How do I pay my Tax Bill from my Self-assessment?

Are you a UK taxpayer puzzled about how to pay your Self-Assessment tax bill? Worry not! We've got you covered with this comprehensive guide on how to make the payment process as straightforward as possible.

What You Need to Know About Self-Assessment Tax Bills

When you receive your Self-Assessment tax bill, it's crucial to understand the following components to make your payment smoothly and on time:

How to Make a Payment using the Pie App

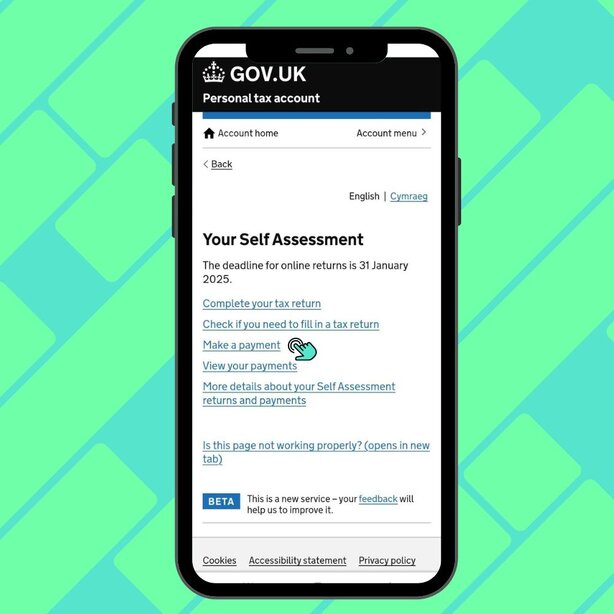

How to Locate the Payment Option

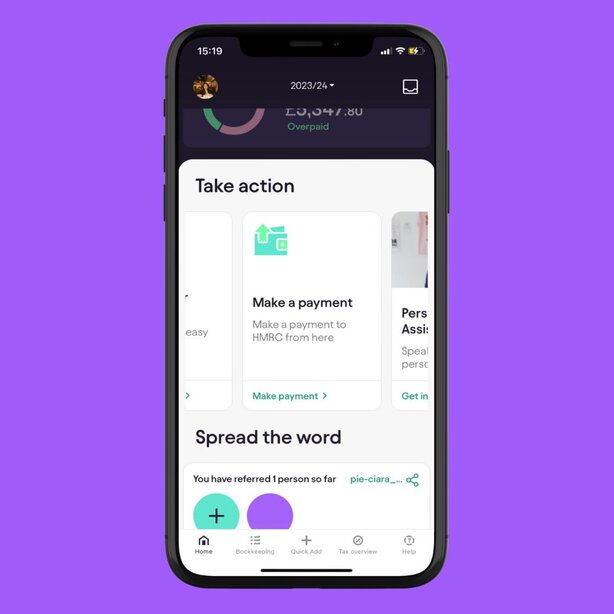

To make a payment to HMRC, start by accessing your account and navigating to the Home screen. Here, you'll find the "Make a Payment" option within the action menu. This is where you can initiate the process to settle any outstanding tax payments.

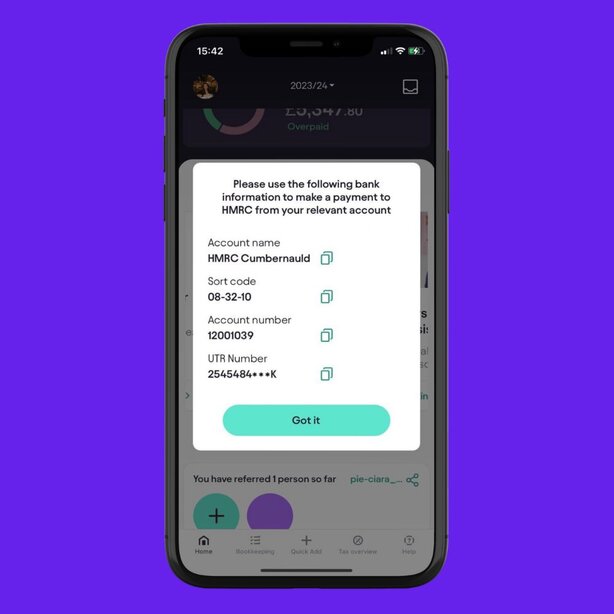

Once you've selected this option, a pop-up will display with all the necessary details for making your payment, including the relevant HMRC bank account information and your unique payment reference.

