Anxiety About Taxes: How to Reduce Tax Stress

Every year nearly a quarter of UK individual taxpayers fail to get their tax returns or payments in by the January 31st deadline. Most of the time it is not a case of wilful disregard for tax laws. It's usually more a matter of being unclear about changes to certain laws, or simply not having enough money to make a tax payment by the due date. These and other issues can create enormous amounts of stress in a person's life. And make no mistake, tax stress is a very real psychological issue. In this post, the pros at Pie take a look at anxiety related to taxes and how you can reduce your tax stress.

Dealing with Tax Anxiety and Tax Stress

Constantly worrying about filing and paying taxes on time can and often does lead to increased stress levels, lost sleep, poor performance at work and a general sense of unease and unhappiness.

In this post, we'll look at ways you can reduce the stress created by tax deadlines and then we'll look at practical ways you can ensure your taxes get filed and paid on time.

5 Tips on How to Deal With Tax Stress

Tip 1: Acknowledge the Stress

The first step in resolving a problem is acknowledging its existence. That goes for just about everything, including tax stress. Instead of trying to maintain a stiff upper lip, acknowledge that you are stressed out and that you’re feeling overwhelmed. Oftentimes, simply dragging an issue out into the light in this way can reduce its impact.

Tip 2: Don’t Procrastinate

People who are feeling stressed out at tax time often freeze like a deer in the headlights. Their response to the stress is to simply kick the can down the road and hope it goes away. But all that does is make a bad situation worse. Don’t procrastinate. Talk to a tax pro and get involved in the solution.

Tip 3: Stay Positive

There are two ways we can approach any issue. We can focus on the potential downside and indulge in fear and self-pity while stressing ourselves out, or we can stay positive and pro-active and look for solutions. Remember, every problem has a solution. You just have to find it.

Tip 4: Don’t Do Things that Will Make Your Situation Worse

If you think you might have a hard time making your tax payment on January 31st, hold off on the expensive purchases and nights on the town until you've paid the debt. Often a bit of fiscal restraint is all that's necessary to meet a tax obligation.

Tip 5: Talk About it

There are support groups all over the UK where people meet and share situations that are stressing them out. Anxiety UK, for instance, operate scores of in-person and online support groups that offer a safe place for adults to share their experiences and coping strategies. Do yourself a favour and take advantage of them.

Practical Ways to Ensure You Meet Your Tax Obligations

Nearly 3/4 of all freelance workers in the UK say that taxes are the biggest source of stress in their lives. And more than 1/3 say it’s because they just don’t understand the UK tax system. We hear you. That’s why we created the Pie app.

