Understanding Personal Tax Accounts

Are you a UK taxpayer puzzled about how to create your personal tax account? Worry not! We've got you covered with a comprehensive guide on setting up your personal tax account effortlessly.

Understanding the Process

When you decide to create your personal tax account, it's crucial to understand the following components:

The Government Gateway ID is your secure login identifier. It’s essential as it grants you access to various government digital services, including tax services.Government Gateway ID

Accurately enter your personal information such as your name, National Insurance number, and address. This information confirms your identity and links your tax records to your account.Personal Information

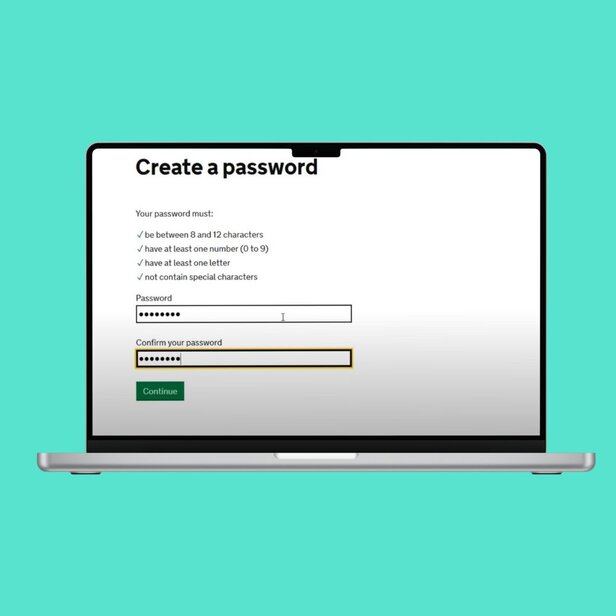

Security setup entails choosing a password and setting up recovery options. This is vital for protecting your account from unauthorized access.Security Setup

How to Create Your Personal Tax Account

Follow these steps to create your personal tax account seamlessly:

Visit the HM Revenue and Customs HMRC website.

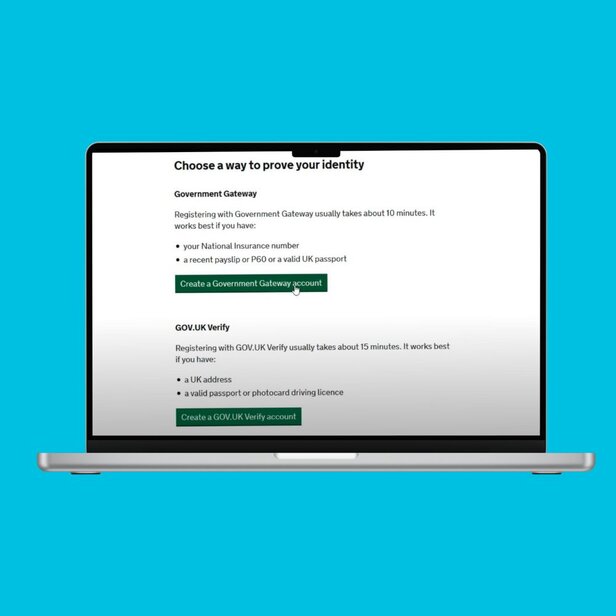

To access your Personal Tax Account, you'll first need to create a Government Gateway ID.

