A Guide to Recognizing and Correcting Tax Misconceptions

Tax season can be stressful, especially when misconceptions lead to costly errors. Many taxpayers unknowingly make mistakes due to common myths or misunderstandings about tax regulations. This guide will help you identify and correct these misconceptions, ensuring accurate tax filings and preventing unnecessary fines.

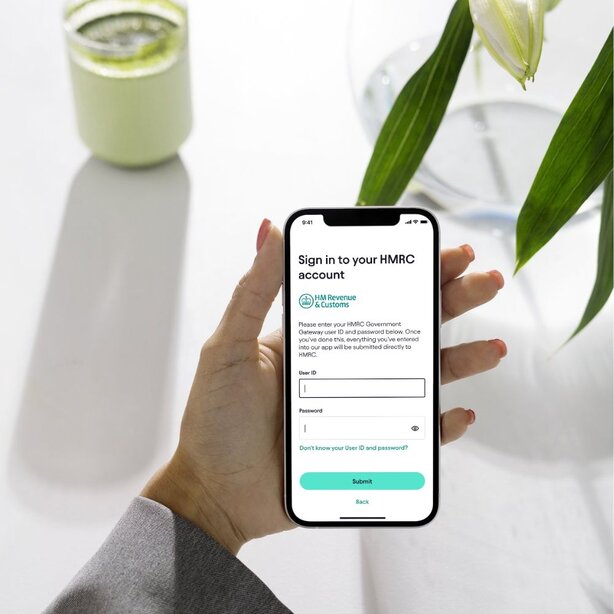

The Pie Tax App, along with the expert tax assistants available on the Pie app, offers tools and advice to navigate complex tax situations. By educating yourself on common tax myths, you can confidently manage your taxes and avoid pitfalls.

Misconception: Only High Earners Need to File

One common misconception is that only high earners need to file taxes. In reality, anyone with taxable income must file a return, regardless of their earnings.

Another myth is that self-employed individuals can avoid taxes, which is not true self-employed individuals must report all income.

Misconception: HMRC Will Automatically Correct Mistakes

Another widespread misconception is that HMRC will automatically correct any errors on your tax return. However, the responsibility for accurate filing lies with the taxpayer.

Additionally, many believe that minor mistakes won’t attract penalties, but even small errors can lead to fines.

In the UK, 45% of taxpayers admitted to making errors on their returns, with 25% facing penalties. These numbers highlight the importance of accurate tax filing.Recent Tax Penalties Statistics

Tax misconceptions lead to an estimated £250 million in fines annually. Additionally, 60% of taxpayers who misunderstood their obligations faced delays in refunds.Impact of Tax Misconceptions

How to Correct Common Tax Errors

Correcting tax errors starts with understanding your obligations. If you discover a mistake on your tax return, act quickly by submitting an amended return or contacting HMRC for guidance.

Using the Pie Tax App can streamline this process, providing reminders and expert advice to avoid future errors. Regularly review your tax documents for accuracy and keep up-to-date with any changes in tax laws.

Proactively managing your tax obligations helps prevent costly mistakes and ensures you stay compliant with HMRC regulations.

Benefits of Accurate Tax Filing

Accurate tax filing not only prevents fines but also ensures you receive all eligible deductions and credits. By avoiding common tax misconceptions, you can maximize your refund and minimize your tax liability.

The Pie Tax App simplifies the filing process by guiding you through each step and helping you identify potential errors before submission.

With the support of expert tax assistants available on the Pie app, you can confidently file your taxes knowing that your return is accurate and compliant with current regulations.

Common Tax Misconceptions: Tips to Keep You on Track

Expenses: Not Everything Is Claimable It's crucial to understand which expenses qualify as business-related. Misclaiming personal expenses can lead to penalties. Always double-check what's allowable before filing.

Assuming No Tax Due on Side Income Earnings from side jobs or hobbies are often taxable. Ignoring this can result in unexpected tax bills. Declare all income sources to avoid penalties.

HMRC Errors Are Your Responsibility Even if HMRC makes a mistake, you're liable for any unpaid tax. Regularly review your tax records to catch errors early and correct them.

Fun Facts

Did you know that the UK's first income tax was introduced in 1799 to fund the Napoleonic Wars? Since then, tax laws have evolved significantly, making tools like the Pie Tax App essential for accurate filing.

Expert Tips for Accurate Tax Filing

Double-check all income sources before filing your return. Use the Pie Tax App to cross-reference your documents and identify potential deductions. If in doubt, consult with expert tax assistants available on the Pie app to ensure your return is accurate.

Ensure you report all income, including freelance or side gigs, to avoid penalties. Use the Pie Tax App to keep track of your earnings throughout the year, reducing the risk of omissions.Avoiding Common Filing Mistakes

Tax laws frequently change, so staying informed is crucial. The Pie Tax App provides updates on the latest tax regulations, helping you stay compliant and avoid errors.Staying Informed About Tax Changes

Summary

In summary, understanding and correcting common tax misconceptions is crucial for accurate tax filing. By recognizing these myths and taking proactive steps to avoid them, you can prevent costly errors and penalties.

The Pie Tax App offers tools and expert advice to help you navigate tax season with confidence. Accurate filing not only ensures compliance with HMRC regulations but also maximizes your deductions and minimizes your tax liability.

Stay informed, use reliable resources like the Pie Tax App, and consult with experts to handle your taxes effectively.

Frequently Asked Questions

What should I do if I made a mistake on my tax return?

Submit an amended return or contact HMRC. The Pie Tax App can guide you through the correction process.

Can I avoid penalties if I file my taxes late?

Filing late usually results in penalties. However, if you have a reasonable excuse, you may appeal to HMRC.

How can the Pie Tax App help with my tax filing?

The Pie Tax App offers reminders, expert advice, and tools to help you file accurately and avoid common mistakes.

Is it true that only high earners need to file taxes?

No, anyone with taxable income must file a tax return, regardless of their earnings.

How often do tax laws change, and how can I stay informed?

Tax laws change frequently. The Pie Tax App provides updates and expert advice to help you stay compliant.