As a small business owner, finding the right accounting software is crucial for managing your finances effectively. FreshBooks has long been a popular choice, but it’s not the only option out there. In today’s competitive market, numerous alternatives offer different features and benefits tailored to your unique business needs. In this blog post, we’ll explore the top FreshBooks alternatives for small businesses and discuss the factors to consider when choosing the accounting software that’s right for you.

Evaluating FreshBooks Alternatives

Choosing the right accounting software involves more than just picking the most popular option. It’s essential to consider several factors, such as:

- Cost

- Features

- Ease of use

- Scalability

To ensure the software meets your specific business needs. Aligning your bookkeeping plan with your entrepreneurial situation and objectives can help you maximise the software’s utility and guarantee that the cost is proportionate with the value it brings to your business.

Moreover, it’s crucial to select accounting software tailored to the size of your business to ensure proper management of your accounting data.

Pricing Comparison

When evaluating FreshBooks alternatives, it’s essential to compare pricing plans to find the best fit for your budget. However, it’s important to weigh the costs and benefits of each plan carefully. Opting for the cheapest plan could leave you without necessary features, while choosing the most expensive plan may result in overpaying for features you may not use.

From free plans to premium options with advanced features, there’s a wide range of pricing options available across different accounting software solutions. Make sure to compare the features and pricing of various alternatives before making your final decision.

Features Overview

Aside from pricing, it’s crucial to evaluate the key features offered by different accounting software solutions. When searching for FreshBooks alternatives, you should look out for key features such as:

- Contact management

- Project time tracking

- Inventory management

- Invoice templates

- Automatic bank feeds

These customer relationship management features can prove valuable in many aspects of running a business or organisation.

Additionally, consider the availability of customisable options, as they allow you to tailor generic contracts, project proposals, invoices, and other CRM documents to your specific requirements with a personal touch. Comparing the features of various alternatives will help you choose the most suitable accounting software for your business needs.

Ease of Use

The ease of use of accounting software is paramount for efficient business operations and avoiding any additional stress that a steep learning curve may bring. When selecting accounting software, consider its user-friendliness, platform format (e.g., desktop or mobile device), and the overall user experience.

If a particular accounting software has no mobile app, you might end up having to wait hours or even days to log on should you find yourself with no immediate access to a laptop or desktop computer. Conversely, software that’s accessible on mobile will allow you to do everything conveniently on-the-go, as and when you have time to spare.

Accounting software with a user-friendly interface and intuitive design can save you time and effort while managing your business’s finances. With the right bookkeeping software, you can further streamline your financial management process, and even explore other accounting software options to find the best fit for your needs.

Scalability for Business Growth

As your business grows, your accounting software should be able to accommodate the expansion and adapt to varying requirements. Scalability for business growth offers the advantage of allowing businesses to expand without having to switch to different accounting software, thus saving time and money while reducing the risk of data loss.

Some accounting software options, such as NetSuite ERP and Sage 50Cloud, provide scalability for business growth with features like inventory management, billing, order management, fixed assets, revenue management, and financial management.

Top FreshBooks Alternatives

With the factors for evaluation in mind, let’s dive into the top FreshBooks alternatives for small businesses. In this blog post, we’ll explore:

