Navigating Accounting Software Options for Your Business

Choosing the right accounting software for your construction business is crucial for managing finances, monitoring expenses, and ensuring project success. With numerous options available, it can be overwhelming to decide which one best suits your needs. This blog post delves into essential features, top construction accounting software options, and tips for selecting the perfect accounting software for builders.

Construction accounting software offers essential features such as job costing, project management, invoicing, and billing to aid financial management in the construction industry. Top options include Sage 100 Contractor, QuickBooks Online, FreshBooks, Xero, and Pie for tailored solutions. Research cost-effectiveness and user feedback before making a decision to ensure successful implementation and maximum benefits for your builder business.

Construction accounting software, also known as accounting software for construction, is specifically designed to cater to the unique financial requirements of the construction industry. These software solutions, including financial construction ERP software, streamline financial management, allowing you to focus on building. Essential features include job costing, project management, invoicing and billing, and tax compliance.

Accurate job costing helps estimate project costs and track expenses throughout the project’s life. Project management tools streamline tasks, improve communication, and ensure projects stay on track and within budget. Efficient invoicing and billing maintain accurate financial records and ensure timely payments. Tax compliance features help builders adhere to regulations and avoid penalties. By incorporating these features into your construction accounting software, you can ensure that your business remains compliant, efficient, and profitable.

Top Construction Accounting Software for Builders

Pie

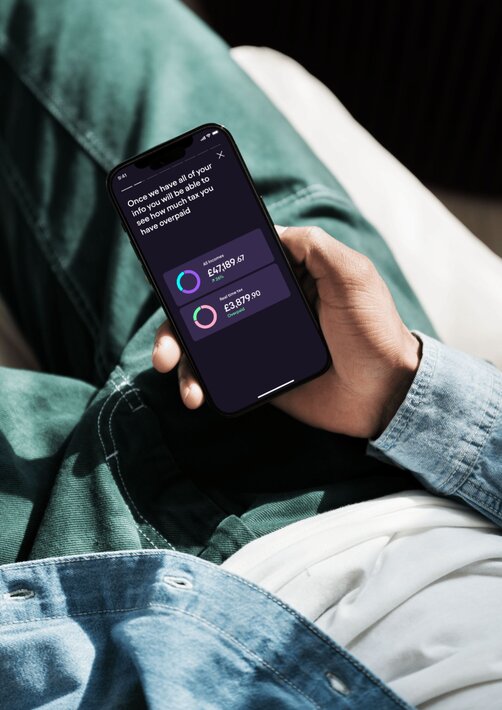

Pie presents comprehensive and up-to-the-minute tax information through an easily accessible dashboard on a user-friendly mobile application. This app removes complexity by efficiently organising earnings and expenditures, consolidating all pertinent information in one central location. The management of multiple revenue streams becomes notably simpler with Pie, and industry-specific tax assistants are at your disposal for personalised guidance. The user-friendly app interface propels the Pie app into the realm of an all-encompassing financial companion for construction businesses, delivering real-time tax computations and simplified returns, while also imparting profound expert insights.

In the realm of accounting software, Pie shines as a beacon of innovation, empowering users to navigate their financial journeys with confidence. Key features include a mobile app, real-time tax figures, bookkeeping, receipt reconciliation, open banking integration, multiple income and account management, and direct HMRC submission. Invoicing is included for free, making it an excellent choice for cost-conscious users. The app also offers tax support and advice with the Tax Assistance Plan for £6.99 per month and tax return checks for an additional £59.99. The Pie tax app stands out by providing essential tools and support, ensuring users have everything they need for effective financial management.

Recent studies show that 68% of self-employed professionals use accounting software to efficiently manage their finances. This statistic highlights the growing reliance on digital tools for financial management among independent workers.Accounting Solutions for Self-Employed Professionals

Additionally, 52% of these users reported increased business efficiency after adopting a new accounting platform. This statistic underscores the importance of selecting the right accounting solution, as it can significantly enhance business operations and productivity for self-employed individuals.Improved Business Efficiency with the Right Accounting Solution

Sage

Sage 100 Contractor is an on-premises application designed to provide construction firms with valuable tools to ensure the successful and profitable completion of projects. This software offers a comprehensive suite of features for small to mid-sized builders, including general ledger, inventory management, payroll management, project management, and mobile implementation. One of the key advantages of using Sage 100 Contractor is its ability to import data from local suppliers, providing access to up-to-date material and cost lists. Tailored specifically for the construction industry, this accounting platform is an ideal choice for builders seeking an industry-specific solution. With Sage 100 Contractor, users can effectively manage construction projects, track expenses, and gain insights into the financial health of their projects. However, the pricing of Sage 100 Contractor is not publicly available at the time of writing.

QuickBooks Online

QuickBooks Online is a cloud-based accounting software specifically designed for construction businesses, allowing users to access it from anywhere and facilitating seamless collaboration. Its robust cloud-based tools enable builders to efficiently manage their finances, with one of its standout features being job cost management, which offers a detailed breakdown of total hourly costs, including wages, employee taxes, and overhead per employee. This flexibility ensures that builders can access their financial data anytime and work collaboratively with their teams for effective project management. QuickBooks Online offers several pricing plans to accommodate different needs, including Self-Employed for £10 per month, Simple Start for £14 per month, Essentials for £24 per month, Plus for £34 per month, and Advanced for £70 per month.

Tips for Discovering Ideal Accounting Solutions for Self-Employed Professionals

Assess Your Unique Business Needs Choosing the right accounting solution can significantly impact your financial health. Start by assessing your unique business needs, including income types and transaction volume. This will guide you towards finding a tailored service.

