Understanding the SA105 Tax Form

The SA105 form is a crucial part of the UK self-assessment tax return process for individuals who earn rental income. Specifically, if you rent out property or land in the UK, this supplementary form is necessary to declare your untaxed income. By completing the SA105 form accurately, you ensure that you meet HMRC's reporting requirements and avoid potential fines. This article will guide you through every aspect of the SA105 form, from who needs to fill it out to the essential tips for a smooth submission process.

Rental income can come from various sources, including single properties, multiple properties, furnished or unfurnished rentals, and even holiday lettings. Each of these scenarios has specific sections and guidelines within the SA105 form. Understanding these nuances is critical to completing the form correctly and ensuring compliance with tax regulations. Let's delve into the specifics of the SA105 form, including eligibility, the submission process, and the common pitfalls to avoid.

Who Needs to Fill SA105?

If you receive rental income from any UK property, the SA105 form is essential. This applies whether you rent out a single property or multiple properties, and whether those properties are furnished or unfurnished. Additionally, holiday lettings fall under this requirement.

By submitting the SA105 form, you declare your rental income and related expenses, ensuring your tax records are complete and accurate. Properly filing this form helps you stay compliant with HMRC regulations and can potentially maximise your allowable deductions, ultimately affecting your tax liability positively.

What Information is Required?

To complete the SA105 form, you'll need detailed financial information about your rental properties. This includes the total rent received, allowable expenses, and details of any losses carried forward from previous years.

This not only aids in compliance with HMRC regulations but also ensures you maximise your tax deductions, potentially reducing your overall tax liability. Proper documentation and thorough record-keeping are crucial for a smooth and accurate filing process.

31 January is the annual deadline for filing your SA105 form for the previous tax year. Missing this deadline can result in penalties and interest charges. Ensure you are well-prepared to file on time, keeping all necessary documentation in order.Important Deadlines

Filing your SA105 form after the 31 January deadline can incur a £100 fine, even if you have no tax to pay. Continuing delays can result in increased penalties, so timely submission is crucial to avoid unnecessary expenses.Penalties for Late Filing

How to File the SA105 Form

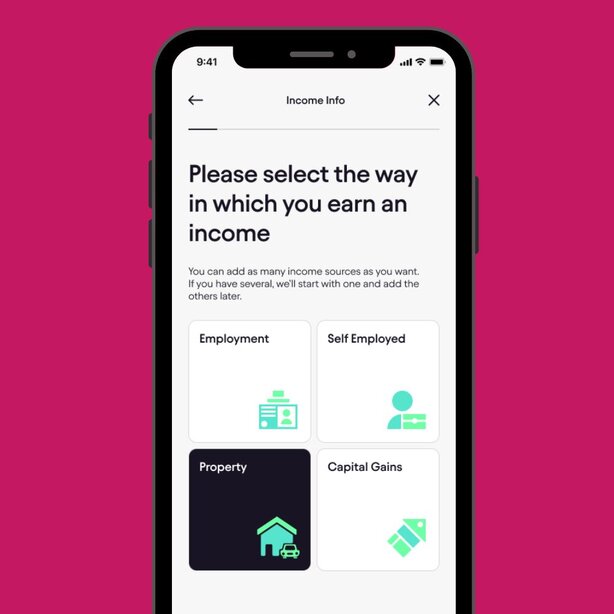

The SA105 form can be filed either online or via paper submission. For online filing, you can use the Pie Tax App, which provides a user-friendly interface designed to guide you through the process. The app includes built-in checks to help you avoid common errors and ensures all required sections are completed accurately. Alternatively, you can download the form from the HMRC website, complete it manually, and mail it to HMRC.

When filing, ensure that all income and expenses are reported clearly. Double-check that the figures match your records and supporting documentation. Availing the services of expert tax assistants available on the Pie app can provide additional peace of mind by reviewing your submission for accuracy and compliance.

Common Mistakes to Avoid

One frequent mistake is failing to report all sources of rental income. It's essential to include every rental property and detail all related income, even if the amounts seem insignificant. Another common error is incorrectly categorizing expenses. Ensure you understand what qualifies as an allowable expense to avoid inaccuracies.

Mistakes in reporting can lead to complications and potential fines, so accuracy is key. Another pitfall is not keeping updated records throughout the year.

Consistent record-keeping makes the process smoother and ensures that all necessary information is readily available when completing the form. Don’t wait until the last minute to gather your documents; stay organised to avoid stress during the submission period.

Three Quick Tips for Future Filings

Stay organised throughout the year to make filing more straightforward. Keeping clear, detailed records will save you time and reduce stress.Year-Round Organisation for Easy Filing

Consider setting reminders for key deadlines to ensure you never miss important dates like the 31 January filing deadline.Set Reminders for Key Deadlines

Seek professional guidance if you feel uncertain. Using the Pie Tax App and expert tax assistants available on the app can streamline the process and help you avoid costly mistakes.Professional Guidance with Pie Tax App

Fun Fact About SA105

Did you know? The UK has over 2.5 million landlords who rely on forms like the SA105 to report their rental income accurately. Many use modern apps and professional assistance to reduce errors and ensure compliance.

Advice for Handling the SA105 Form

If the SA105 form seems daunting, consider breaking down the process into manageable steps. Start by gathering all your rental income details and related expenses. Organising this data will make filling out the form more straightforward. Additionally, consider using digital tools like the Pie Tax App, which has built-in assistance and checks to help you through the process and reduce potential errors.

Enlisting the help of expert tax assistants available on the Pie app can also be incredibly beneficial. They can review your completed form, offer advice on allowable expenses, and ensure that you've accurately reported all required information. This professional review can help you avoid penalties and ensure that your submission is as smooth as possible.

Keep detailed records of all rental income and expenses throughout the year. Proper organization can save time and reduce stress when it's time to complete the SA105 form.Stay Organised Year-Round

Avail the services of expert tax assistants available on the Pie app. Their guidance can help you navigate the complexities of the SA105 form and ensure accuracy.Use Professional Assistance

Summary

In summary, the SA105 form is essential for anyone who earns rental income in the UK. Thoroughly completing this form ensures compliance with HMRC regulations and avoids potential fines. The process involves documenting all rental income, allowable expenses, and understanding specific deadlines. Using digital tools like the Pie Tax App and seeking the aid of expert tax assistants can simplify the filing process, offering peace of mind and helping you avoid common pitfalls.

Staying organised, using digital tools for submission, and seeking professional assistance can all contribute to a smooth and successful SA105 filing. Additionally, being aware of the important deadlines and penalties associated with the SA105 form ensures you stay compliant with tax regulations and avoid unnecessary fines.

Frequently Asked Questions

Who needs to file an SA105 form?

Anyone earning rental income from UK properties needs to file an SA105 form as part of their self-assessment tax return submission.

What is the deadline for SA105 filing?

The annual deadline for submitting the SA105 form is 31 January following the end of the tax year.

What happens if I file my SA105 form late?

Late filings incur a £100 penalty, with additional fines and interest accruing for prolonged delays.

Can I file the SA105 form online?

Yes, you can file the SA105 form online via the HMRC website or using the Pie Tax App for a guided, error-checked process.

What information is needed to complete the SA105 form?

You'll need to report your rental income, document allowable expenses, and detail any losses carried forward from previous years for a complete submission.