Understanding How to Download Your SA302 from HMRC Online

Are you a UK taxpayer puzzled about how to download your SA302 form from HMRC online? Worry not! We've got you covered with a comprehensive guide on how to easily access your SA302 form.

Understanding the SA302 Form

When you need proof of your earnings, it's crucial to understand the following related components of the SA302 form:

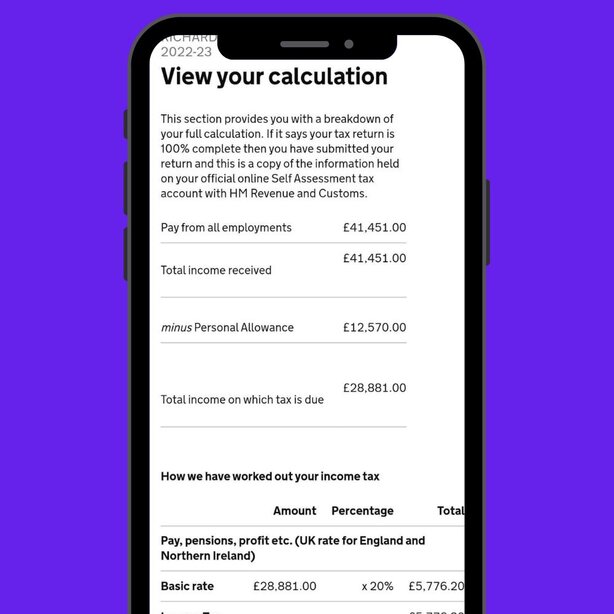

This section provides a breakdown of your annual income, which is essential for verifying your earnings to lenders or other organizations.Annual Income Summary

This section details the calculations of your tax based on your income, allowing you to review and confirm the amounts deducted.Tax Calculations

This part of the form outlines the total tax due, offering a clear summary of what you've paid and any potential amounts owed.Total Tax Due

How to Download Your SA302 from HMRC Online

Follow these steps to download your SA302 form seamlessly:

Visit the HMRC website and log in to your account using your credentials.Log in to Your HMRC Online Account

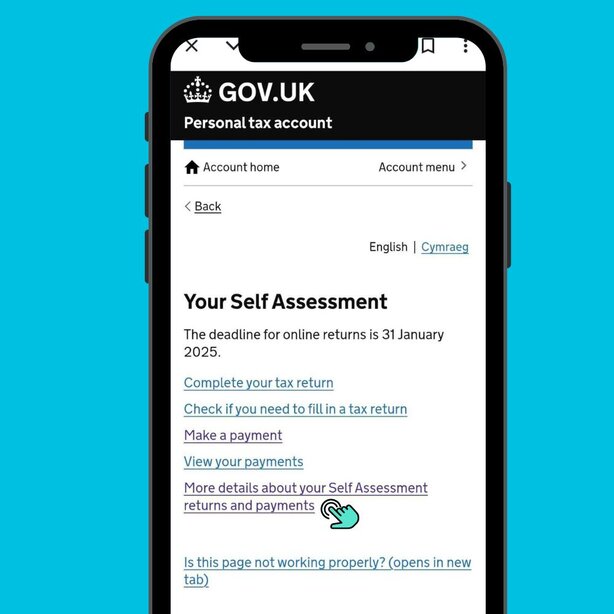

Once logged in, navigate to your Self-Assessment account and click "More details about your self-assessment".Navigate to Your Self-Assessment Account