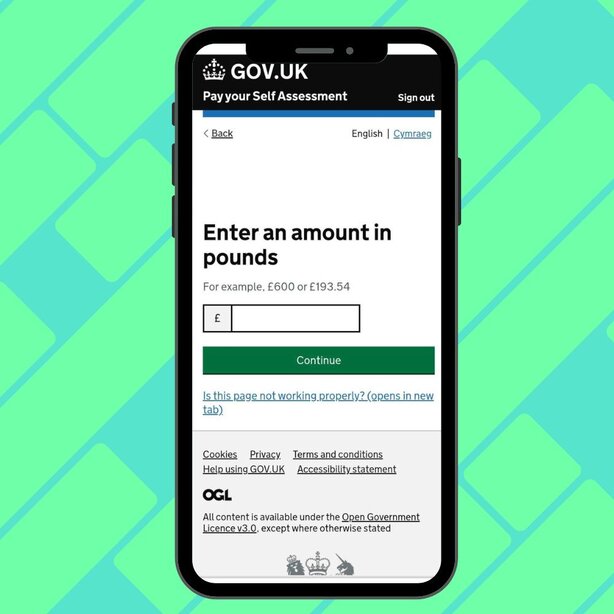

How to Make the Payment

After retrieving the required details, you can proceed to your bank’s app or online banking service. The pop-up will provide the following HMRC bank information needed for the transfer:

- Account name: HMRC Cumbernauld

- Sort code: 08-32-10

- Account number: 12001039

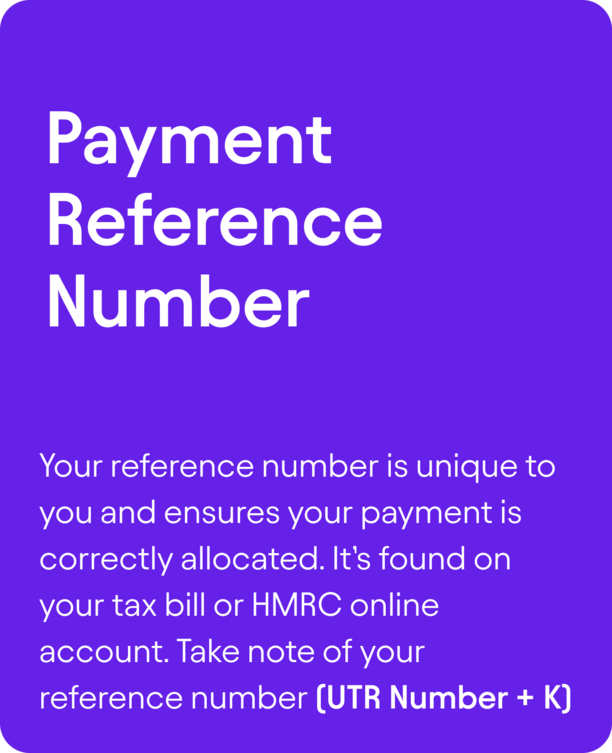

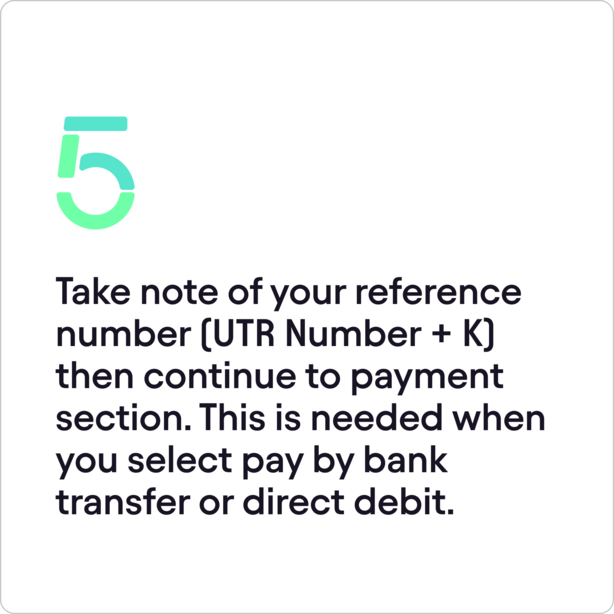

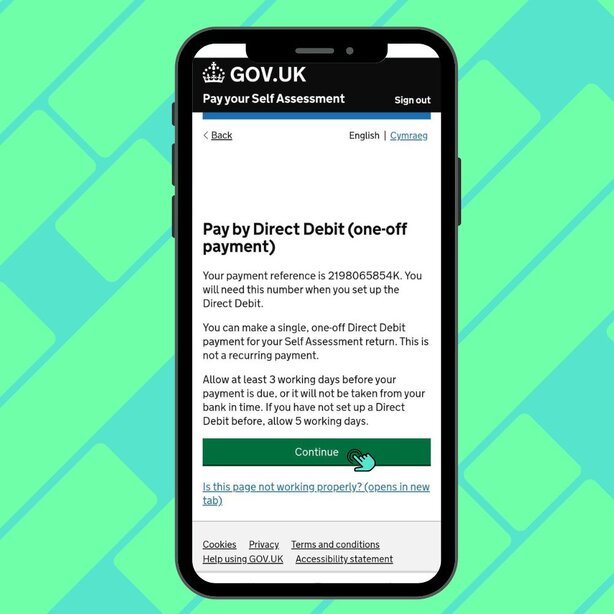

- Payment reference: Your UTR number followed by the letter K (e.g., 1234567890K)

Use these details to make the payment directly to HMRC. Be sure to double-check that the reference number is entered correctly to ensure your payment is properly attributed. Once the payment is complete, confirm the transaction and ensure your records are updated accordingly.

How to Pay Your Self-Assessment Tax Bill through HMRC

Follow these steps to pay your Self-Assessment tax bill seamlessly:

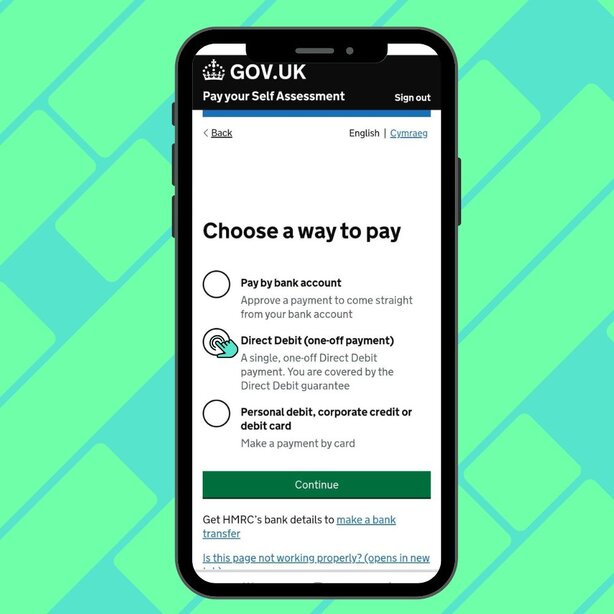

Payment Options/Methods

Option 1: Direct Debit

This option allows you to set up a recurring payment directly from your bank account, which means you don't have to manually make payments each time. This automated process saves you time and effort, ensuring that your payments are always made on schedule. As a result, it makes managing and remembering your financial obligations significantly easier, reducing the risk of missed or late payments.

Option 2: Debit/Credit Card Payment

You can pay online using your debit or credit card, allowing you to handle transactions from anywhere at any time. This method is a quick way to settle your bills without the need for cash or checks. However, it's important to be aware that card payments might incur a processing fee, which can vary depending on the payment processor or the following terms set by the merchant.

Option 3: Faster Payment

This is a quicker method where payments are usually made within a couple of hours, providing you with an efficient way to transfer funds swiftly. By using this method can ensure that your payments are processed almost immediately, which is useful for urgent transactions or when meeting tight deadlines. However, it's essential to check that your bank supports faster payments, as not all banks or accounts offer this feature.

Option 4: Bank Transfer

Make a payment via bank transfer, this allows you to move funds directly from one bank account to another. While this is a reliable and secure way to handle transactions, it is important to note that bank transfers might take a few working days to process, depending on the banks involved and the type of transfer. This means you should plan accordingly to ensure that your payment reaches the recipient on time, avoiding any potential disruptions or late fees.

Additional Considerations

Frequently Asked Questions

What is the deadline for paying my self-assessment tax bill?

The deadline is usually January 31st for the previous tax year.

What happens if I miss the self-assessment tax payment deadline?

You may face penalties and interest charges on the amount owed.

Can I set up a payment plan if I can't pay my tax bill in full?

Yes, you can arrange a Time to Pay agreement with HMRC.

How do I find my payment reference number?

Your payment reference number can be found on your HMRC online account or your tax bill.

Are there any fees for paying by debit or credit card?

Yes, paying by credit card may incur a processing fee. Check with HMRC for specific costs.