•Pie

•Xero

•Sage Business Cloud Accounting

•Zoho Books

•QuickBooks Online

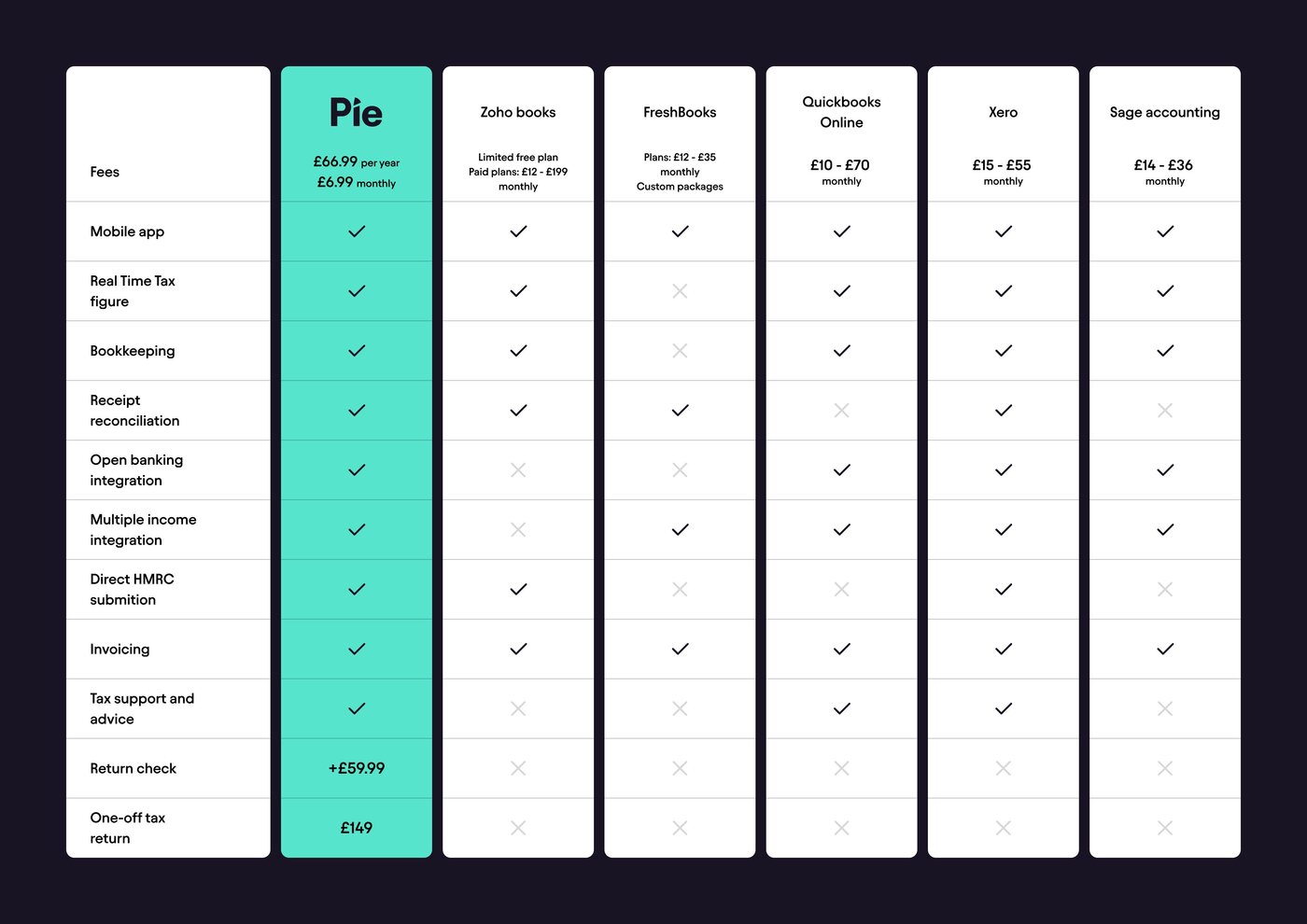

Each offering unique features and benefits that cater to different business needs. Here is a quick overview:

*with our premium plan at an extra £3 per month

By understanding the strengths and weaknesses of each alternative, you’ll be better equipped to choose the accounting software that’s right for you.

Pie

Pie provides comprehensive, real-time tax information on a dashboard made accessible via a user-friendly mobile app. The app eliminates hassle by streamlining the sorting of income and expenses, with all the relevant details collected in one place. Pie offers two pricing plans; Essential, which is priced at £6.99 per month, and Premium, which is priced at £9.99 per month.

Managing multiple income streams becomes a much simpler task with Pie, and industry-specific tax assistants are available to offer personalised guidance. The intuitive app interface elevates Pie to the status of all-round financial ally; from delivering live tax calculations and simplified returns, to sharing in-depth expert insights, Pie is a little bit like having an accountant in your pocket.

