Explore the Best TaxScouts Alternatives for 2024

Are you looking for the best alternative to TaxScouts for your 2024 tax return? With a myriad of tax return software available, choosing the perfect fit for your individual needs can be overwhelming. In this blog post, we will dive deep into the world of TaxScouts alternatives and compare the top contenders to help you make an informed decision.

We will discuss important factors to consider when selecting a tax return software, conduct an in-depth analysis of the leading TaxScouts alternatives such as Pie, GoSimpleTax, QuickBooks Self-Employed, and TaxCalc and explore unique features and tools that streamline the self-assessment process. Get ready to make tax returns a breeze!

Finding the Right TaxScouts Alternative: Key Factors to Consider

When choosing a TaxScouts alternative, it is crucial to consider key factors such as affordability, user-friendliness, and features tailored to specific requirements. With TaxScouts offering a competitive price, it is also essential to evaluate whether other options provide a similar cost-effective solution.

Moreover, ease of use plays a significant role in selecting a tax return software. TaxScouts aims to relieve much of the stress associated with the tax return process, but could there be even simpler alternatives? Let’s compare the top TaxScouts alternatives and identify the best fit for your needs.

Comparing Top TaxScouts Alternatives: In-Depth Analysis

In this section, we will analyse the top TaxScouts alternatives, namely:

- Pie: Prioritises user-friendliness and provides great value and many features

- GoSimpleTax: Known for its affordability

- QuickBooks Self-Employed: Offers comprehensive financial management features

- TaxCalc: Takes a traditional desktop software approach with advanced capabilities

Each alternative offers unique advantages, making them viable options for tax preparation. Here is a quick overview:

*with our premium plan at an extra £3 per month

Let’s dive into the details of each alternative

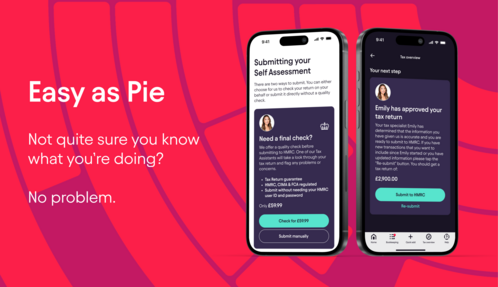

Pie: HMRC-Recommended Tax Return Software that Prioritises User-Friendliness

Pie is a HMRC recommended software provider for the MTD (Making Tax Digital) initiative, presenting an unparalleled real-time clarity through its dashboard, seamlessly merging tax bills, projections, and income. This user-friendly mobile app streamlines the sorting of income and expenses, leaving no detail unnoticed.

Pie’s two pricing plans both provide great value, with an Essential plan priced at only £6.99 per month and a Premium plan priced at £9.99 per month.

Pie excels in effortlessly managing multiple income streams, while its industry-specific tax assistants offer personalised guidance via live chat. With help from its intuitive interface, Pie emerges as an all-encompassing financial ally, delivering live tax calculations, simplified returns, and expert insights, all in one place. With official HMRC Approval, robust bank-level encryption, and adherence to FCA regulations, Pie also places data security at the forefront. Within the realm of accounting software, Pie stands out for its ability to empower users to confidently navigate their financial journeys.

The innovative features and tools offered by Pie can significantly streamline the self-assessment process and remove unnecessary admin. In particular, the mobile app enables users to quickly access their tax information and receive personalised recommendations for tax savings.

By leveraging technology and modern features, Pie can offer the following benefits:

- Reduce the time and effort involved in tax return filing

- Help users stay organised and compliant with tax regulations

- Track expenses and receipts

- Calculate tax owed

- Make the self-assessment process more manageable and efficient

- Ultimately lead to a stress-free tax season

QuickBooks Self-Employed: Comprehensive Financial Management

QuickBooks Self-Employed is a great solution for small businesses and self-employed individuals seeking comprehensive financial management tools. It offers features such as:

•Expense tracking

•Invoicing

•Tax filing

•Integration with other QuickBooks products

This enables easy management of finances across multiple platforms.

However, QuickBooks Self-Employed isn't without some limitations. For example, the base product only generates SA103 forms, excluding forms such as SA100, SA102, and SA106, which may be important for certain users.

Nevertheless, its comprehensive financial management capabilities may outweigh these drawbacks for some users.