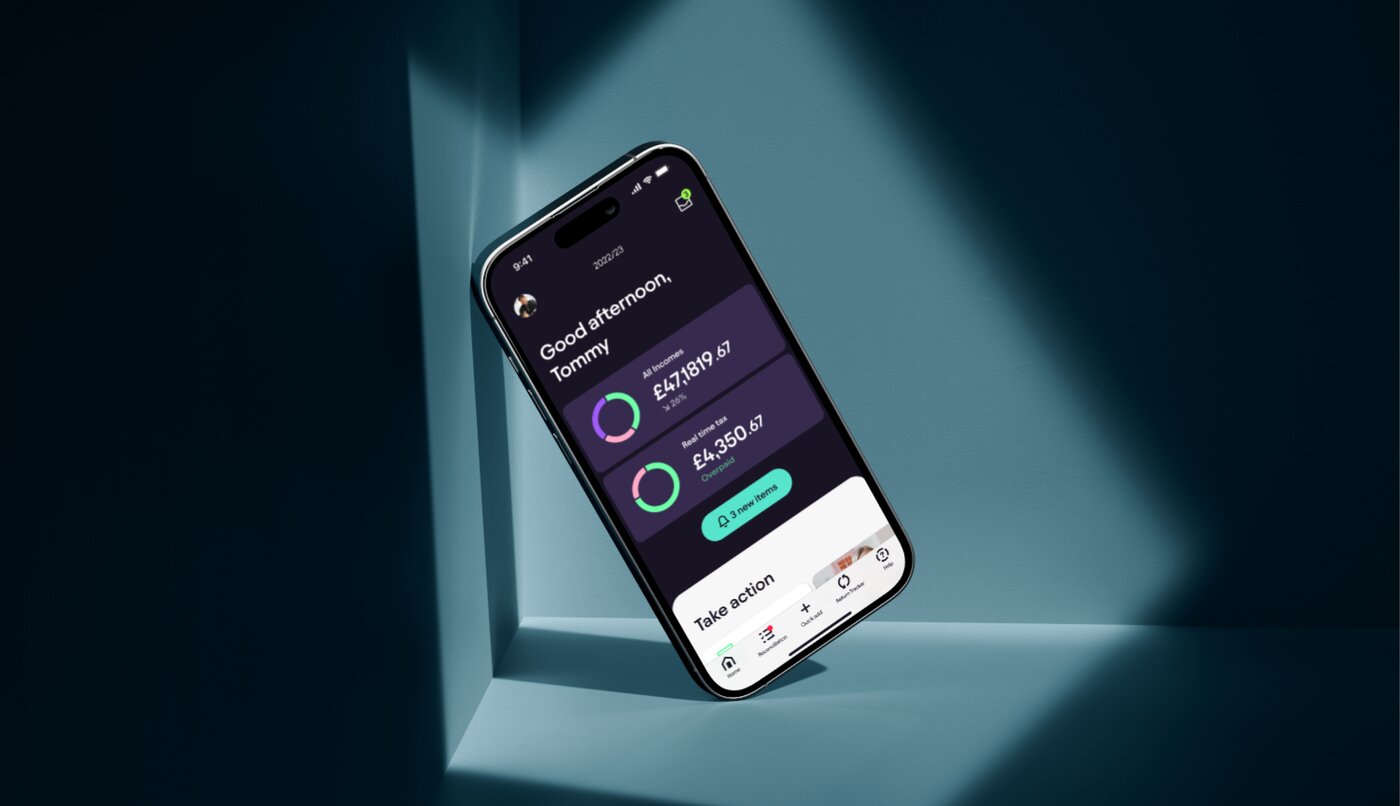

Our goal was to create an effective tool that would simplify your tax calculations, preparation and payment, and the Pie mobile app is just that.

You can continue on as you are, going through annual periods of abject fear, uncertainty and stress. Or you can leave all that behind with the Pie app.

With its intuitive interface, modest learning curve and unparalleled reliability it’s the best way there is to get a productive handle on your relationship with HMRC and relieve yourself of tax anxiety once and for all.

The Pie app provides an array of tools that allow you to achieve that goal, including:

Integrated Invoicing

Create and send digital invoices, track payments, send automatic payment reminders and manage income all from within the app. Our revenue tracking feature allows you to keep a real-time eye on income and expenses so you know exactly where you stand as tax time approaches.

Real-Time Tax Insights

The government’s Making Tax Digital initiative is set to make quarterly income reporting a requirement. With Pie on your side that’s not an issue. You’ll know exactly where you stand from a tax position 24 hours a day 365 days a year. That way you can relax and plan accordingly to ensure you meet all your compliance obligations.

Effortless HMRC Integration

Every year countless UK citizens are forced to pay the £100 fine for submitting a late tax return. With Pie on your side, you won't be one of them. Pie is fully registered and integrated with the HMRC system so you can handle all aspects of the tax submission process, including payments, directly through the app.

Live in-app Tax Support

No matter how good an app may be there will still be times you will need to talk to a human, someone with expert knowledge who can clarify things for you or help you find solutions to a vexing problem. Pie maintain a highly trained live support staff ready to answer your questions and help you get the most from the app.

Best of all you’ll get sector specific advice that will help reduce or eliminate your tax anxiety by answering your toughest questions quickly and accurately.

Leaving Tax Stress Behind is as Easy as Pie

If you’ve had enough of feeling stressed out every tax season it’s time to step up to Pie. Our state-of-the-art mobile app will simplify the tax calculation, filing and payment process enabling you to relax and sleep easy. View pricing information (and learn about our 60-day free trial) here: https://www.pie.tax/pricing.