Understanding PAYE Information

Are you a taxpayer in the UK, puzzled about how to retrieve your Pay As You Earn (PAYE) information from your personal tax account? Worry not! We've got you covered with a comprehensive guide on accessing this crucial information seamlessly.

Understanding the PAYE Information Retrieval Process

When you need to get your PAYE information, it's crucial to understand the following components:

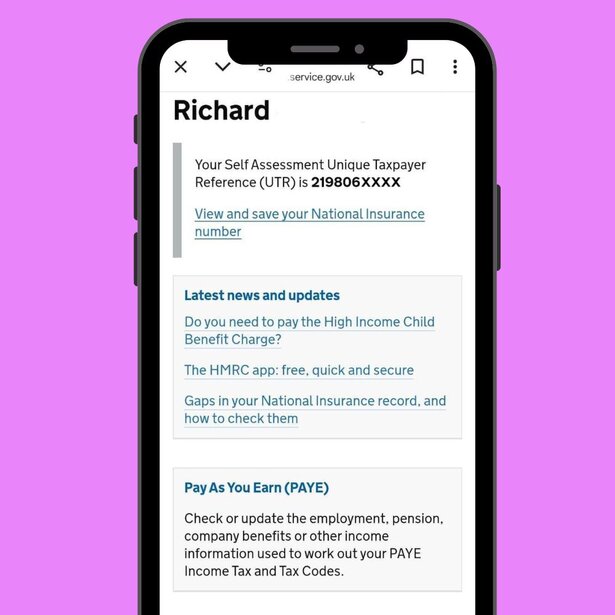

Your personal tax account acts as a central hub where you can manage and access your tax affairs. Creating this account is vital as it offers a consolidated view of your PAYE information. Personal Tax Account

Your National Insurance (NI) number uniquely identifies you in the UK tax system. This is crucial to ensuring that all your tax records are accurately associated with you. National Insurance Number

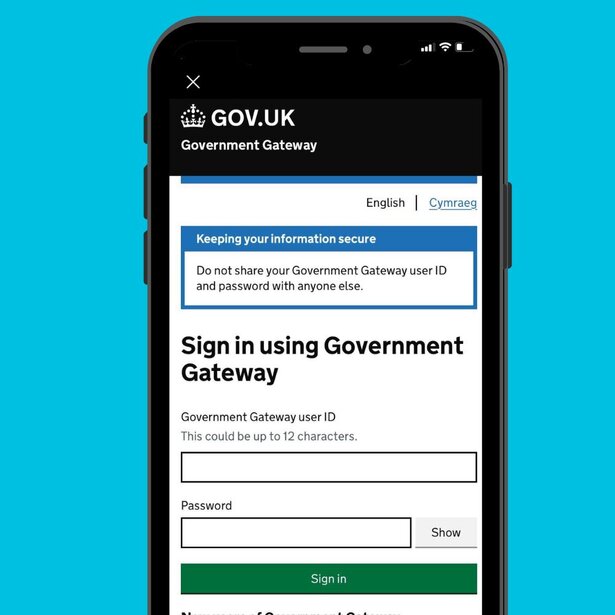

The HMRC Gateway acts as the secure online portal connecting you to your personal tax account, allowing you to access your PAYE details and other tax-related information.HMRC Gateway

How to Access Your PAYE Information

Follow these steps to retrieve your PAYE information seamlessly:

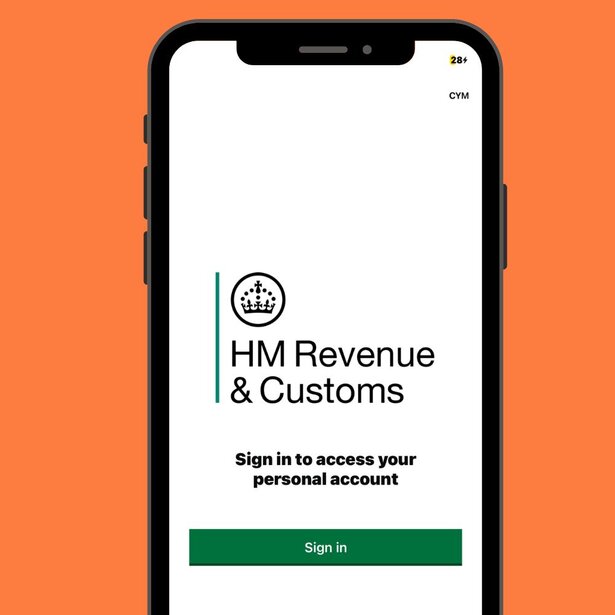

Visit your HMRC App and begin the process.