Choose Between Traditional Firms and Cloud-Based Software Consider whether you prefer traditional accounting firms or cloud-based software. Traditional firms offer personal interaction, while online tools can provide flexibility and accessibility for managing finances on-the-go.

Seek Recommendations and Read Reviews read reviews and seek recommendations from fellow self-employed professionals. Personal experiences can highlight strengths and weaknesses of potential accounting solutions, ensuring you make an informed decision that suits your business best.

FreshBooks

FreshBooks is an accounting software solution that offers invoicing and expense tracking capabilities for businesses of all sizes. Designed with growing businesses in mind, it streamlines tasks such as expense management, time tracking, and customer follow-ups, helping builders enhance their productivity. Additionally, FreshBooks enables builders to generate polished estimates and invoices that reflect their brand, while allowing clients to make payments through their preferred methods, eliminating the need for builders to pursue payments. This allows you to focus more on your core work and less on accounting tasks. FreshBooks provides a customisable plan option, alongside three main packages: Lite at £12 per month, Plus at £22 per month, and Premium at £35 per month.

Xero

Xero is a cloud-based accounting software designed specifically for small and medium-sized businesses, enabling secure integration with banks, accountants, bookkeepers, and various business applications. With seamless connectivity to over 1,000 apps, Xero provides an economical solution for managing financials. Its effortless integration with third-party applications is particularly popular among builders, as it allows them to expand the functionality of their accounting software and tailor it to their specific needs. Xero offers four different pricing plans: Starter at £15 per month, Standard at £30 per month, Premium at £42 per month, and Ultimate at £55 per month.

How is Pie different?

Pie is the only app for self assessment with tools for bookkeeping, your live tax figure, easy tax returns and helpful advice when you need it.

Save £168 per year vs Quickbooks, file your self assessment today for free with Pie

FREE

£69

+£59.99

£149

Quickbooks

£168

per year7 features

TaxScouts

£169

per year4 features

Accountant

£450

avg per year5 features

* Optional add on

Selecting the Best Accounting Software for Builders

Customisation and scalability are important factors to consider when choosing accounting software for your builder business. Customisation allows you to modify or tailor the software to meet your specific needs or preferences, while scalability refers to the software's ability to manage increasing amounts of work or data without sacrificing performance or functionality.

For instance, customisable software solutions enable you to personalise the features, layout, and functionality to suit your needs. Scalable systems can adjust to changing demands and can be readily upgraded or extended as your business grows. By considering customisation and scalability when selecting construction accounting software, you can ensure that your chosen solution can accommodate the evolving requirements of your business.

Security and data protection should be a priority when selecting construction accounting software. Your financial data holds sensitive information, and protecting it from unauthorised access is crucial to maintaining the integrity of your business.

When evaluating accounting software options, consider the security measures implemented by the software and the data protection measures in place. This may include data encryption, secure server hosting, and robust access controls. Furthermore, you should check if the software is approved by an official regulatory body such as the FCA (Financial Conduct Authority), which protects consumers and ensures they get a fair deal. By prioritising security and data protection when choosing your construction accounting software, you can safeguard your financial data and ensure the continued success of your business.

With so many construction accounting software options available, it can be challenging to decide which one is the best fit for your builder business. Here are some tips to help you make an informed decision.

Consider the size of your company and your available budget. Different software solutions cater to different business sizes and budgets, so it’s essential to find one that fits your needs. Identify the features you desire in your accounting software by creating a list and prioritising them according to your company’s requirements.

Research and compare the top construction accounting software options, such as Sage 100 Contractor, QuickBooks Online, FreshBooks, Xero, and Pie. Evaluate each option based on your prioritised list of features and consider factors such as ease of use, cost-effectiveness, and user feedback. By following these tips, you can choose the right accounting software for your builder business that will enable you to manage your finances efficiently and effectively.

Choosing scalable accounting software ensures that your solution grows with your business needs. Additionally, reliable customer support is crucial for resolving any issues promptly. Consider these factors to enhance your financial management.Key Points on Expert Advice

Ensure your accounting software can handle future business growth and offers robust customer support. The right choice will streamline your operations and provide long-term benefits, backed by expert guidance from the Pie Tax App.Summarising Expert Advice

Summary

In conclusion, choosing the right accounting software for your construction business is crucial to ensuring efficient financial management, improved project outcomes, and overall business success. By understanding the essential features of construction accounting software, evaluating top software options, and considering factors such as customisation, scalability, security, and data protection, you can make an informed decision that best suits your builder business’s needs.

Transitioning from manual to digital accounting can greatly improve your financial management processes, allowing you to focus more on your core work and less on time-consuming manual tasks. By utilising training and support services, you can maximise the benefits of your chosen software and ensure its successful implementation and use.

Take the first step towards better financial management and choose the right accounting software for your builder business today.

Frequently Asked Questions

Why is time tracking important in accounting software?

Time tracking ensures accurate billing and project management, helping you capture the time spent on tasks for precise invoicing.

What are the benefits of customisable invoicing?

Customisable invoicing enhances professional branding and simplifies invoice management, fostering trust with customers and streamlining financial processes.

How do payment integrations improve cash flow?

Payment integrations offer multiple options for customers, ensuring faster and secure transactions, thus improving your business’s cash flow.

Why should I consider trial periods for accounting software?

Trial periods allow you to test software features and compatibility with your business needs, ensuring you make an informed purchase decision.

How can the Pie Tax App help with accounting software selection?

The Pie Tax App provides expert tax assistants who offer guidance on selecting the best accounting software, tailored to your specific business needs.