Understanding HMRC Repayments

Are you a UK taxpayer, puzzled about how long it takes for HMRC to process repayments? Worry not! We've got you covered with a comprehensive guide on understanding and expediting HMRC payouts.

Factors Affecting HMRC Repayments

When you submit a tax return claiming a refund, it's crucial to understand how various factors impact the payout timeline:

The time of year when you submit your tax return can affect the timeframe. For instance, during peak periods such as January (self-assessment deadline month), HMRC experiences higher volumes, potentially leading to delays.Submission Timeframe

HMRC occasionally requires additional checks to verify the information submitted. These extra verification steps, including anti-fraud measures, can lengthen the payout duration.Verification Processes

Your chosen payment method (bank transfer or cheque) can also impact how swiftly you receive your repayment. Bank transfers are generally faster compared to cheques.Payment Method

How to Expedite Your HMRC Repayment

Follow these steps to ensure a smooth and swift refund process:

File your tax return as early as possible to avoid the rush and potential delays during peak periods.Submit Early

Ensure all information provided in your tax return is accurate to avoid additional verification processes.Consult with your Pie Tax Assistant

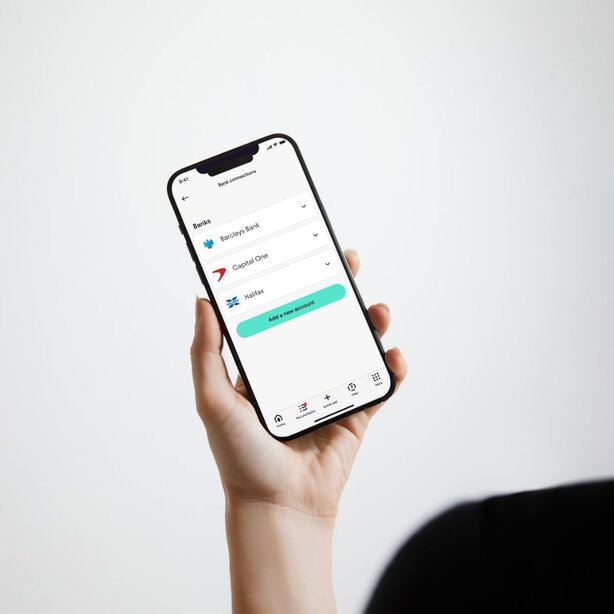

When you submit a return through Pie your repayment will be automatically sent to your registered bank account.Repayment Method

Keep track of your tax return status on your HMRC online account to catch and address any issues promptly. Alternatively, You may request your Pie Tax Assistant to do this for you. Regularly Monitor

For reassurance, If there are delays beyond the typical timeframe, don’t hesitate to contact HMRC for updates and resolution.Contact HMRC

Options for Submitting Your Self-Assessment

Option 1: Direct Bank Transfer

This method is typically faster, as the repayment will be transferred directly to the bank account details provided in your tax return. Direct bank transfers ensure that funds are deposited securely and efficiently, reducing the risk of delays associated with other payment methods. It's essential to double-check your bank account information on your tax return to avoid any issues with incorrect details. Using direct bank transfers also provides a clear record of the transaction in your bank statements, making it easier to track payments.

Option 2: Cheque

Receiving a cheque via postal service is an alternative to direct bank transfers. While secure, it generally takes longer due to postal delays and the additional time required to deposit and clear the cheque through your bank. This method may be preferable if you do not wish to share your bank details electronically or if you prefer to handle physical documents. Keep in mind that cheque deposits may take several business days to process, which can delay access to your funds.

Additional Considerations

Always double-check the details you provide, especially your bank account information, to prevent repayment delays.Double-Check Details

Maintain records of your interactions with HMRC and any correspondence received.Keep Records

Typically, repayments are processed within 5 working days for online submissions and up to 8 weeks for paper submissions.Understand Timeframes

Expert Assistance with Pie

Navigating the repayment process can be complex, but with PIE.tax, you have access to expert tax assistance that can guide you through every step. Our easy-to-use personal tax software ensures your tax returns are accurate and submitted on time, reducing the likelihood of delays. Get started today with PIE.tax and enjoy faster, hassle-free repayments.

On average, HMRC processes 92% of online self-assessment refunds within 5 working days.

Nearly 3 billion pounds are refunded by HMRC each year through self-assessment repayments.

Frequently Asked Questions

How long does it take to get a tax repayment from HMRC?

Typically, it takes 5 working days for online submissions and up to 8 weeks for paper submissions.

Can I expedite my HMRC repayment process?

Yes, submitting your tax return early, ensuring accuracy, and choosing bank transfer as your repayment method can expedite the process.

Why is my HMRC repayment delayed?

Delays can be due to additional verification checks by HMRC, errors in the submitted information, or high-volume periods.

What should I do if my repayment hasn't arrived?

First, check your HMRC online account for any updates. If the delay persists, contact HMRC for assistance.

Is it safe to get my repayment via bank transfer?

Yes, bank transfers are safe and generally faster than receiving a cheque. Ensure your bank details are accurately recorded in your tax return.