GoSimpleTax: Affordable Tax Return Software

GoSimpleTax is an economical tax return software that rivals TaxScouts. With prices starting at £54.99 per tax year, GoSimpleTax offers a more flexible and convenient solution compared to TaxScouts; with its straightforward user interface, automated calculations, and the ability to import data from other tax software, GoSimpleTax simplifies the tax return process, making it an attractive alternative.

Additionally, in comparison to QuickBooks Self-Employed, GoSimpleTax provides a more comprehensive solution. Here are some key differences:

- QuickBooks Self-Employed is cloud-based and does not require installation, while GoSimpleTax offers a complete toolkit.

- QuickBooks Self-Employed lacks the ability to file tax returns immediately with HMRC, while GoSimpleTax allows you to do so.

- Many forms like SA100, SA102, and SA106 are not included in the base product of QuickBooks Self-Employed, but they are included in GoSimpleTax.

TaxCalc: Traditional Desktop Software with Advanced Features

TaxCalc offers a traditional desktop software approach with advanced features, including automated calculations, data import from other tax software, and report generation. Priced at £35 per tax year, TaxCalc is an affordable option for individuals seeking a more traditional tax return software.

However, TaxCalc may not be as user-friendly as alternatives like Pie. It has no mobile app, requires offline installation, and its interface may be less intuitive for some users. Nevertheless, TaxCalc remains a viable option for those who prefer a desktop-based tax return software with advanced capabilities.

Tax Advice and Assistance: How TaxScouts Alternatives Measure Up

When it comes to tax advice and assistance, each TaxScouts alternative offer various services, including online tools that provide one-off tax advice from chartered accountants and tax charities that assist individuals with low incomes on tax-related issues. These alternatives help users navigate the complexities of tax laws and ensure accurate tax filings.

Exploring the different TaxScouts alternatives and their tax advice services is essential to identify the most suitable option for your individual needs. Whether you require expert advice on tax reliefs or support with filing your self-assessment tax returns, the right TaxScouts alternative can provide valuable resources to assist you in your tax journey.

User Reviews: Real Experiences with TaxScouts Alternatives

Real experiences and reviews from users of these four TaxScouts alternatives can provide valuable insight into the pros and cons of each option. By examining user reviews, you can gain a comprehensive understanding of the advantages and disadvantages of each alternative, enabling you to make an informed choice when selecting the most suitable tax return software for your needs.

Users often highlight the following aspects in their reviews of financial management software, including assessment software:

•Cost-effectiveness

•User-friendliness

•Comprehensive financial management

•Traditional desktop software with enhanced features

•Modern features and tools

While each alternative offers unique benefits, it is important to weigh the pros and cons based on your individual requirements and preferences.

Summary

In conclusion, TaxScouts alternatives such as GoSimpleTax, QuickBooks Self-Employed, TaxCalc, and Pie offer unique and diverse solutions for filing your 2024 tax returns. By considering important factors such as affordability, user-friendliness, and tailored features, you can make an informed decision and select the best tax return software for your individual needs.

Remember, the perfect tax return solution is out there waiting for you. So take the time to explore your options, assess your requirements, and embark on a hassle-free tax journey. Happy tax filing!

Frequently Asked Questions

What are the key factors to consider when choosing a TaxScouts alternative?

When choosing a TaxScouts alternative, it is important to consider affordability, user-friendliness, and features tailored to your specific requirements.

These features should be weighed against the cost of the service, as well as the ease of use. It is also important to consider the customer service and support offered by the provider. Finally, make sure that the service is tailored to your needs.

How do TaxScouts alternatives streamline the self-assessment process?

Some of the TaxScouts alternatives looked at in this article come with easy-to-use features and tools that make tax return filing straightforward and more accessible, streamlining the self-assessment process.

For example, the mobile app offered by Pie makes it easier for individuals to file their taxes without having to worry about complex calculations or missing important information. It also provides helpful guidance and advice to ensure that the process is as smooth and stress-free as possible.

How can user reviews of TaxScouts alternatives help me choose the best option for my needs?

User reviews offer a great way to compare and choose the best TaxScouts alternative for your specific needs, providing you with valuable information about the pros and cons of each option.

By reading user reviews, you can get a better understanding of the features and benefits of each TaxScouts alternative, as well as any potential drawbacks. This can help you make an informed decision about which option is best for you.