Xero

Xero is a budget accounting software alternative to FreshBooks, offering unlimited user access and more integrations. With four pricing tiers and a complimentary 30-day trial period, Xero provides a range of features like bank account integration, automatic sales tax calculation, purchase orders, and inventory management. Here is a breakdown of the four tiers:

- Starter: £14 per month

- Standard: £28 per month

- Premium: £36 per month

- Ultimate: £49 per month

The entry-level Starter plan has certain limitations. It allows a maximum of five bills and 20 invoices per month. Overall, Xero is an excellent option for small businesses looking for a cost-effective, yet feature-rich accounting software.

Zoho Books

Zoho Books is an accounting solution that helps simplify back office operations. It optimises workflows and enables secure sharing with your accountant. Offering a range of features such as:

- Customisable invoice templates

- Online payments

- Transaction approval

- Recurring expenses

- Vendor credits

- Landed cost

- Inventory tracking

- Receivables

- Payables

- Items

- Banking

- Timesheet

- Contacts

- Reports

Zoho Books provides a free plan for businesses with less than £35K in annual revenue and paid plans starting at £10 per month.

If you’re seeking a cost-effective alternative to FreshBooks with a comprehensive set of features, Zoho Books is an excellent choice.

QuickBooks Online

QuickBooks. Online is a popular alternative to FreshBooks, offering granular transaction tracking tools, robust reporting capabilities, and more software integrations. With a variety of pricing plans and features such as project tracking, time tracking, invoicing, and reporting, QuickBooks Online caters to a wide range of small businesses.

However, some users have reported slow or unresponsive customer support. Overall, QuickBooks is a great program. Online is a reliable choice for businesses seeking a comprehensive accounting software solution.

Additional Factors to Consider

In addition to the factors already discussed, here are a few more features that should be taken into consideration when weighing up different accounting software:

- Time Tracking Tools: Accurate time tracking tools are crucial for effective billing and project management in FreshBooks alternatives. By capturing the time spent on various tasks and projects, these tools can help you create accurate invoices, monitor project progress, and make data-driven decisions. Consider the specific needs of your business when choosing the right time tracking tool for your accounting software.

- Project Management Capabilities: Project management features in accounting software are vital for better organisation, collaboration, and expense management within your business. By providing tools to plan, track, and manage projects, project management software can help you streamline processes, improve communication, and enhance overall productivity. When evaluating FreshBooks alternatives, consider the importance of project management capabilities for your business’s unique needs.

- Payment Integrations: Seamless payment integrations in accounting software are essential for smooth transactions and improved cash flow. By offering a variety of payment options, such as PayPal, Stripe, and other payment gateways, businesses can cater to the preferences of their customers and facilitate quicker, more secure transactions. When selecting an accounting software for your small business, consider the available payment integrations and their compatibility with your existing systems.

Customisable Invoicing: Customisable invoice templates are advantageous for small businesses as they enable professional and consistent branding. This assists in projecting a professional image and fostering trust with customers, while also simplifying the monitoring of invoices and payments.

Summary

In conclusion, selecting the right accounting software for your small business is a crucial decision that can significantly impact your financial management and overall success. By considering factors such as pricing, features, ease of use, and scalability, you can better evaluate FreshBooks alternatives and choose the accounting software that best meets your unique business needs. Whether you opt for Xero, Sage Business Cloud Accounting, Zoho Books, QuickBooks Online, or Pie, each alternative offers distinct advantages and features that can help you manage your finances efficiently and effectively.

Frequently Asked Questions

What factors should I consider when choosing an accounting software alternative to FreshBooks?

When selecting an accounting software alternative to FreshBooks, make sure to take into account the cost, features, ease of use, and scalability for your business needs.

Consider the cost of the software, the features it offers, how easy it is to use, and how well it can scale with your business as it grows.

Does FreshBooks work in the UK?

Yes, FreshBooks works in the UK and is popular among small businesses for its affordable prices, great design and powerful features.

Is it worth reading user reviews of FreshBooks alternatives?

Absolutely, user reviews are a fantastic resource that can help you to compare and select the best FreshBooks alternative for your particular needs. By examining a wide range of different reviews from users, you should start to get a clear idea of the advantages and disadvantages associated with each option.