Improve Tax Savings by Declaring Business Expenses

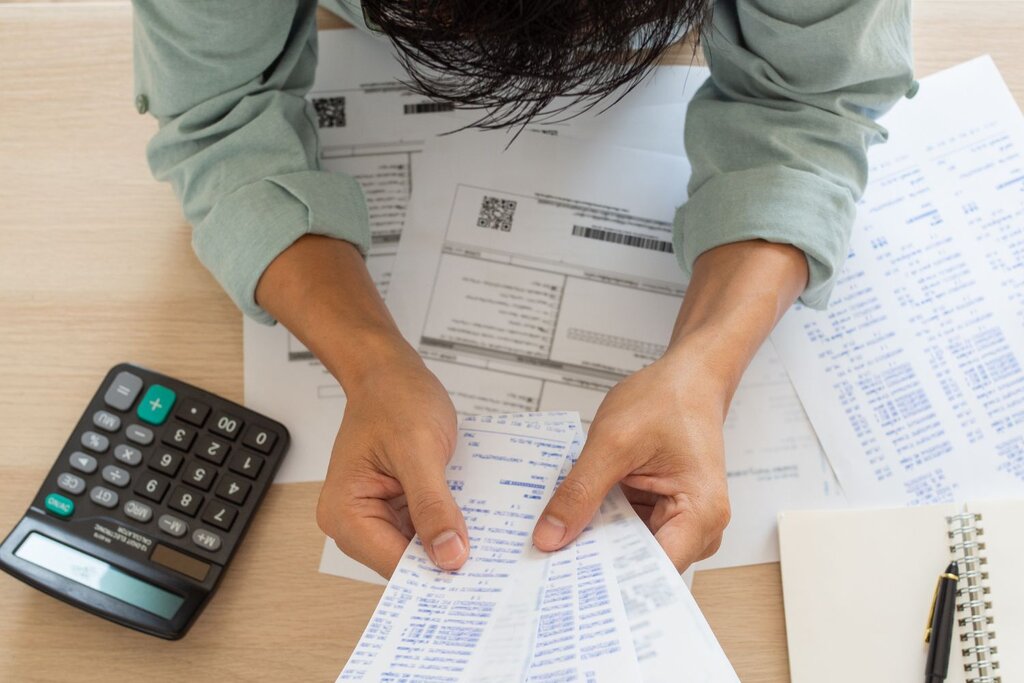

Navigating the intricacies of business

expenses when filing your Self Assessment and Universal Credit can be complex, yet an essential task for maximising your tax savings. If you are self-employed or own a small business, the overlap between your expense declarations can cause confusion. However, understanding these specifics can save you considerable money, reduce stress, and ensure compliance with government regulations.

The ability to claim business expenses on your Self Assessment and Universal Credit can significantly impact your tax liabilities and benefits. Properly organising and declaring these expenses will not only lower your taxable income but also potentially increase your Universal Credit entitlement. Nevertheless, it is crucial to know exactly how and when to report these expenses to avoid any complications or misstatements that could result in penalties or reduction in benefits.

Our aim is to simplify this process for you by breaking down the key aspects of declaring business expenses on both your Self Assessment and Universal Credit. Utilising tools such as the Pie Tax App and advice from expert tax assistants available on the Pie app, you can ensure a seamless and favourable outcome in your tax and benefits filings.

Self Assessment Business Expenses

Understanding what qualifies as allowable business expenses is vital for self-employed individuals. It includes a range of costs necessary for running your business efficiently. These expenses may encompass office supplies, travel costs including mileage, and utility bills for business premises. Keeping meticulous records of these expenditures ensures accurate tax filings and maximises potential deductions, contributing to your overall financial health as a business owner.

