooth and satisfying user experience every time without fail.

QuickBooks Online: A Popular Choice

QuickBooks Online is a popular choice among businesses of all sizes, thanks to its broad feature set and various pricing plans. With QuickBooks Online, you can:

•Manage your income and expenditure

•Track the financial health of your business

•Send invoices

•Generate reports

•Pay bills

•Prepare taxes

This cloud-based accounting software is available in five pricing plans:

•Self-Employed: £10 per month

•Simple Start: £14 per month

•Essentials: £24 per month

•Plus: £34 per month

•Advanced: £70 per month

To assess whether QuickBooks Online suits your business, you might want to consider their 30-day free trial. This will provide you with ample time to explore the software’s features and gauge its suitability for your specific accounting needs.

Zoho Books: Flexible Option for Small-to-Medium Sized Businesses

Zoho Books is another good alternative to Xero, providing an effective solution for small to medium-sized businesses. This cloud-based accounting software offers a range of features, including alternatives to Xero such as:

- Inventory management

- Expense tracking

- Project management

- CIS and VAT

- Integration with up to 40 tools

Zoho Books offers a free plan, as well as additional paid plans, making it a flexible option for businesses with varying budgets. The free plan is only suitable for businesses with revenue under £35,000 per annum, accommodates just 1 user & accountant, and has limited support. Here is a full breakdown of the paid plans:

- Standard: £12 per month

- Professional: £24 per month

- Premium: £30 per month

- Elite: £99 per month

- Ultimate: £199 per month

For businesses in need of more specialised features, Zoho Books provides add-on options that let you amplify your accounting capabilities without necessitating an upgrade to a more expensive plan. This makes Zoho Books an ideal choice for businesses that need a scalable accounting solution.

FreshBooks: Ideal for Freelancers and Independent Contractors

FreshBooks is an ideal accounting software solution for freelancers and independent contractors who require a more focused set of features. With FreshBooks, users can take advantage of time tracking and project management capabilities, in addition to standard accounting features.

FreshBooks, with its time-saving features like recurring invoices and automated expense tracking, can be particularly beneficial for freelancers and independent contractors. The software’s focus on the specific needs of these professionals makes it a top Xero alternative in this niche market.

This software offers various pricing plans; below is a full overview.

•Lite: £12 per month

•Plus: £22 per month

•Premium: £35 per month

•Custom Package: Bespoke Monthly Price

Sage Business Cloud Accounting: Scalable Solutions

Sage Business Cloud Accounting is a scalable solution that caters to businesses of all sizes. It offers advanced features such as budgeting and job costing, making it a suitable alternative to Xero for growing businesses.

Sage Business Cloud Accounting offers the following pricing plans:

- Start: £14 per month

- Standard: £28 per month

- Plus: £36 per month

Its plethora of features and adjustable pricing plans make this software a strong candidate for businesses in search of a malleable accounting solution.

OneUp: Immediate Access to All Features

OneUp is a flexible accounting software option for small businesses, providing immediate access to all features regardless of the plan you choose. This makes OneUp an attractive choice for businesses that want to start with a lower-tier plan but still require access to advanced features. OneUp offers five different plans, catering to various business sizes and budgets:

- Self: $9 per month (£7.27 at time-of-writing)

- Pro: $19 per month (£15.36 at time-of-writing)

- Plus: $29 per month (£23.44 at time-of-writing)

- Team: $69 per month (£55.76 at time-of-writing)

- Unlimited: $169 per month (£136.58 at time-of-writing)

With features such as:

- Invoicing

- Bill payment

- Contacts management

- Bank account connections

- Income and expense tracking

OneUp is an all-in-one solution for businesses seeking a versatile accounting software. The instant access to all features positions OneUp as a prime Xero alternative for those in pursuit of flexibility and customisation.

AccountEdge Pro: Catering to Sole Proprietors and Consultants

AccountEdge Pro is an accounting software tailored for small businesses, catering specifically to the needs of sole proprietors and consultants. This software offers features such as sales order processing, customer portal, and payroll management, making it ideal for those in this niche market. With its desktop accounting software, command centers, accounts management, banking features, sales tracking, time billing, purchases management, payroll management, inventory tracking, customer management, and bank reconciliation capabilities, AccountEdge Pro provides a robust solution for sole proprietors and consultants.

In terms of pricing, AccountEdge Pro offers the following:

- 12 Months Service Agreement: £300 + VAT

- 12 Months Service Agreement plus UK Payroll: £360 + VAT

AccountEdge Pro’s emphasis on catering to the specific needs of sole proprietors and consultants positions it as a leading Xero alternative for businesses in need of a devoted accounting solution.

Summary

In conclusion, there are various Xero alternatives available in the market, each catering to different business sizes and industry-specific needs. By evaluating your business’s size and required features, you can find the perfect accounting software solution to streamline your financial processes and support your business’s growth.

Remember to make use of free trials and explore comprehensive reviews to find the best accounting software for your unique requirements. With the right software in place, you can confidently manage your business’s finances and focus on what truly matters – growing your business.

Frequently Asked Questions

How can I make Xero cheaper?

Sign up to a pricing plan and add an organisation to become the subscriber for that organisation. Xero offers discounts when subscribing to more than one Business Edition organisation with the same email address, or use any existing promo codes available on the 'choose a pricing plan' page.

Which Xero alternative is best?

Choosing the best Xero alternative depends on your business’s specific needs, such as the size of your business and the sector-specific features required. If you can put up with its various limitations and minimal support, you might find that a good option is the free package offered by Zoho Books. But that alternative will only be suitable for businesses with revenue under £35K per annum. If you want freedom from such limitations, plus a comprehensive feature set and a user-friendly interface, Pie may be the best choice for your business.

What factors should I consider when choosing accounting software?

When choosing accounting software, take into account your business size, features needed for your industry, and what fits within your budget.