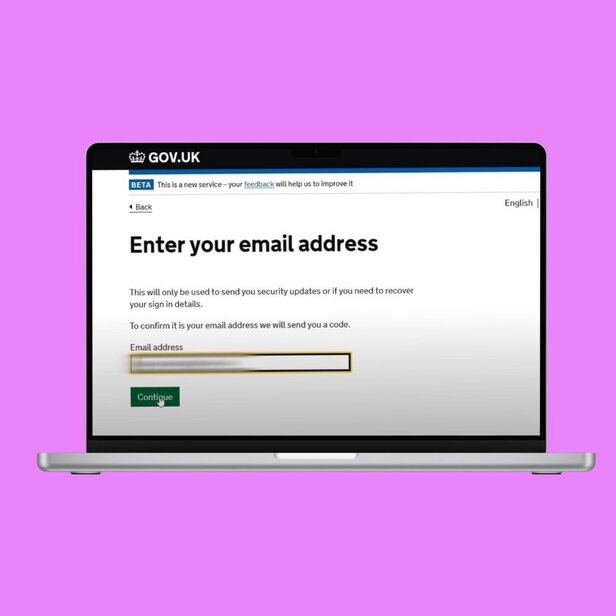

Enter your personal details including your full name and email address.

Generate a secure password and set up recovery options.

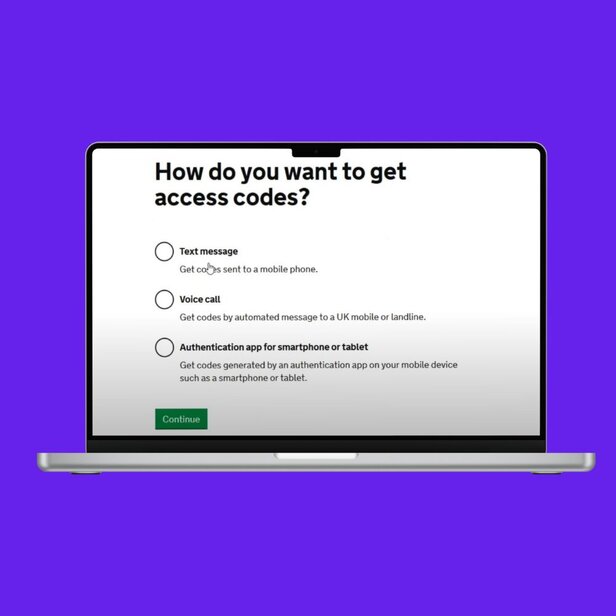

Verify your identity via email or text message, and complete the account setup.

Alternative Options

Option 1: Manual Registration

If you prefer, you can register for your Personal Tax Account manually by completing a paper form and sending it by post to HMRC. While this method is an option, it may take longer due to postal delays and manual processing times. Be sure to account for extra time if you're approaching any tax deadlines. This option might suit those who are not comfortable with online registration or prefer traditional methods.

Option 2: Online Assistance

For a faster and more convenient process, you can make use of the online guides and customer support available on the HMRC website. These resources can guide you step-by-step through the account creation process, making it easier to navigate any challenges you might face. Online assistance ensures you can set up your Personal Tax Account without delays. This option is ideal for those who are comfortable with digital tools and want to complete the process quickly and efficiently.

Additional Considerations

Always store your Government Gateway ID and password securely.Secure Login

Regularly monitor your account for updates and notifications from HMRC.Account Monitoring

Be wary of phishing attempts; HMRC will never ask for personal details via email.Phishing Awareness

Expert Assistance with Pie

Navigating the personal tax account creation process can be complex, but with PIE.tax, you have access to expert guidance that can help you through every step. Experience seamless tax management with our easy-to-use software and dedicated support team.

Over 10 million individuals in the UK use personal tax accounts to manage their affairs.

Approximately 94% of UK taxpayers now file their taxes online.

Frequently Asked Questions

What is a Government Gateway ID?

A Government Gateway ID is a unique identifier that allows you to access various UK government digital services, including HMRC tax services.

How long does it take to set up a personal tax account?

Setting up a personal tax account online typically takes around 10-15 minutes if you have all the necessary information.

Can I use my personal tax account to file my taxes online?

Yes, you can use your personal tax account to file your taxes online, track your tax credits, and view your tax statement.

What if I forget my Government Gateway ID or password?

You can recover your Government Gateway ID or reset your password by following the instructions on the HMRC website.

Is it safe to use the online tax account system?

Yes, the HMRC online tax account system is secure, but you should always practice good cybersecurity habits to protect your information.