Understanding How to Unregister as Self-Employed

Are you a self-employed individual in the UK, puzzled about how to unregister with HMRC? Worry not! We've got you covered with a comprehensive guide on correctly completing this process.

Key Components of Unregistering as Self-Employed

When you decide to stop operating as a self-employed individual, it's crucial to understand the related components:

You must inform HMRC that you are ceasing to operate as self-employed. This is crucial to ensure you are no longer liable for self-assessment tax returns.HMRC Notification

Preparing and submitting your final tax return accurately is necessary to detail your earnings up until the date you stopped working.Final Tax Return

You may need to pay any outstanding National Insurance contributions and understand how your future contributions will be managed.National Insurance

How to Unregister as Self-Employed

Follow these steps to complete the process seamlessly:

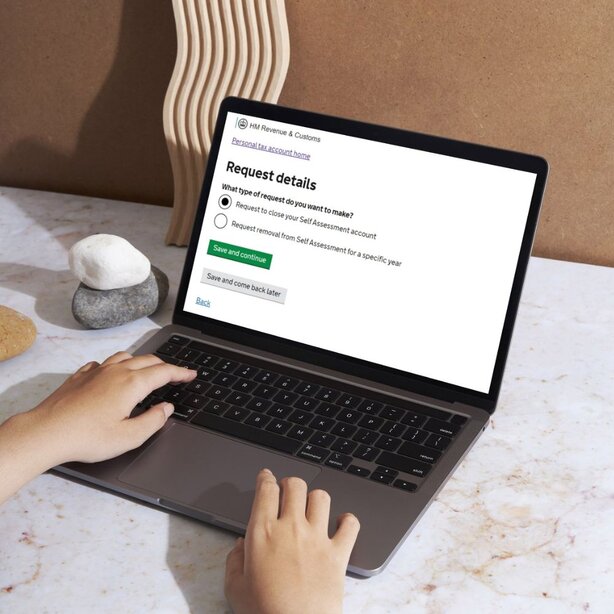

Notify HMRC by filling out the ‘Stopping self-employment’ form online through your Government Gateway account.Inform HMRC

Submit your final self-assessment tax return, including all necessary financial details and dates related to your business closure.Final Tax Return

Ensure you settle any outstanding tax liabilities from your final self-assessment. You can make HMRC payments using the Pie App.Pay Outstanding Taxes

Contact HMRC to discuss the settlement of any outstanding National Insurance contributions and future contribution management.National Insurance

Once all steps are completed, wait for a confirmation from HMRC stating you are no longer registered as self-employed.Confirmation

Potential Issues and Solutions

Option 1: Online Submission Problems

When trying to unregister as self-employed in the UK, technical issues can sometimes arise during the online submission process. If the form fails to load or submit properly, it may be due to browser-related problems. To resolve this, try clearing your browser’s cache or switching to a different browser. If the issue persists, you can also contact HMRC’s online services support for assistance.

Option 2: Missing Deadlines

If you delay informing HMRC about your decision to stop being self-employed, you may face penalties for late submissions. Missing the deadline to notify HMRC could result in being charged for National Insurance Contributions (NICs) that you no longer need to pay. In this case, contact HMRC immediately, explain your situation, and seek guidance on minimising any potential fines or late payment charges.

Additional Considerations

Maintain records of all communications with HMRC for future reference.Records

Keep financial records for at least five years after submitting your final tax return.Retention

Check your eligibility for other forms of support or benefits once you are no longer self-employed.Eligibility

Expert Assistance with Pie

Navigating the deregistration process can be complex, but with Pie.tax, you have access to expert assistance who can guide you through the process efficiently. Start your journey with Pie.tax today and ensure a stress-free experience.

20% of self-employed individuals in the UK fail to notify HMRC when they cease trading.

Approximately 15% of former self-employed individuals face issues with final tax return submissions.

Frequently Asked Questions

How quickly will HMRC respond to my deregistration request?

HMRC typically responds within 30 days, but times may vary based on demand.

What documents do I need to keep after deregistering as self-employed?

Keep all financial records, tax returns, and correspondence with HMRC for a minimum of five years.

Can I re-register as self-employed after deregistering?

Yes, you can re-register as self-employed at any time by notifying HMRC again.

Will deregistering affect my state pension?

Deregistering may impact your National Insurance contributions, which can affect your state pension. Contact HMRC for personalized advice.

What happens if I do not inform HMRC that I have stopped being self-employed?

Failure to inform HMRC can result in penalties and continued tax liabilities. Ensure you notify them as soon as possible.