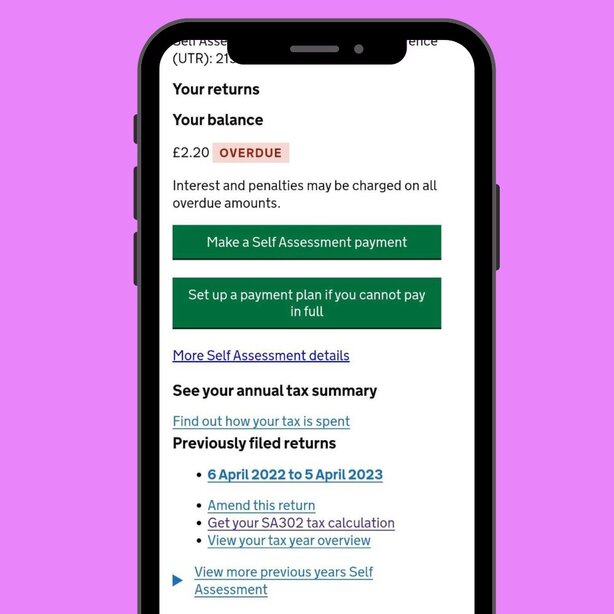

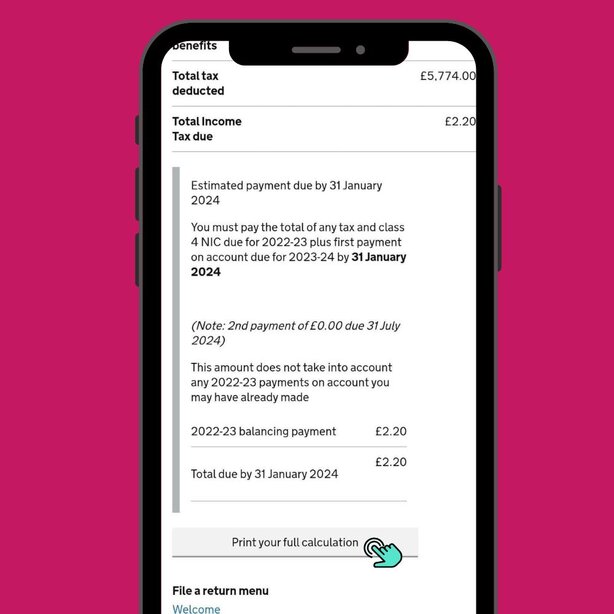

Select the option that says "Get your SA302 Tax calculation"SA302 Tax Calculation

Click on the 'View Your Return' option to see the details of your tax return.View Your Tax Return

Finally, locate and download the 'SA302' form. It is usually available in a PDF format for easy printing and sharing.Download Your SA302

Alternatives to Downloading Your SA302

Option 1: Request by Phone

You can request a copy of your SA302 by calling HMRC’s Self Assessment helpline at 0300 200 3310. Have your National Insurance number and Unique Taxpayer Reference (UTR) ready for verification. Once confirmed, HMRC will mail the form to your address within 10 working days. This is a good alternative if you cannot access the online system.

Option 2: Use Pie App

You can easily access your SA302 form using the Pie App. Simply navigate to the correct tax year, click on "Tax Overview," then scroll down to "Tax Calculation." From there, you can review your figures and download the SA302 form as a PDF file. This method is quick and convenient, allowing you to manage your tax documents directly from your device.

Additional Considerations

Double-check that you are selecting the correct tax year when downloading your SA302 form to avoid errors in your submission.Tax Year Selection

Ensure you have your Government Gateway ID and password ready, as these are required to access your HMRC account.Login Credentials

If you encounter technical difficulties while downloading the form, clear your browser cache or try using a different browser before contacting HMRC for assistance.Technical Issues

Expert Assistance with Pie

Navigating the process of obtaining your SA302 can be complex, but with Pie.tax software, you have access to expert assistance who can guide you through the process. Try our service today to experience seamless tax management.

85% of UK taxpayers now use HMRC's online services for their tax-related needs.

Over 7 million SA302 forms are requested each year for mortgage purposes alone.

Frequently Asked Questions

What is an SA302 form?

An SA302 form is a document provided by HMRC that shows a summary of your earnings and tax paid.

Why do I need an SA302 form?

You may need an SA302 form to prove your income for mortgage applications or financial assessments.

How often should I download my SA302?

It's a good practice to download your SA302 annually after you submit your self-assessment tax return.

Can I download SA302 forms for previous years?

Yes, you can download SA302 forms for previous tax years from your HMRC online account.

Is there an alternative to the online method?

Yes, besides the online method, you can request the form by phone or through your accountant.