Understanding How to Change Personal Information on Your HMRC App

Are you a UK taxpayer puzzled about how to update personal information in your HMRC app? Worry not! We've got you covered with a comprehensive guide on ensuring your details are accurate and up to date.

Understanding the Basics of HMRC App Information Updates

When you decide to update your HMRC app, it's crucial to understand the related components:

Ensure your credentials are up to date to securely access your app.User Identification

Keeping your address and phone number current to stay informed about tax matters.Updated Contact Information

Ensuring your bank details are correct to avoid disruptions in payments or tax refunds.Banking Details

How to Update Your Personal Information on HMRC App

Follow these steps to update your information seamlessly:

Open the HMRC app on your mobile device and log in.

Navigate to "Your details" at the bottom right of the screen.

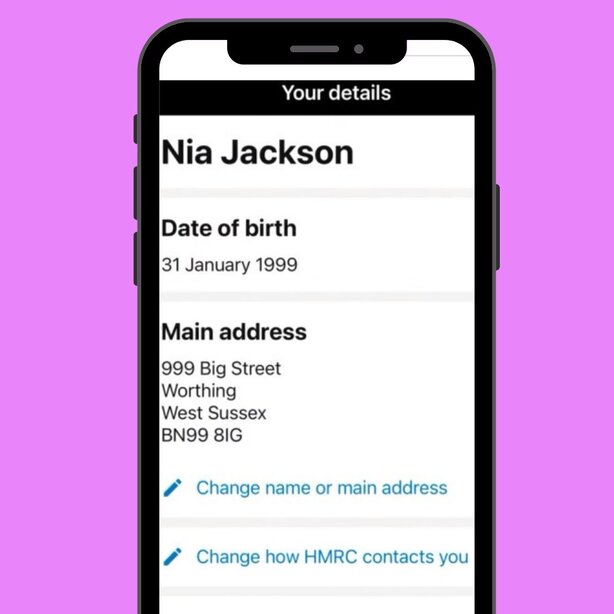

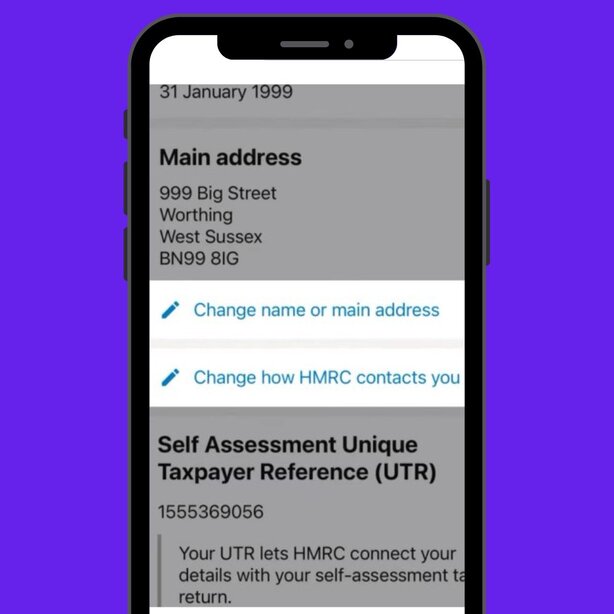

Determine which personal information you would like to change.

Edit the necessary fields such as address, contact, or bank details.

Review details and confirm to save the updates.

Options to Update Your Info on HMRC

Option 1: Update via HMRC App

One of the easiest ways to change your personal information is by using the HMRC app directly. The app allows you to update details like your address or contact information in real-time, ensuring that your records are accurate and up to date. Simply log in with your Government Gateway ID, navigate to your personal details, and make the necessary changes. This method is fast, convenient, and provides immediate confirmation of your updates.

Option 2: Contact HMRC Support

If you're unable to make changes through the app or prefer personalized help, you can contact HMRC support through various channels. HMRC offers support via phone, web chat, and even online forms to assist with updating your personal information. Speaking to a representative ensures that any updates you need are handled accurately, and they can guide you through the process if you're unsure. This is a great option for those who may need additional support or have more complex updates.

Additional Considerations

Always use a secure internet connection when accessing the HMRC app to protect your personal information. Avoid public Wi-Fi networks to minimize the risk of data breaches.Security

Regularly check for updates to the HMRC app to ensure you have access to the latest features and security improvements, which may facilitate smoother information updates.Updates

Keep your contact information updated to receive important notifications from HMRC regarding your account or any changes made to your personal information.Contact Information

Expert Assistance with Pie

Navigating HMRC updates can be complex, but with Pie.tax, you have access to expert help that can guide you through the process. Visit our website today to see how we can assist you!

Approximately 85% of UK taxpayers have successfully updated their information through the HMRC app.

HMRC reports a 30% decrease in incorrect data-related issues after implementing the app update feature.

Frequently Asked Questions

How do I reset my HMRC app password?

Click ‘Forgot password’ on the login page and follow the prompts to reset via your registered email.

What if I don’t receive a confirmation email after updating my details?

Check your spam folder first. If not there, contact HMRC support for assistance.

Can I update my employment details through the app?

Currently, the app allows updates only for personal and contact information. Employment details need to be updated directly with HMRC.

How often should I check my details on the HMRC app?

It's advisable to review your details annually or whenever there are significant changes in your personal or financial situation.

Is the HMRC app safe to use for sensitive information?

Yes, the HMRC app is encrypted and uses secure protocols to protect user data. Always ensure you're using the latest version of the app.