Log in to your personal tax account using your credentials.

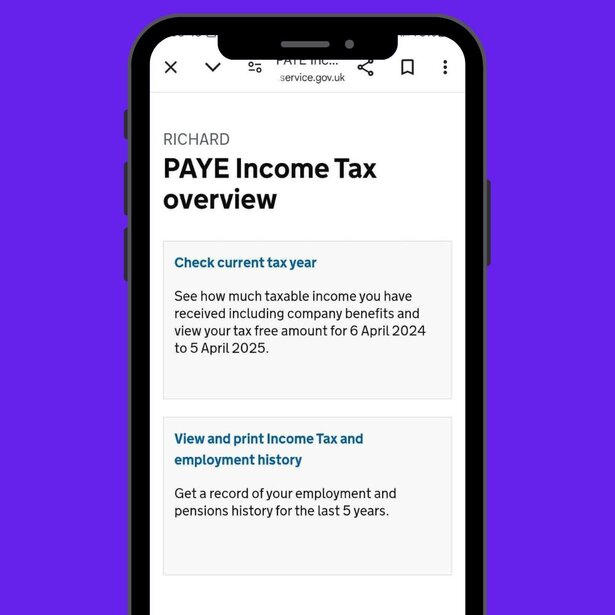

Navigate to the section labeled Pay As You Earn (PAYE).

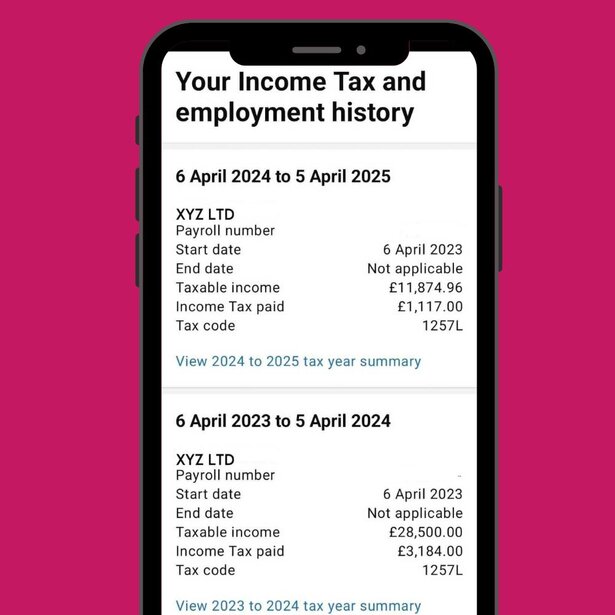

Select the specific tax year for which you need PAYE details.

Review and download the information as needed.

Accessing Your PAYE Information

Option 1: Access via a Desktop Interface

Using a desktop to log into your personal tax account gives you a more comprehensive view of your PAYE information. The larger screen and detailed layout make it easier to navigate through multiple sections, download documents such as your P60, and manage your tax details more thoroughly. This option is ideal when handling more complex tasks or reviewing records in detail.

Option 2: Access through the HMRC App

By downloading the HMRC app on your mobile device, you can easily view your PAYE information anytime, anywhere. The app provides quick access to essential details like tax codes, income summaries, and payments made, offering flexibility when you need to check your records on the go. It’s a convenient solution for managing your PAYE information without needing a computer.

Additional Considerations

Double-check your login details to avoid issues when accessing your account. Incorrect information may delay your ability to retrieve your PAYE details.Login Accuracy

Ensure your contact details are up-to-date to receive timely alerts and notifications from HMRC regarding your PAYE status or tax matters.Contact Information

Make sure to download and store important documents, like your P60 and tax code notices, for future reference. These are helpful when completing your tax return or verifying your earnings.Document Downloads

Expert Assistance with Pie

Navigating the PAYE information retrieval process can be complex, but with Pie Tax, you have access to expert assistance that can guide you through the process. Get started today and simplify your tax management experience with Pie Tax.

According to HMRC data, nearly 7 million UK taxpayers utilised online personal tax accounts in 2022.

Over 80% of PAYE queries can be resolved through online accounts, as stated by HMRC reports.

Frequently Asked Questions

How do I create a personal tax account?

Visit the HMRC website and follow the steps to register for a new account.

What if I forget my login credentials?

Use the "Forgotten details" option on the HMRC login page to recover your credentials

Can I access past PAYE information?

Yes, you can access PAYE information for previous tax years through your personal tax account.

Is my PAYE information safe?

Yes, HMRC uses secure systems to protect your data.

Can I update my PAYE information online?

Changes must often be reported directly to HMRC or your employer.