Universal Credit Business Expenses

When declaring business expenses for Universal Credit, it's crucial to ensure they are reported accurately. This not only reflects your actual income but also helps to avoid potential benefit reductions that could arise from inaccurate reporting. By diligently recording and reporting your business expenses, you can maintain compliance with Universal Credit guidelines and ensure that you receive the appropriate support tailored to your financial circumstances as a self-employed individual.

In the fiscal year 2021/22, UK self-employed individuals claimed a total of £20 billion in business expenses, highlighting their significant contribution to the economy through legitimate tax deductions. This figure underscores the importance of accurately reporting expenses to optimise tax efficiency and financial planning strategies. Understanding allowable deductions such as office supplies, travel expenses, and utility bills can further assist in maximising tax relief.Business Expenses Claims

The average annual business expense claims per self-employed individual amount to approximately £5,000, pointing to significant potential savings that can be realised. However, approximately 15,000 businesses are audited annually due to inaccuracies in expense declarations, highlighting the critical need for precise reporting to avoid penalties and ensure compliance with HMRC regulations, which is essential for maintaining financial integrity and operational transparency.Overview of Business Expenses

Steps for Declaring on Self Assessment

First, identify and categorise all your business-related expenses throughout the tax year. Keep detailed records and receipts to support these claims. Tools like the Pie Tax App can simplify this process by tracking and storing your expenses digitally, ensuring you do not miss any allowable deductions.

Next, input these expenses on your Self Assessment tax return. Enter them in the appropriate sections to ensure they impact your tax calculations correctly. Accurately declared expenses will reduce your taxable income, lowering your overall tax liability.

Declaring on Universal Credit

For Universal Credit, you need to declare your business expenses differently. Report your income after expenses to reflect your true profit. This includes regular submissions of monthly earnings and costs. The Universal Credit system assesses your net earnings, so precise and consistent reporting is crucial.

Utilise expert tax assistants available on the Pie app for personalised guidance on correctly declaring your expenses. This can improve your benefits while staying compliant with regulations. Remember, incorrect reporting can lead to benefit adjustments or repayments, so accurate declarations are a must.

Tips for declaring business expenses to Universal Credit:

Maintain detailed records of all business expenses, including receipts and invoices, to substantiate your claims.Keep Accurate Records

Ensure you only claim expenses that are allowable under Universal Credit rules to avoid complications or overpayments.Claim Eligible Expenses Only

Regularly update your Universal Credit account with accurate information about your business expenses to reflect changes promptly.Update Regularly:

Tax Savings

Did you know? Recent surveys reveal that only 35% of self-employed individuals in the UK fully utilise available business expense deductions, missing out on substantial tax savings.

Expert Tips for Managing Declarations

Ensuring your business expenses are correctly declared on both Self Assessment and Universal Credit can be overwhelming. Here are some expert tips to help you navigate this more efficiently.

First, invest in quality accounting software or an app like the Pie Tax App. These tools simplify expense tracking and submission, making the process less tedious and more accurate. For the self-employed, this can mean less time on paperwork and more time on your business.

Second, regularly consult with expert tax assistants available on the Pie app to stay updated with the latest tax laws and regulations. This will help prevent any mistakes and optimise your expense declarations, securing your tax savings and benefits.

Maintaining organised financial records and receipts is a critical step for accurate expense reporting. Regularly update and cross-check your expense data.Stay Organised

Embrace digital tools like the Pie Tax App that can streamline your record-keeping and ensure you do not miss any eligible deductions.Use Digital Tools

Summary

Successfully declaring business expenses on both your Self Assessment and Universal Credit is essential for maximising your tax savings and ensuring you receive the correct benefits. Accurate record-keeping, strategic use of digital tools, and expert advice are your best allies in this endeavour. By utilising the Pie Tax App and consulting with tax assistants, you can streamline the process, avoid pitfalls, and potentially save a significant amount on your tax bill.

Utilising resources like the Pie Tax App, which offers seamless integration and expert assistance, can simplify your filings. These tools and services ensure you are not only compliant but also maximising your benefits.